What is a gift of equity letter?

A gift of equity letter is a document that outlines the transfer of ownership of a property from one party to another, where the value of the property is less than the amount owed on the mortgage. In simple terms, it is a way for a homeowner to sell their property to a family member or friend at a discounted price. The gift of equity letter serves as proof of the transaction and ensures that all parties involved are aware of the terms and conditions.

The gift of equity works by allowing the seller to give a portion of the equity in their property as a gift to the buyer. This gift can be used towards the down payment or to reduce the mortgage loan amount. The buyer benefits from this arrangement as they are able to purchase the property at a lower price, while the seller benefits by helping their loved one or friend become a homeowner. It is important to note that the gift of equity must be an actual gift and not a loan, as loans can complicate the mortgage approval process.

The purpose of a gift of equity letter is to establish the transaction as a legitimate gift and prevent any misunderstandings or disputes in the future. The letter should include details such as the names of the parties involved, the property address, the amount of the gift, and any conditions or requirements. By having a written agreement, both the buyer and seller have a clear understanding of their rights and responsibilities.

The benefits of a gift of equity include financial assistance for the buyer, as they are able to purchase a property at a lower price and potentially avoid the need for a large down payment. It also allows the seller to help their loved ones achieve homeownership and potentially save on real estate agent commissions. Additionally, the gift of equity can help the buyer qualify for a mortgage loan, as the equity gift can be used to meet the lender’s down payment requirements.

What is included in the gift of equity documentation?

When it comes to the gift of equity documentation, there are several important items that need to be included to ensure a smooth and legally binding transaction:

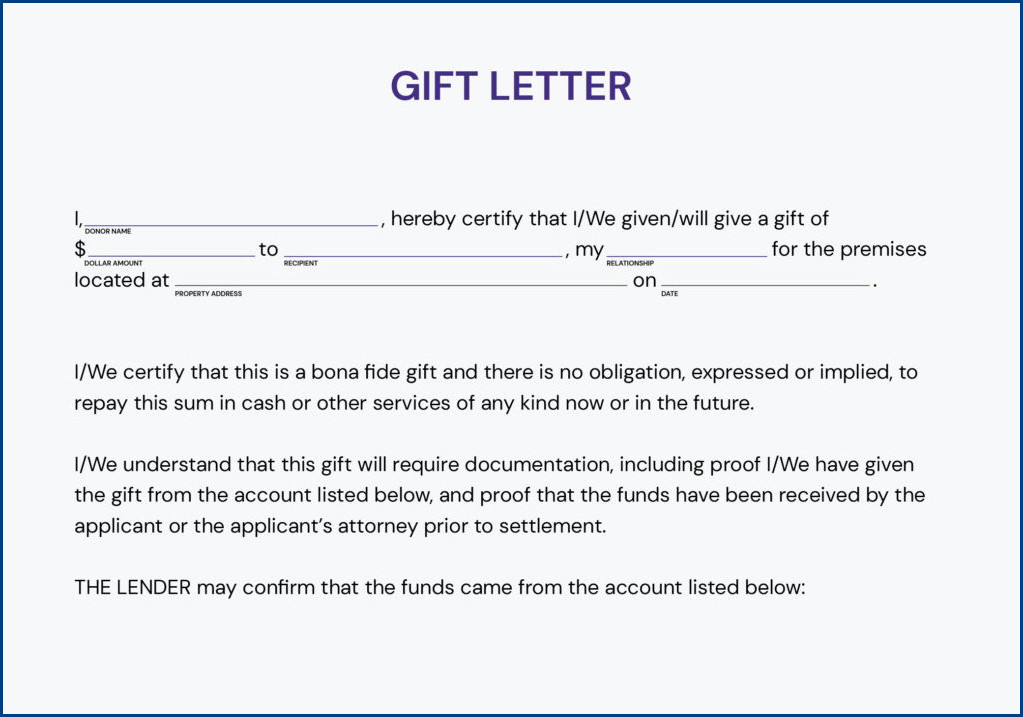

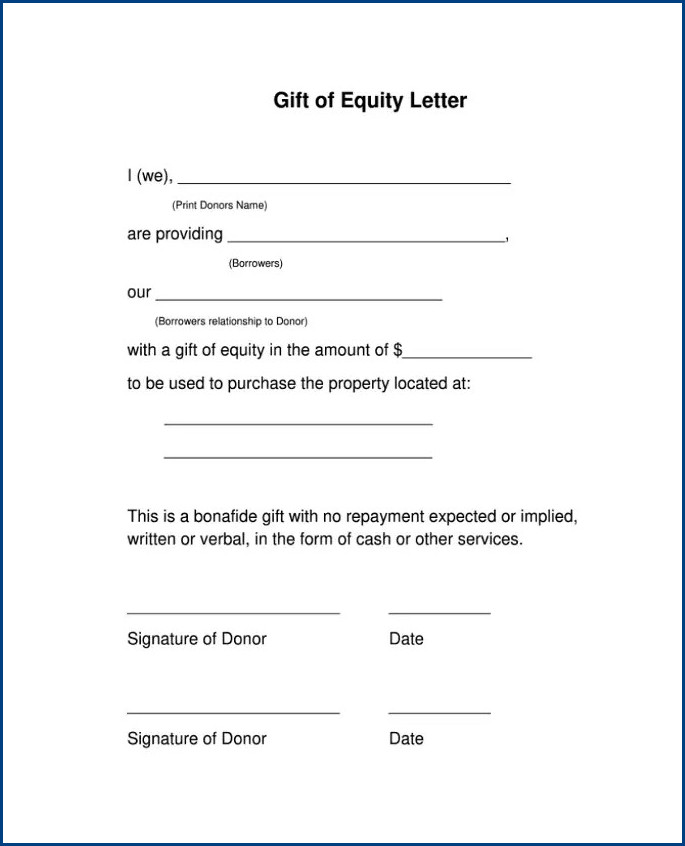

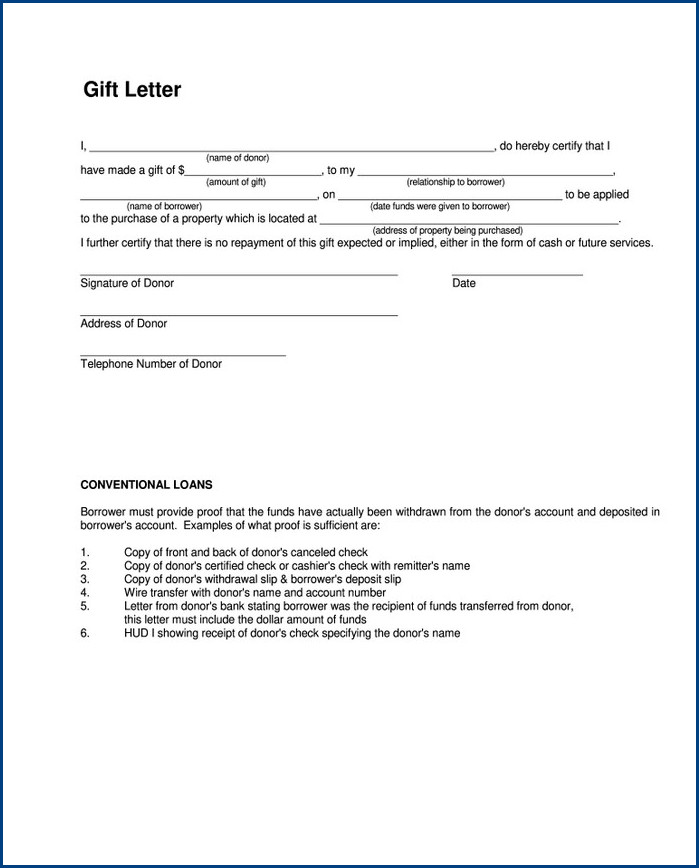

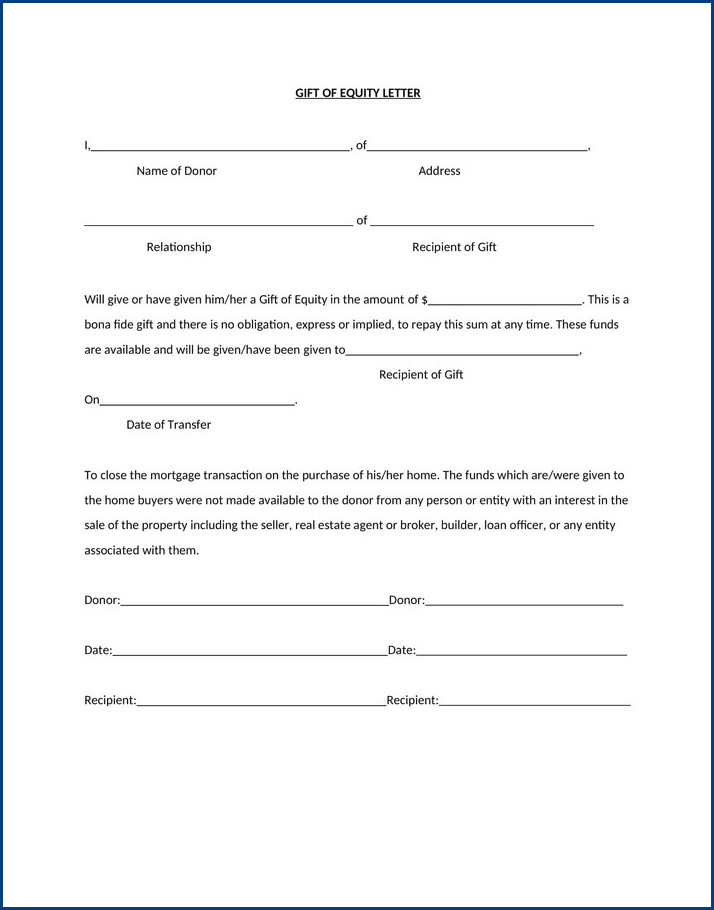

- Gift letter: This is a formal letter that outlines the intent to gift equity and includes important details such as the property address, the relationship between the donor and recipient, the amount of equity being gifted, and any conditions or restrictions that may apply. The gift letter serves as proof that the equity is being given as a gift and not as a loan.

- Property appraisal: An appraisal is necessary to determine the fair market value of the property. This value is crucial in calculating the amount of equity being gifted and ensuring that it aligns with legal requirements. The appraisal report should be included in the gift of equity documentation to provide evidence of the property’s value.

- Statement of understanding: This document is signed by both the donor and the recipient, acknowledging their understanding of the terms and conditions of the gift. It clarifies that the equity is being gifted without any expectation of repayment and that both parties are aware of their rights and responsibilities.

Including these essential elements in the gift of equity, documentation helps protect the interests of all parties involved and ensures that the gift is legally recognized.

How do I write a gift of equity letter?

To ensure that your gift of equity letter is clear, concise, and legally binding, follow these steps:

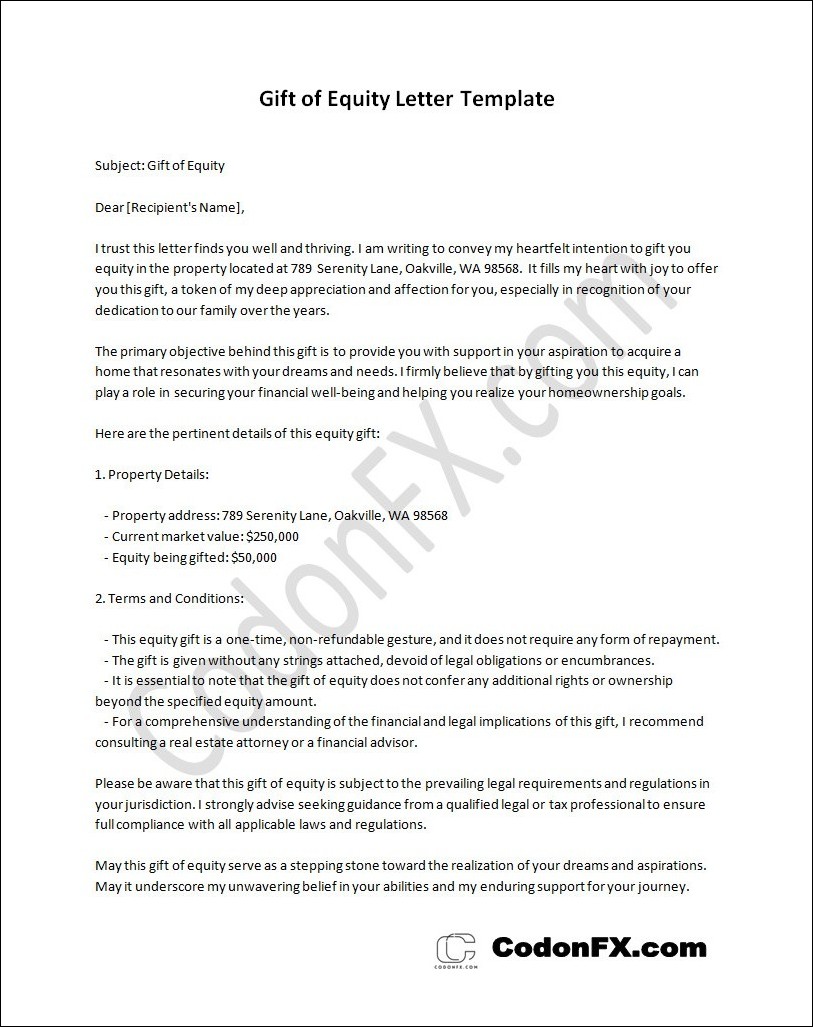

- Include a clear subject line: Begin the letter with a subject line that clearly states the purpose of the letter, such as “Gift of Equity Letter.”

- Address the recipient: Start the letter by addressing the recipient with a formal salutation, such as “Dear [Recipient’s Name].”

- Explain the purpose: Clearly state the purpose of the letter, which is to declare the intention to gift a portion of equity in the property to the recipient.

- Provide property details: Include specific details about the property, such as the address, legal description, and current market value.

- Specify the gifted equity: Clearly state the exact percentage or amount of equity that is being gifted to the recipient.

- Include legal language: Consult with a real estate attorney to ensure that the gift of equity letter includes appropriate legal language to make it legally binding.

- Sign and date the letter: Conclude the letter by signing it and including the date of signing.

Remember to consult with a real estate attorney to ensure that the letter meets all legal requirements and protects the rights and interests of all parties involved.

Gift of Equity Letter Template | Word – Download