Dealing with insurance claims can be a complex and frustrating process. Whether it’s a denied claim, insufficient coverage, or a disagreement over reimbursement, many policyholders find themselves needing to take action. One effective way to address these issues is by writing an insurance company appeal letter. In this article, we will explore what an insurance company appeal letter is, why you might need one when to use it, what to include, and how to write a compelling letter.

What is an Insurance Company Appeal Letter?

An insurance company appeal letter is a written document that policyholders use to contest a decision made by their insurance provider. It serves as a formal request for the company to review and reconsider its decision regarding a claim, coverage, or reimbursement. The letter provides an opportunity for the policyholder to present their case, provide additional information, and argue for a different outcome.

Why Do You Need an Insurance Company Appeal Letter?

There are several reasons why you might need to write an insurance company appeal letter. Here are a few common situations:

- Denied Claims: If your insurance claim has been denied, writing an appeal letter allows you to challenge the decision and provide additional evidence or information to support your claim.

- Insufficient Coverage: If you believe that your insurance policy should cover a specific expense or situation, but the company disagrees, an appeal letter can help you make your case.

- Reimbursement Disagreements: If you are dissatisfied with the amount of reimbursement provided by your insurance company, writing an appeal letter can help you negotiate for a higher amount.

When Should You Write an Insurance Company Appeal Letter?

You should consider writing an insurance company appeal letter when you believe that the decision made by your insurance provider is incorrect or unfair. It’s important to note that most insurance policies have a specific timeframe within which you must file an appeal. Therefore, it is essential to act promptly to ensure your appeal is considered.

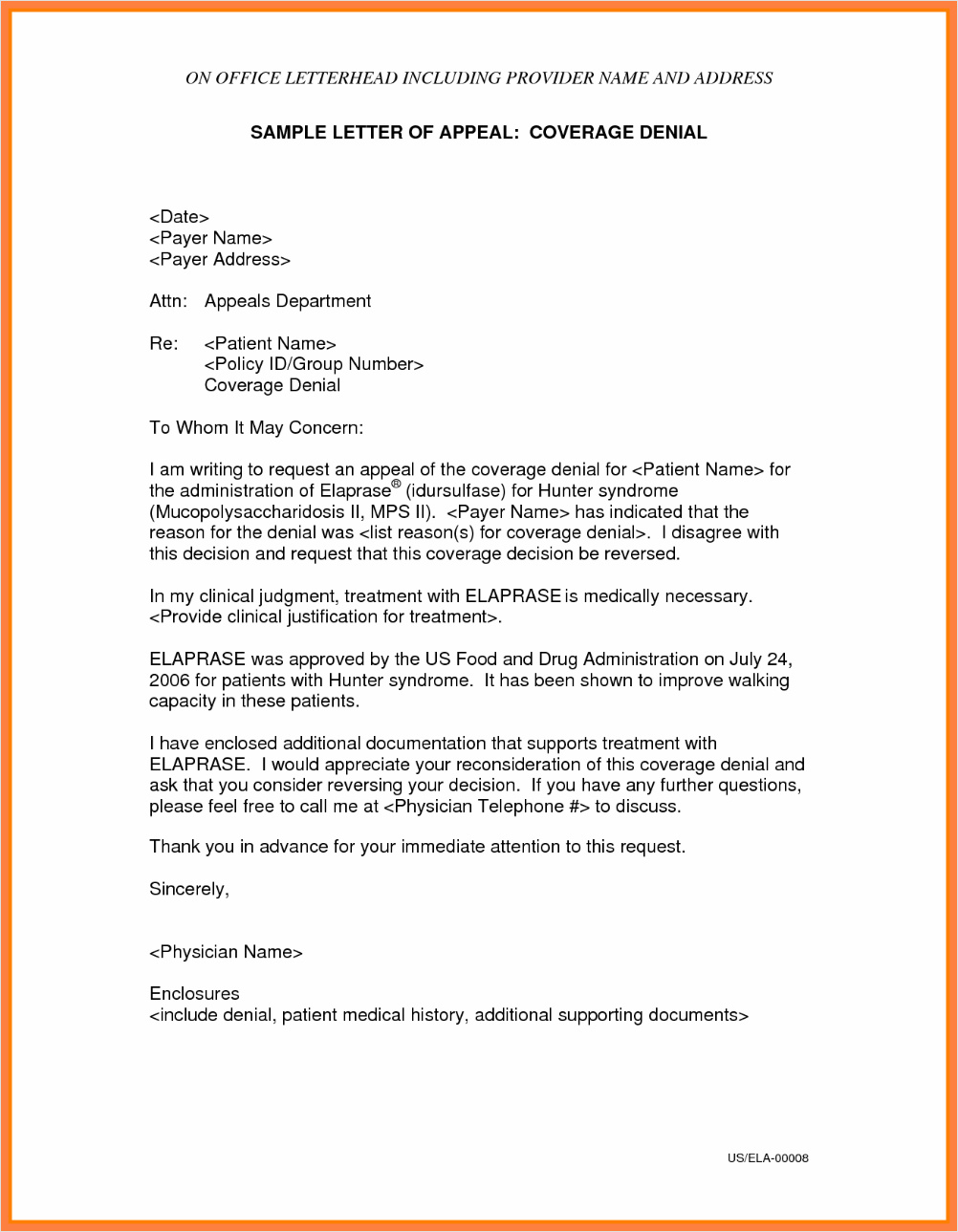

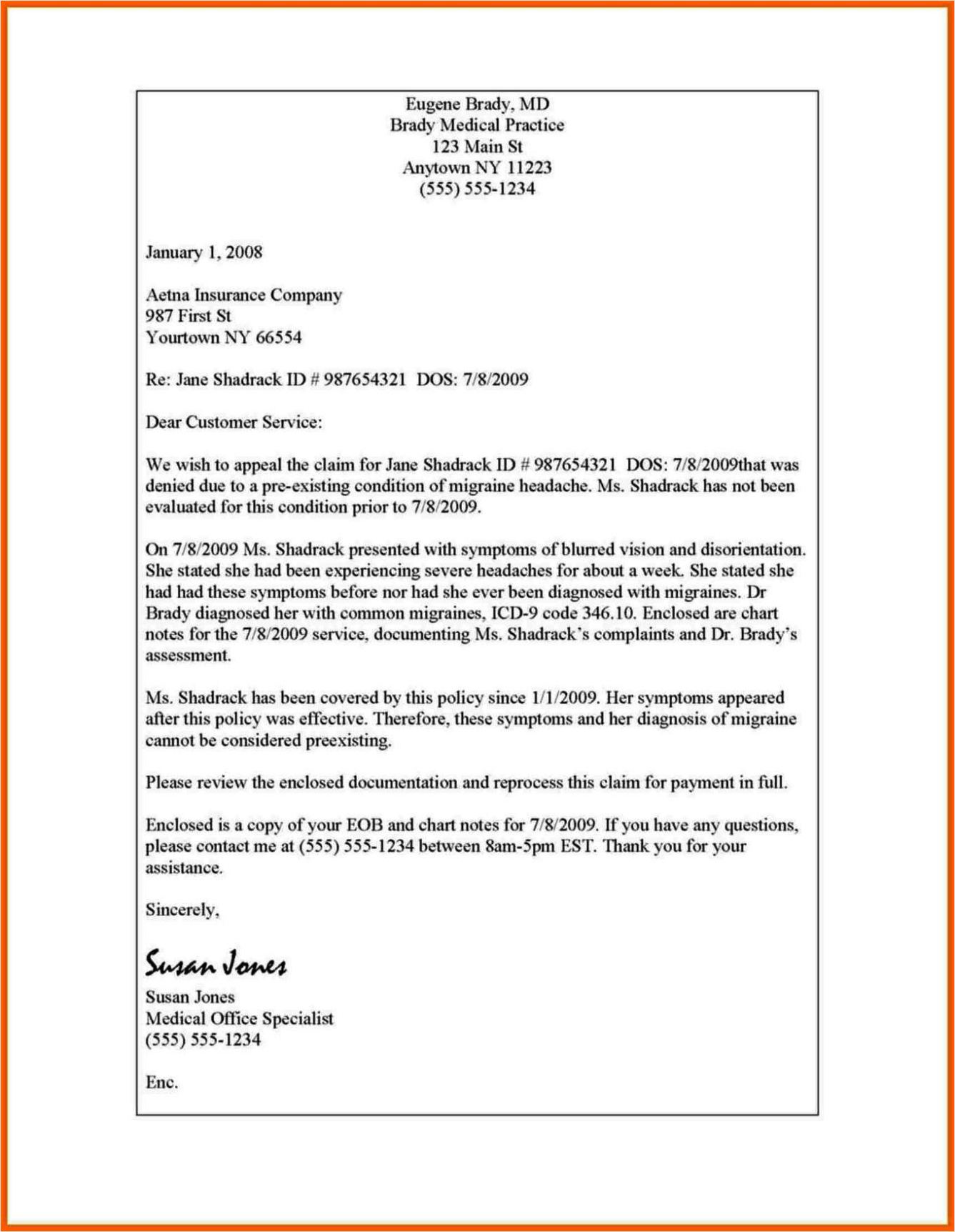

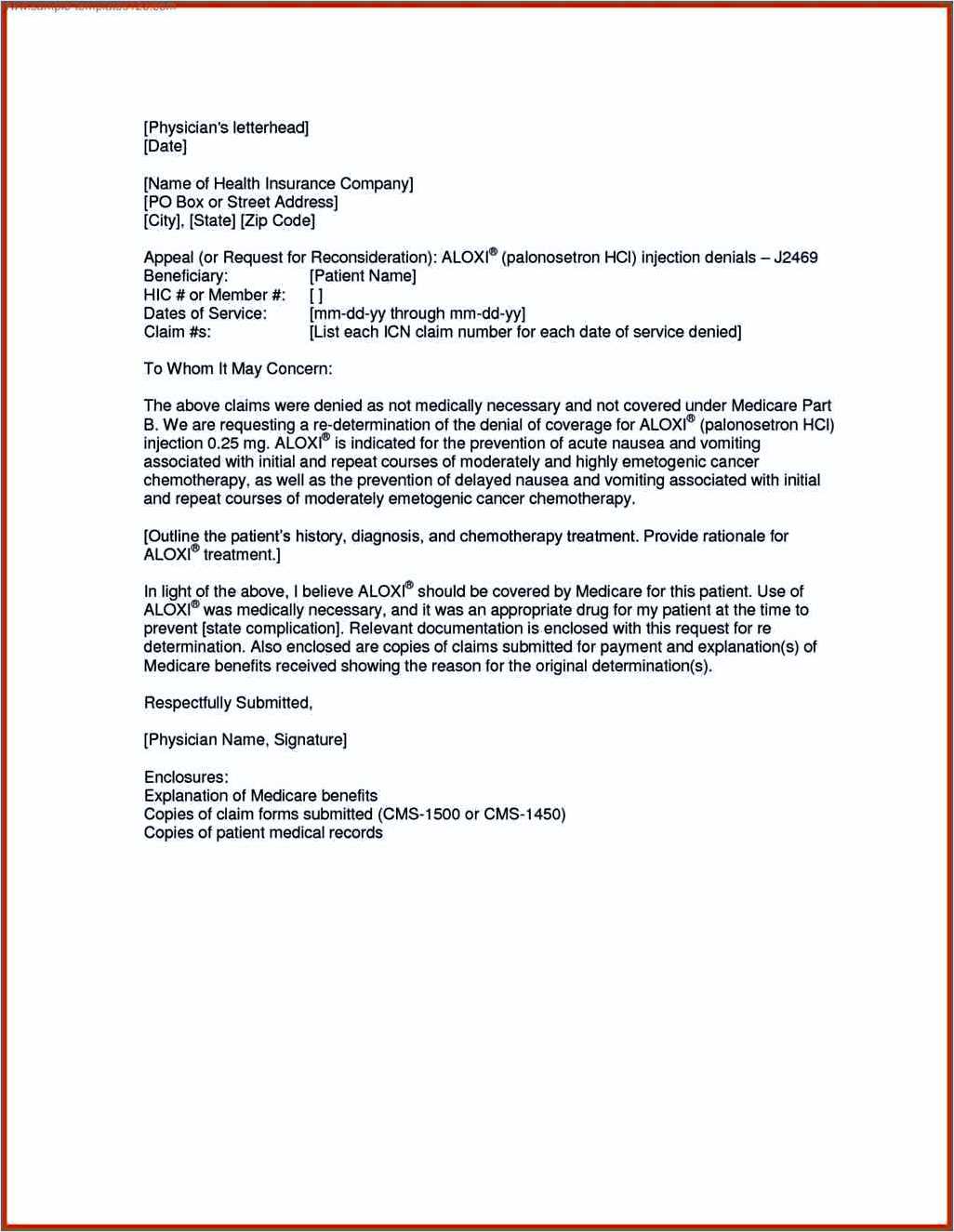

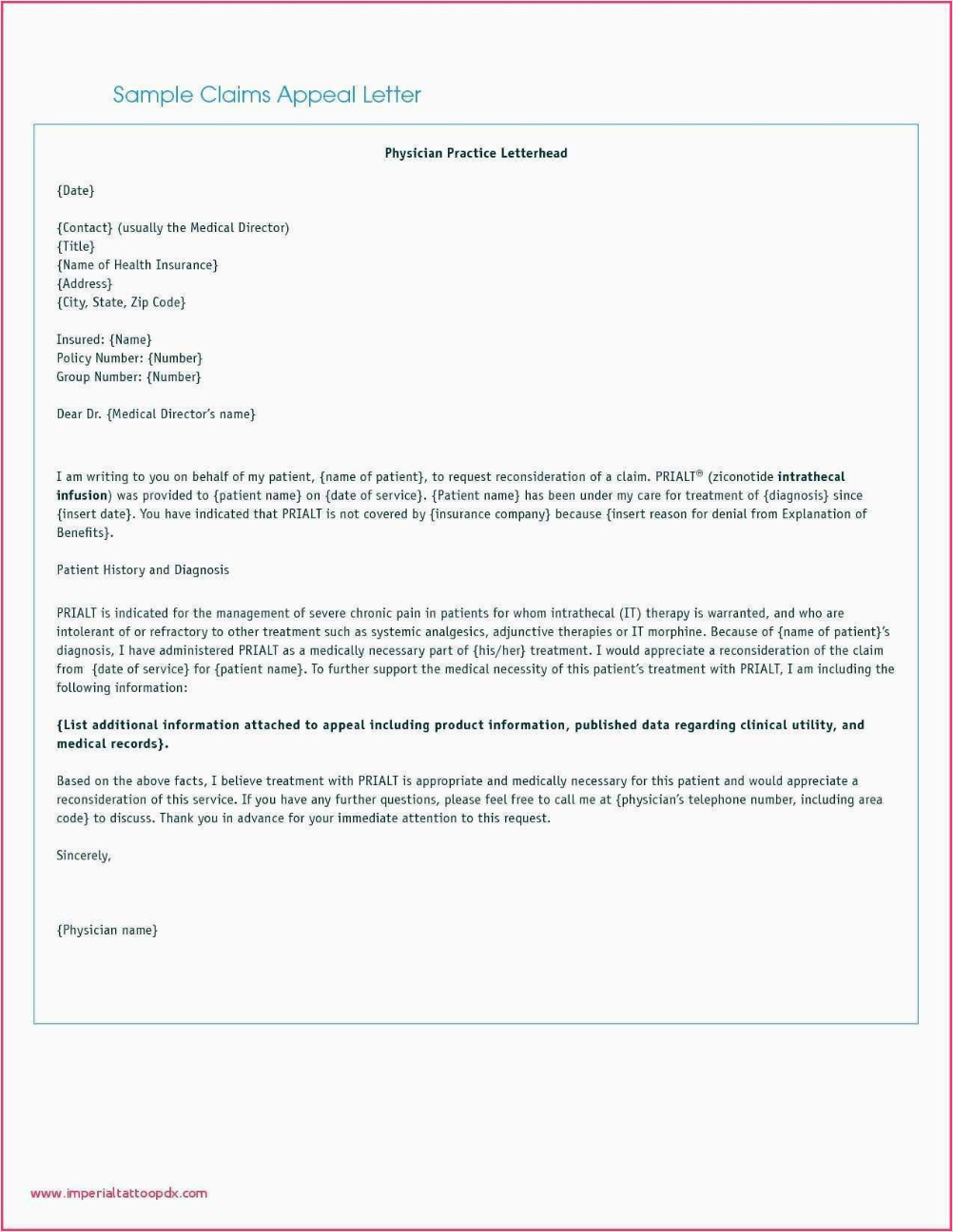

What to Include in an Insurance Company Appeal Letter

When writing an insurance company appeal letter, it’s crucial to include specific details and supporting evidence to strengthen your case. Here are some essential elements to include:

- Policy Information: Provide your policy number, the date of the claim, and any other relevant policy details to help the insurance company locate your file.

- Reason for Appeal: Clearly state the reason for your appeal, whether it’s a denied claim, coverage dispute, or reimbursement disagreement.

- Supporting Evidence: Include any relevant documents or evidence that support your position. This may include medical records, receipts, photographs, or expert opinions.

- Clear and Concise Explanation: Clearly explain why you believe the insurance company’s decision was incorrect or unfair. Use concise language and avoid unnecessary jargon.

- Request for Review: Clearly state that you are requesting a review of the decision and ask for a specific action, such as reconsideration of the claim, revision of the coverage, or a higher reimbursement amount.

- Contact Information: Provide your contact information, including your name, address, phone number, and email address, so the insurance company can reach you with any questions or updates.

How to Write an Insurance Company Appeal Letter

Writing an effective insurance company appeal letter requires careful planning and attention to detail. Here are some steps to help you craft a compelling letter:

- Understand your Policy: Familiarize yourself with the terms and conditions of your insurance policy to ensure you have a clear understanding of your rights and coverage.

- Gather Evidence: Collect all relevant documents, such as medical records, receipts, contracts, or policy documents, to support your case.

- Organize your Thoughts: Create an outline or structure for your letter to ensure a logical flow of information and arguments.

- Write a Clear and Concise Introduction: Start your letter by clearly stating the reason for your appeal and providing necessary policy and claim details.

- Present Supporting Evidence: Present your evidence in a clear and organized manner, making it easy for the insurance company to understand and evaluate.

- Explain your Position: Provide a detailed explanation of why you believe the insurance company’s decision was incorrect or unfair. Use specific examples and avoid emotional language.

- Make a Clear Request: Clearly state what action you are requesting from the insurance company, whether it’s reconsideration of the claim, revision of the coverage, or a higher reimbursement amount.

- Polish and Proofread: Review your letter for clarity, grammar, and spelling errors. Ensure that your writing is professional and respectful in tone.

- Submit and Follow-Up: Send your appeal letter to the appropriate department or individual within the insurance company and keep a record of the date and method of submission. Follow up with the company to confirm receipt and inquire about the timeline for a response.

Writing an insurance company appeal letter can be a powerful tool in resolving disputes with your insurance provider. By following these guidelines and presenting a strong case, you increase your chances of a favorable outcome. Remember to remain professional and respectful throughout the process, as this will help maintain a positive relationship with your insurance company.

Insurance Company Appeal Letter Template Word – Download