Managing your finances can sometimes feel overwhelming, especially if you’re not sure where your money is going. That’s where a simple budget can come to the rescue.

This helpful tool allows you to track your income and expenses, ensuring that you have enough money to cover your needs while also helping you save for the future and reach your financial goals.

What is a Simple Budget?

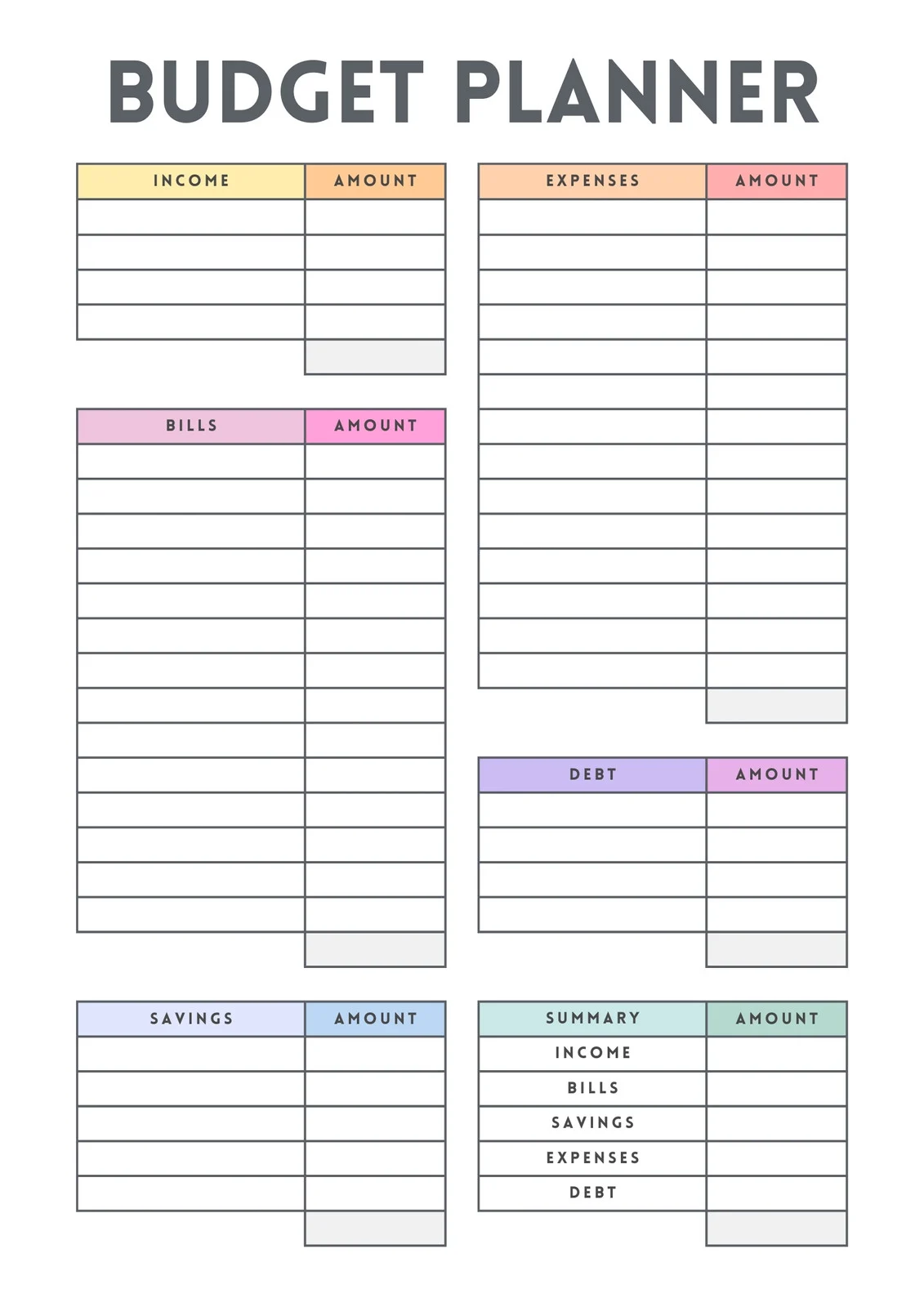

A simple budget is a straightforward and easy-to-use template that helps you organize your finances. It typically consists of different sections where you can input your income, expenses, and savings goals.

By filling out this budget regularly, you can gain a clear understanding of your financial situation and make informed decisions about your spending and saving habits.

Why Use a Simple Budget?

There are several reasons why using a simple budget can be beneficial for managing your finances:

- Track your income and expenses: A budget allows you to see how much money is coming in and how much is going out. By tracking your income and expenses, you can identify areas where you may be overspending and make adjustments accordingly.

- Ensure you have enough money to cover your needs: With a budget, you can prioritize your essential expenses, such as rent, utilities, and groceries. This ensures that you have enough money to cover your needs before allocating funds for wants and discretionary spending.

- Save money: A budget helps you set aside money for savings. Whether you’re saving for a down payment on a house, a vacation, or an emergency fund, a budget can help you reach your savings goals by allocating a specific amount each month.

- Reach your financial goals: Whether it’s paying off debt, saving for retirement, or starting your own business, a budget can help you stay on track and reach your long-term financial goals.

How to Create a Simple Budget

Creating a simple budget is easier than you might think.

Follow these steps to get started:

- Gather your financial information: Collect all your financial statements, including bank statements, credit card statements, and bills. This will give you a clear picture of your income and expenses.

- List your income: Write down all sources of income, including your salary, side hustle earnings, and any passive income you receive.

- Track your expenses: Categorize your expenses into different categories, such as housing, transportation, groceries, entertainment, and debt payments. Be thorough and include all your expenses, no matter how small.

- Calculate the difference: Subtract your total expenses from your total income to determine whether you have a surplus or a deficit. If you have a surplus, consider allocating some of it towards savings or debt repayment. If you have a deficit, look for areas where you can cut back on spending.

- Set goals: Determine your short-term and long-term financial goals. This could include saving for a vacation, paying off debt, or building an emergency fund. Assign specific amounts and timelines to each goal.

- Review and adjust: Regularly review your budget to see if you’re on track with your goals. Make adjustments as necessary, especially if your income or expenses change.

Examples

Tips for Successful Budgeting

To make the most of your simple budget, consider the following tips:

- Be realistic: Set achievable goals and be honest with yourself about your income and expenses.

- Track your spending: Keep receipts or use a budgeting app to track every expense. This will help you stay accountable and identify areas where you may be overspending.

- Automate savings: Set up automatic transfers to your savings account to ensure you’re consistently saving money.

- Review your budget regularly: Make it a habit to review your budget at least once a month. This will help you stay focused on your goals and make adjustments as necessary.

- Stay motivated: Remind yourself of why you’re budgeting and the financial goals you’re working towards. This will help you stay motivated and committed to your budgeting journey.

- Seek support: If budgeting feels overwhelming or confusing, don’t hesitate to seek help. Consider consulting a financial advisor or joining online communities where you can learn from others who are on a similar financial journey.

Conclusion

A simple budget is a valuable tool for managing your finances, ensuring you have enough money to cover your needs, and reaching your financial goals.

By tracking your income and expenses, setting goals, and making adjustments as necessary, you can take control of your finances and build a solid foundation for a secure financial future.

Simple Budget Template – Download