A security deposit receipt template is a document landlords provide to tenants as proof of receiving a security deposit. This template outlines the transaction details, including the deposit amount, the date it was received, and the purpose of the deposit. It serves as a legal record and protects the rights of both parties involved.

Why Do You Need a Security Deposit Receipt Template?

Having a security deposit receipt template is essential for landlords and tenants alike. Here are some reasons why:

- Legal Protection: A security deposit receipt template helps protect the rights of both landlords and tenants by providing a written record of the transaction.

- Documentation: It serves as proof that the deposit was paid, which can be crucial in future disputes or legal issues.

- Clarity: The template clearly outlines the terms and conditions of the security deposit, ensuring that both parties are on the same page.

- Professionalism: Providing a receipt to tenants shows professionalism and builds trust between landlords and tenants.

How to Create a Security Deposit Receipt

Creating a security deposit receipt template is a simple process. Here are the steps to follow:

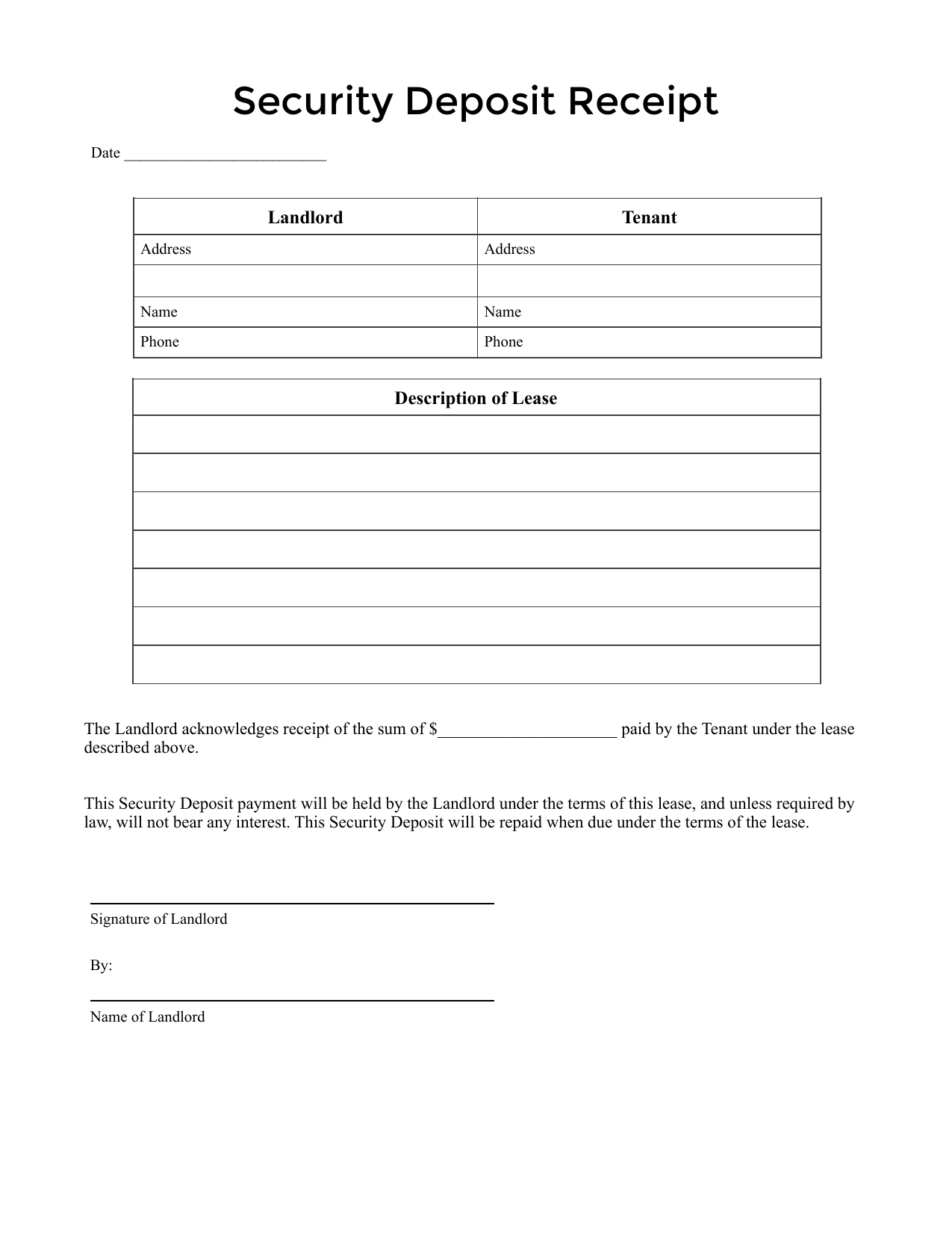

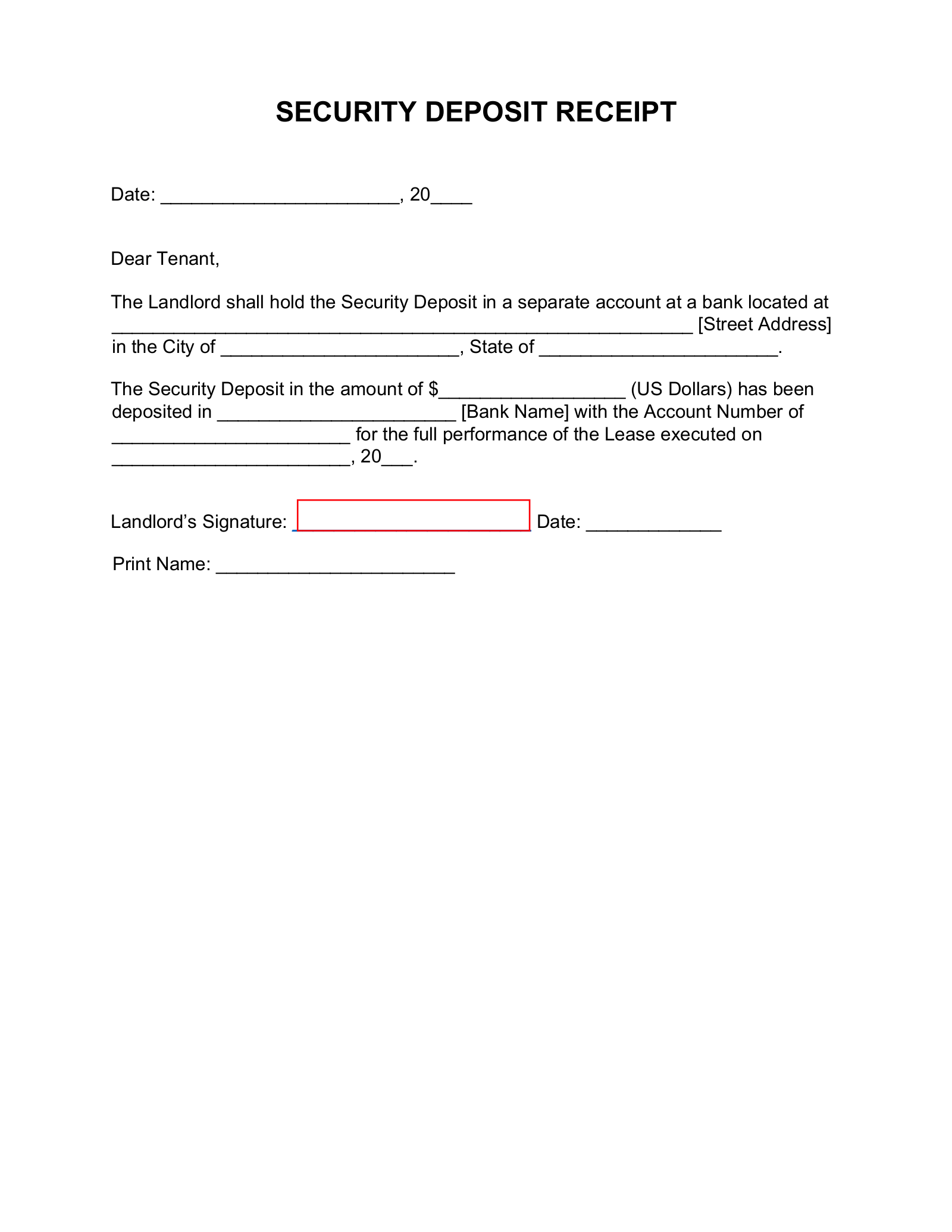

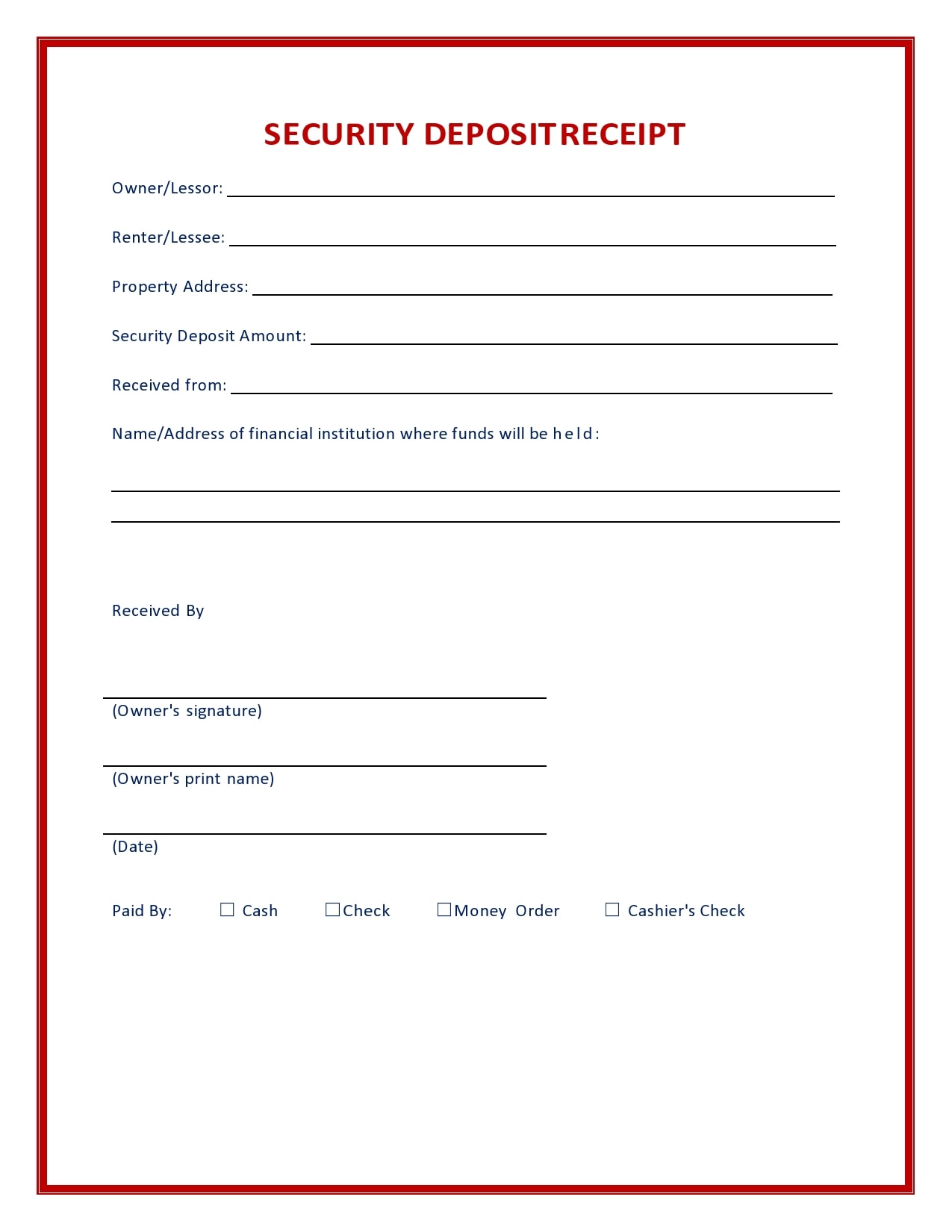

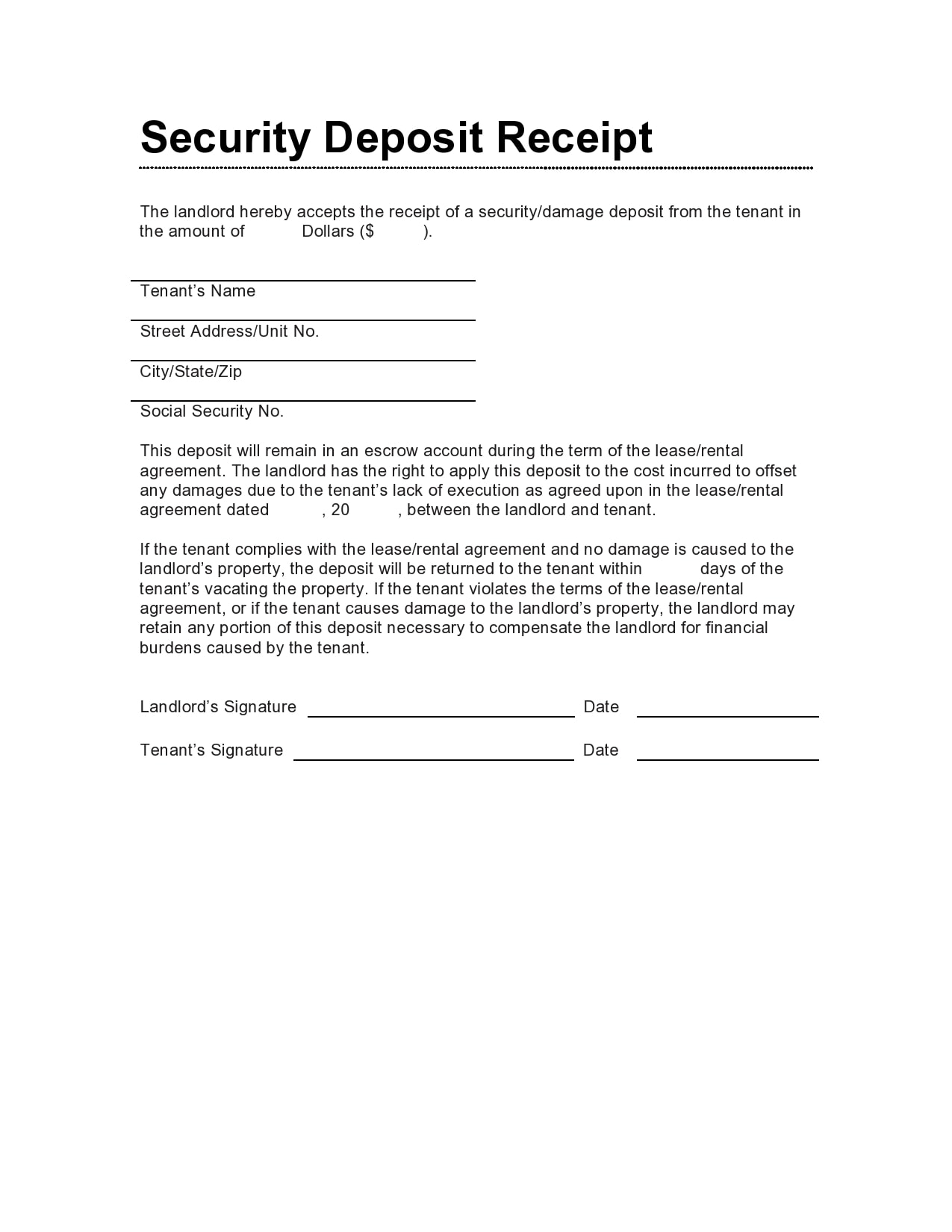

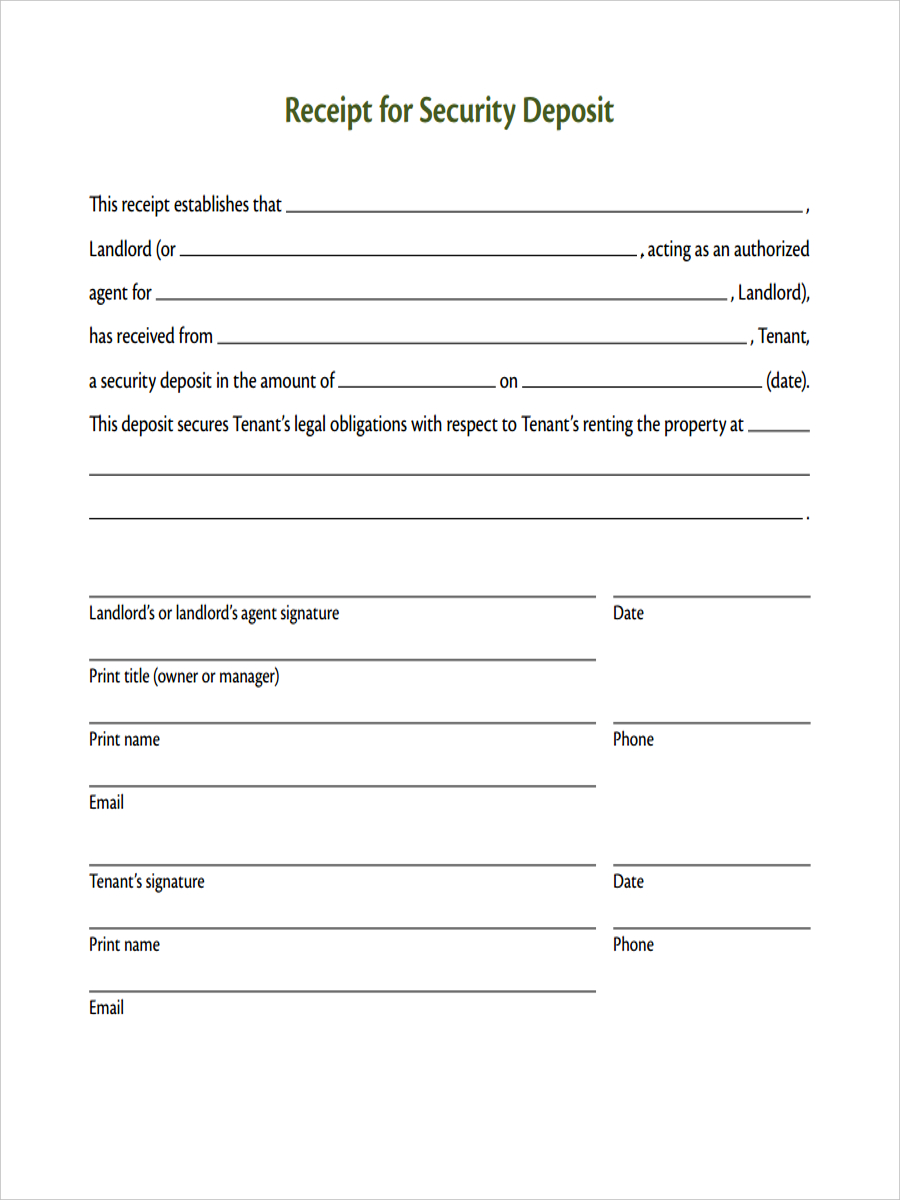

- Header: Start by including the word “Security Deposit Receipt” at the top of the document. You can also include your name or the name of your rental property.

- Landlord and Tenant Information: Include the full names and contact information of both the landlord and the tenant.

- Property Details: Mention the address of the rental property and any unit or apartment numbers if applicable.

- Date and Amount: State the date the security deposit was received and the exact amount of the deposit.

- Payment Method: Specify the method of payment used for the deposit, such as cash, check, or online transfer.

- Purpose: Clearly state that the deposit is for security purposes and will be returned to the tenant upon the termination of the lease, minus any deductions for damages or unpaid rent.

- Terms and Conditions: Include any specific terms and conditions related to the security deposit, such as the timeframe for returning the deposit, deductions allowed, and the process for dispute resolution.

- Signature: Leave space for both the landlord and the tenant to sign and date the receipt.

5 Benefits of Using a Security Deposit Receipt Template

Using a security deposit receipt template provides several benefits for both landlords and tenants. Here are the top five advantages:

- Legal Protection: A security deposit receipt template ensures that both parties are protected legally by providing a written record of the transaction.

- Organization: Having a standardized template helps landlords keep track of security deposits and simplifies their record-keeping process.

- Clarity: The template clearly outlines the purpose of the security deposit and any terms and conditions associated with it.

- Efficiency: Using a template saves time and effort by eliminating the need to create a new receipt from scratch for each tenant.

- Professionalism: Providing a receipt to tenants shows professionalism and builds trust between landlords and tenants.

Common Questions about Security Deposit Receipt Templates

1. Can I modify a security deposit receipt template to suit my needs?

Yes, you can customize a security deposit receipt template to include any additional information or terms specific to your rental agreement. However, make sure to consult with a legal professional to ensure that any modifications comply with local laws and regulations.

2. How should I store the security deposit receipts?

It is essential to store security deposit receipts in a safe and organized manner. Consider creating a digital folder or filing system to keep track of receipts for easy access when needed.

3. Are security deposit receipts required by law?

The legal requirements for security deposit receipts vary by jurisdiction. However, it is generally a best practice to provide tenants with a receipt to avoid any disputes or misunderstandings in the future.

4. Can I use a security deposit receipt template for commercial properties?

While a security deposit receipt template can be used for commercial properties, it is essential to consult with a legal professional to ensure that the template complies with any specific laws or regulations related to commercial leases.

5. How long should I keep the security deposit receipts?

It is recommended to keep security deposit receipts for a reasonable period, typically at least one to three years after the termination of the lease. This ensures that you have access to the receipts in case of any disputes or legal issues.

6. What should I do if a tenant refuses to sign the security deposit receipt?

If a tenant refuses to sign the security deposit receipt, document the refusal and keep a record of any communication related to the receipt. This can be useful in case of disputes or legal issues in the future.

7. Can I use an electronic signature on the security deposit receipt?

The acceptability of electronic signatures for security deposit receipts may vary depending on local laws and regulations. It is advisable to consult with a legal professional to ensure that electronic signatures are legally recognized in your jurisdiction.

Final Words

A security deposit receipt template is a crucial document for both landlords and tenants. It provides legal protection, ensures clarity and professionalism, and serves as a record of the security deposit transaction. By using a template, landlords can streamline their record-keeping process and maintain organized documentation. Tenants can also benefit from having a receipt that verifies their deposit payment. Remember to customize the template to suit your specific needs and consult with a legal professional if necessary. With a well-crafted security deposit receipt template, you can establish trust and transparency in your landlord-tenant relationship.

Security Deposit Receipt Template Word – Download