As a self-employed individual, keeping track of your time and invoicing your clients accurately is crucial for maintaining a successful business. One effective way to accomplish this is by using a self-employed timesheet invoice. In this article, we will explore what a self-employed timesheet invoice is, why you need one, what to include in it, how to write one, and the common mistakes to avoid. So let’s dive in and learn everything you need to know about self-employed timesheet invoices!

What Is a Self-Employed Timesheet Invoice?

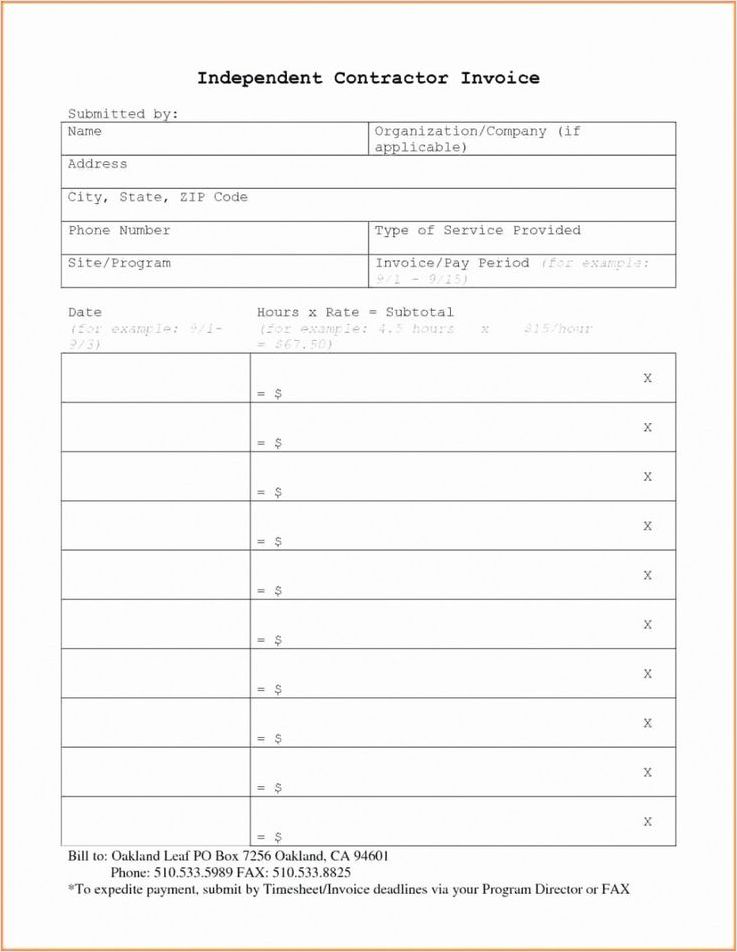

A self-employed timesheet invoice is a document that self-employed professionals use to bill their clients for the time they have spent on a project. It serves as a record of the work completed, the hours worked, and the amount owed by the client. This invoice acts as a formal agreement between the self-employed individual and the client, ensuring transparency and facilitating timely payment.

Self-employed timesheet invoices are typically used by freelancers, consultants, contractors, and other professionals who work on a project basis and need to track their time accurately. By using a timesheet invoice, you can provide your clients with a detailed breakdown of the services you have provided and the corresponding charges, making it easier for them to understand and process the payment.

Why Do You Need a Self-Employed Timesheet Invoice?

Using a self-employed timesheet invoice offers several benefits for both you and your clients:

- Transparency: A timesheet invoice provides a transparent account of the work you have completed, ensuring that your clients have a clear understanding of the services they are paying for.

- Accuracy: By tracking your time and documenting it in an invoice, you can ensure that you are billing your clients accurately, minimizing any potential disputes.

- Professionalism: Sending a professional timesheet invoice showcases your professionalism and helps build trust with your clients.

- Payment facilitation: Having a detailed invoice makes it easier for your clients to process the payment, as they can see the services provided and the amount owed.

- Record keeping: Timesheet invoices serve as a record of the work completed and the payments received, making it easier for you to track your income and manage your finances.

What to Include in a Self-Employed Timesheet Invoice

When creating a self-employed timesheet invoice, it is important to include the following information:

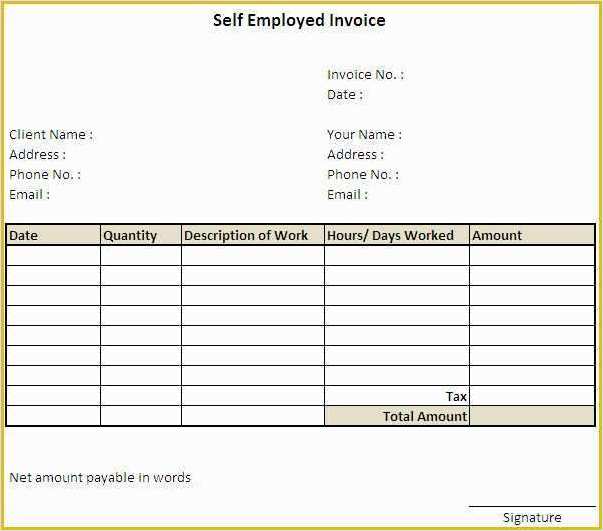

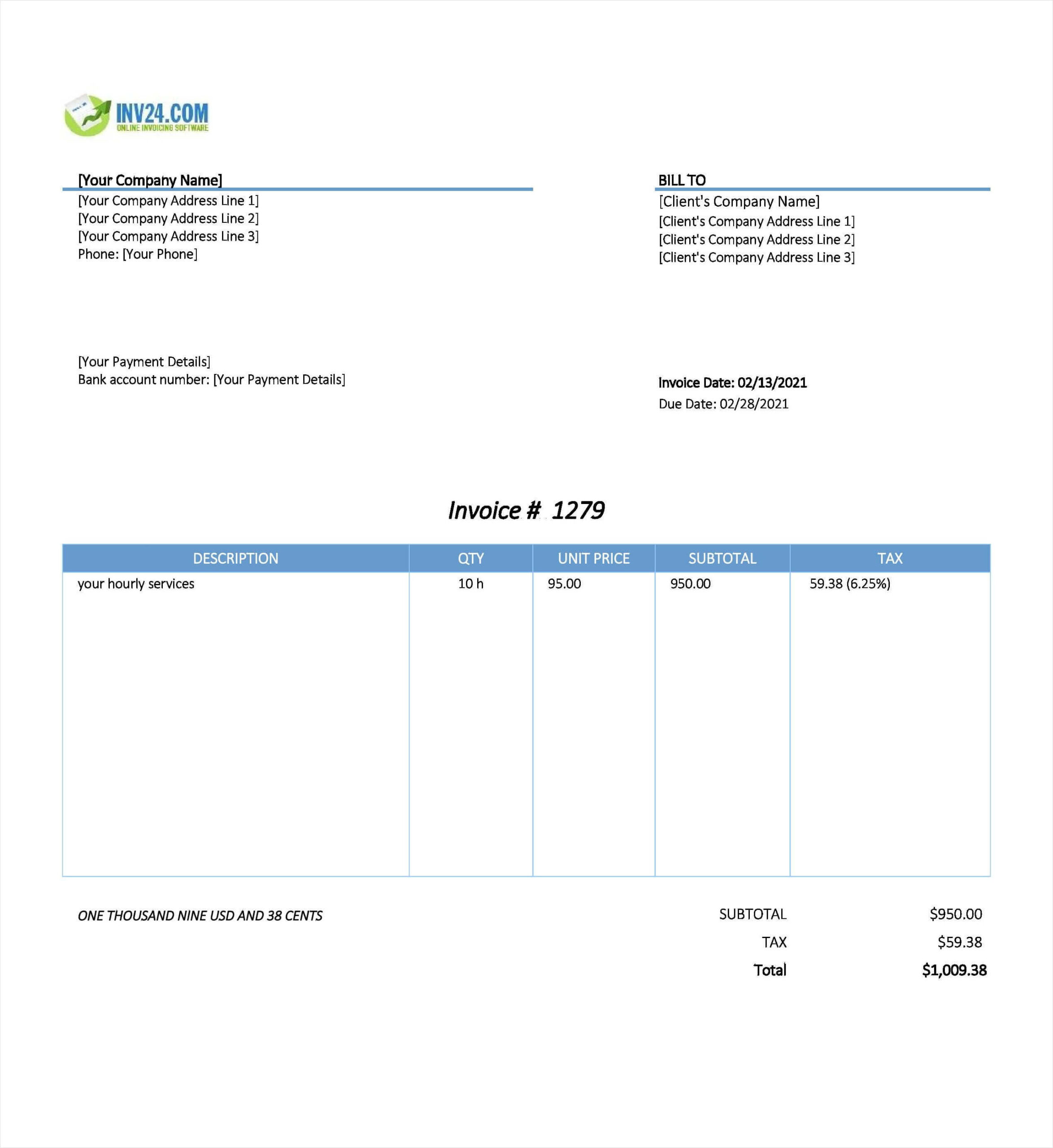

- Your contact information: Include your name, address, phone number, and email address at the top of the invoice.

- Client’s contact information: Provide your client’s name, company name (if applicable), address, and contact information.

- Invoice number and date: Assign a unique invoice number and include the date the invoice was issued.

- Description of services: Clearly describe the services you provided, including the project name, scope of work, and any additional relevant details.

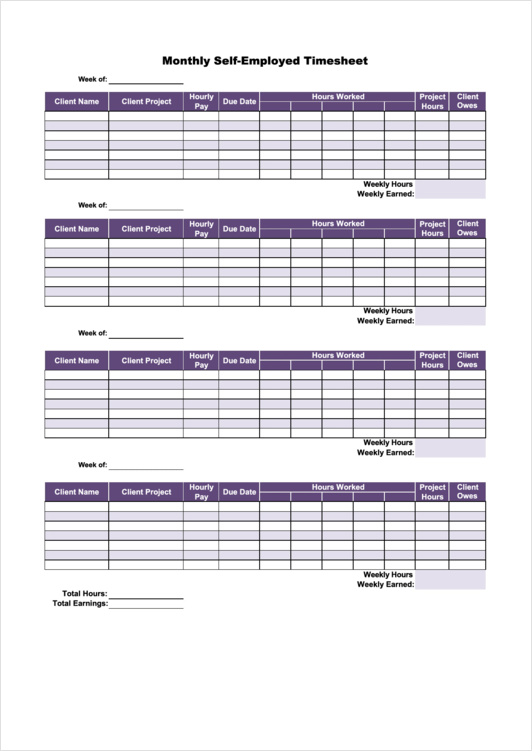

- Hours worked: Specify the number of hours you worked on the project, broken down by date and task if necessary.

- Rate and total amount: State your hourly rate or project fee, and calculate the total amount owed based on the hours worked.

- Payment terms: Clearly outline the payment terms, including the due date, accepted payment methods, and any late payment fees or discounts.

How to Write a Self-Employed Timesheet Invoice

Writing a self-employed timesheet invoice is a straightforward process. Here are the steps to follow:

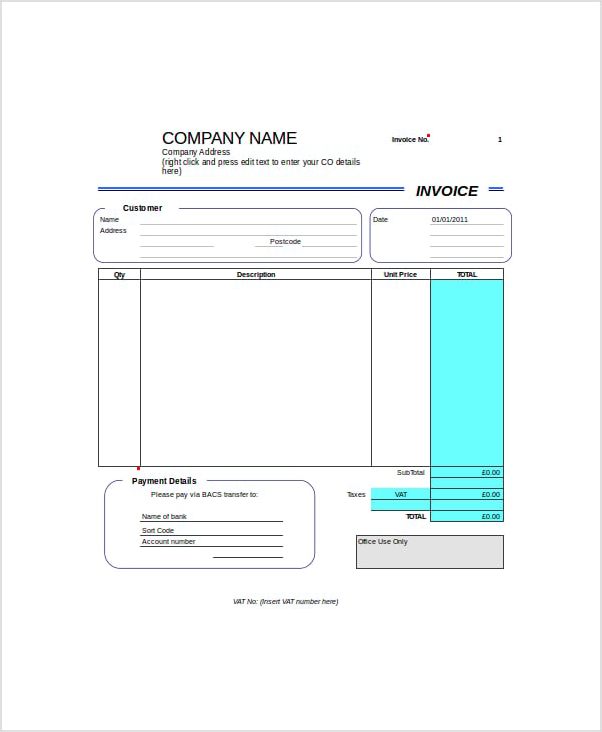

- Choose a template: Start by selecting a professional invoice template that suits your business needs. You can find customizable templates online or use accounting software that provides invoice templates.

- Add your contact information: Include your name, address, phone number, and email address at the top of the invoice.

- Include the client’s contact information: Provide your client’s name, company name (if applicable), address, and contact information.

- Assign an invoice number and date: Assign a unique invoice number and include the date the invoice was issued. This helps with organization and reference.

- Describe the services: Clearly describe the services you provided, including the project name, scope of work, and any relevant details that help your client understand the work performed.

- Specify the hours worked: Break down the hours worked by date and task if necessary, providing an accurate record of your time spent on the project.

- State the rate and total amount: Clearly state your hourly rate or project fee, and calculate the total amount owed based on the hours worked.

- Outline the payment terms: Communicate the payment terms, including the due date, accepted payment methods, and any applicable late payment fees or discounts.

- Review and send the invoice: Double-check the invoice for accuracy and completeness before sending it to your client. Consider sending it via email for a faster and more convenient delivery.

Mistakes to Avoid

When creating and sending a self-employed timesheet invoice, it is important to avoid the following common mistakes:

- Missing or incorrect information: Ensure that all the necessary information is included and accurate to avoid confusion and delays in payment.

- Unclear descriptions: Clearly describe the services provided to avoid any misunderstandings or disputes with your clients.

- Inconsistent formatting: Maintain a consistent format throughout the invoice to enhance professionalism and readability.

- Not setting clear payment terms: Communicate the payment terms to avoid any confusion and ensure timely payment.

- Forgetting to follow up: If the payment due date has passed, don’t hesitate to send a friendly reminder to your client to ensure prompt payment.

By following these guidelines and avoiding these mistakes, you can create and send effective self-employed timesheet invoices that facilitate smooth transactions and maintain a positive relationship with your clients.

In conclusion, a self-employed timesheet invoice is an essential tool for self-employed professionals to accurately bill their clients and track their time spent on projects. By using a well-crafted invoice, you can ensure transparency, accuracy, and professionalism in your business transactions. So start implementing a self-employed timesheet invoice today and streamline your invoicing process!

Self-Employed Timesheet Invoice Template Excel – Download