What is a gift letter for a mortgage?

A gift letter for a mortgage is a document that verifies a financial gift given to a borrower by a family member, friend, or relative, which is then used as a down payment for a home purchase. The purpose of a gift letter is to demonstrate to the mortgage lender that the funds being used for the down payment are not a loan and do not need to be repaid. This letter is an important requirement for many mortgage lenders, as it helps ensure that the borrower has the necessary funds to qualify for the loan.

The benefits of using a mortgage gift letter are numerous.

- It allows borrowers to receive financial assistance from their loved ones, which can be particularly helpful for first-time homebuyers who may struggle to save for a down payment. By using a gift letter, borrowers can use the gifted funds towards their down payment, making homeownership more accessible.

- The use of a gift letter can help borrowers who may not have a high income or savings to still qualify for a mortgage, as they can rely on the gift as a source of funds.

- Lenders want to ensure that the funds being used for a down payment are legitimate and not loans that need to be repaid. By requiring a gift letter, they can verify the source of the funds and confirm that the money is a true gift. This helps protect both the borrower and the lender from potential fraud or misrepresentation.

What is the limit on gift letters for mortgages?

The limit on gift letters for mortgages can vary depending on the loan program and the lender’s guidelines. It is essential to check with your specific lender to determine the maximum allowable gift amount for your mortgage.

In most cases, lenders require a minimum down payment from the borrower’s own funds to ensure their financial commitment to the home purchase. The gift letter can then supplement the remaining amount needed for the down payment.

Some loan programs may allow for the entire down payment to be gifted, while others may have restrictions on the percentage that can be gifted. It is crucial to understand the guidelines and requirements set forth by your lender to ensure compliance and avoid any potential issues during the mortgage process.

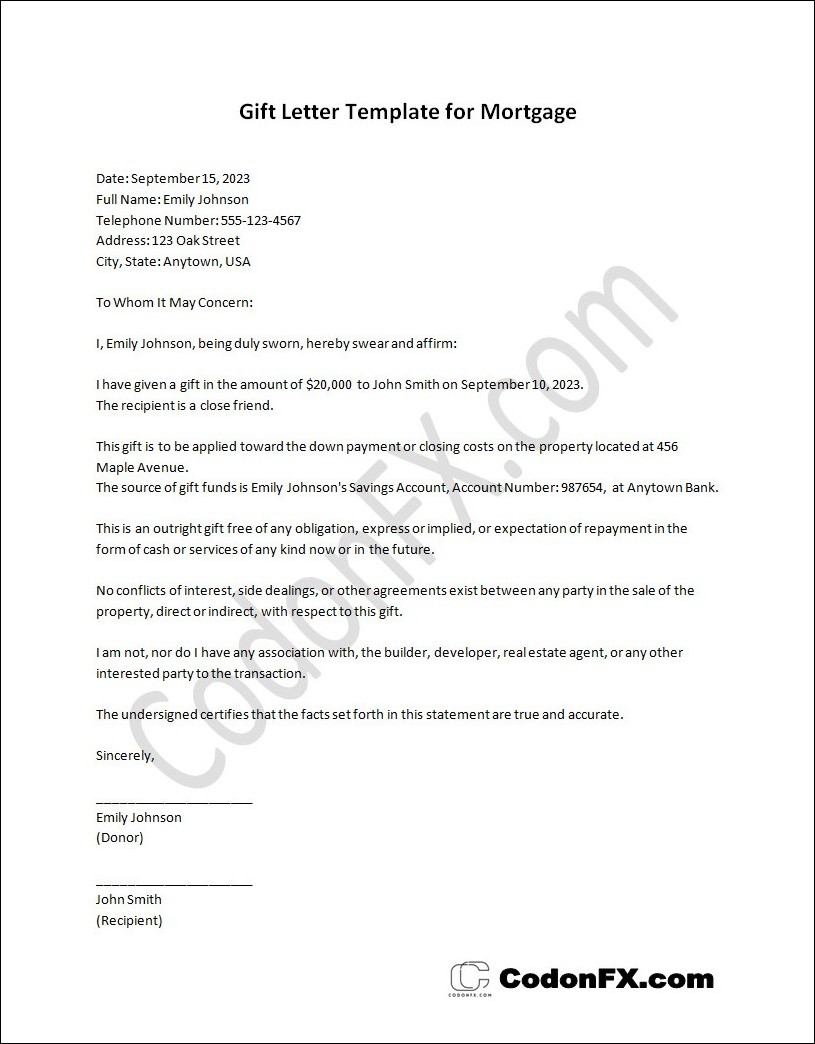

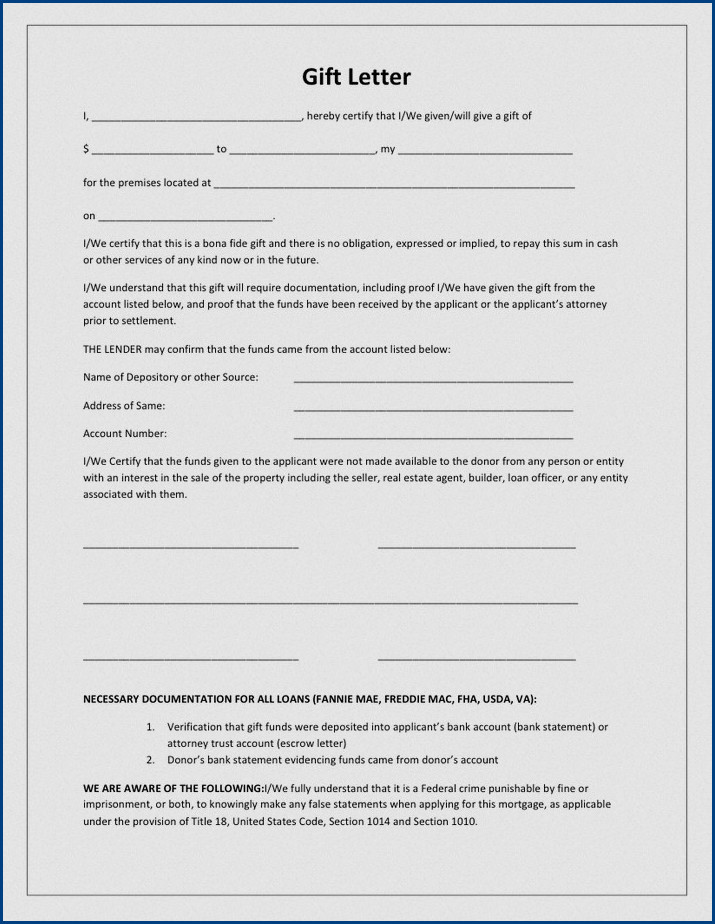

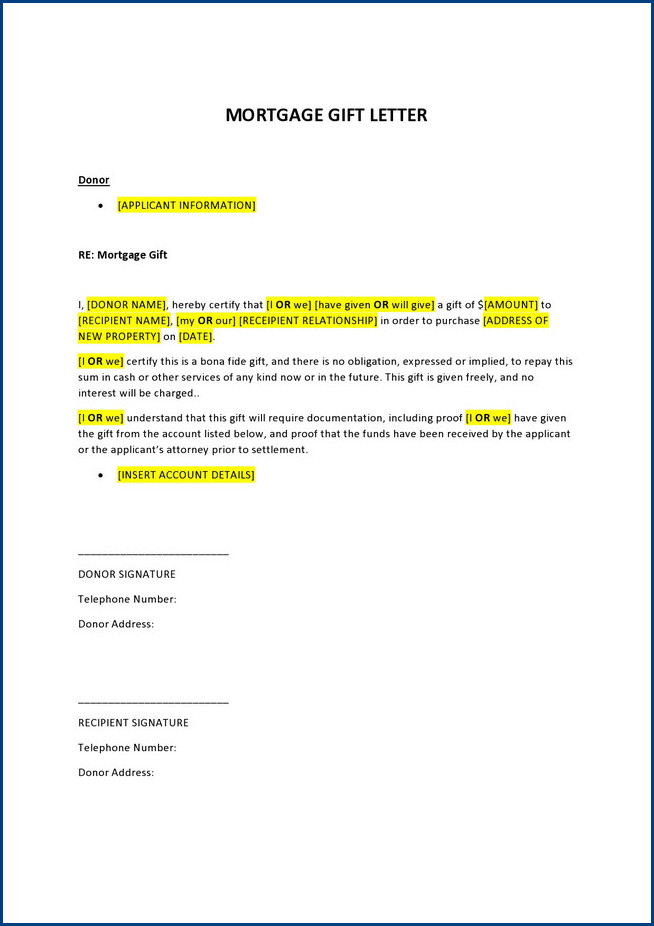

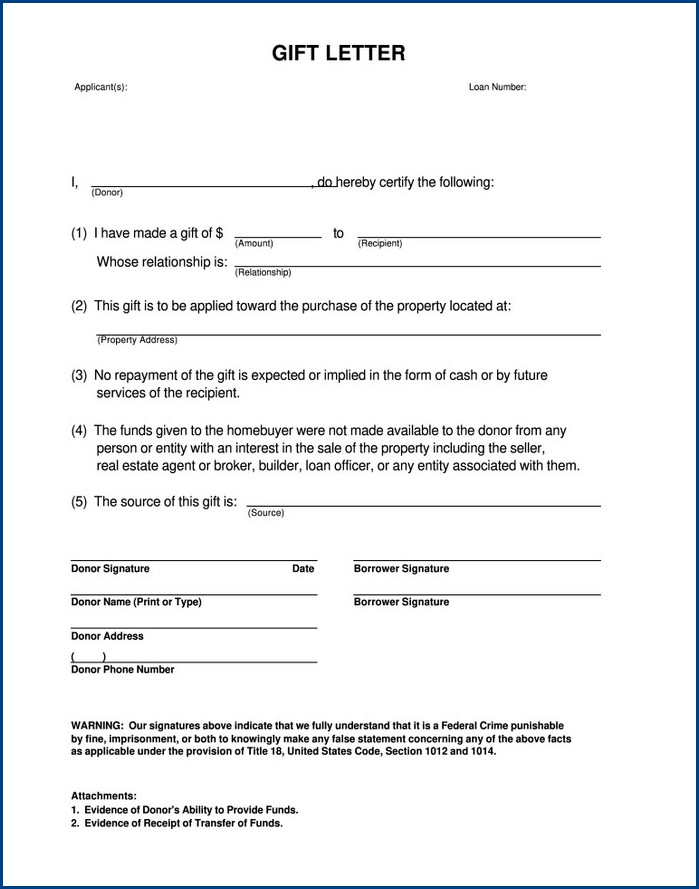

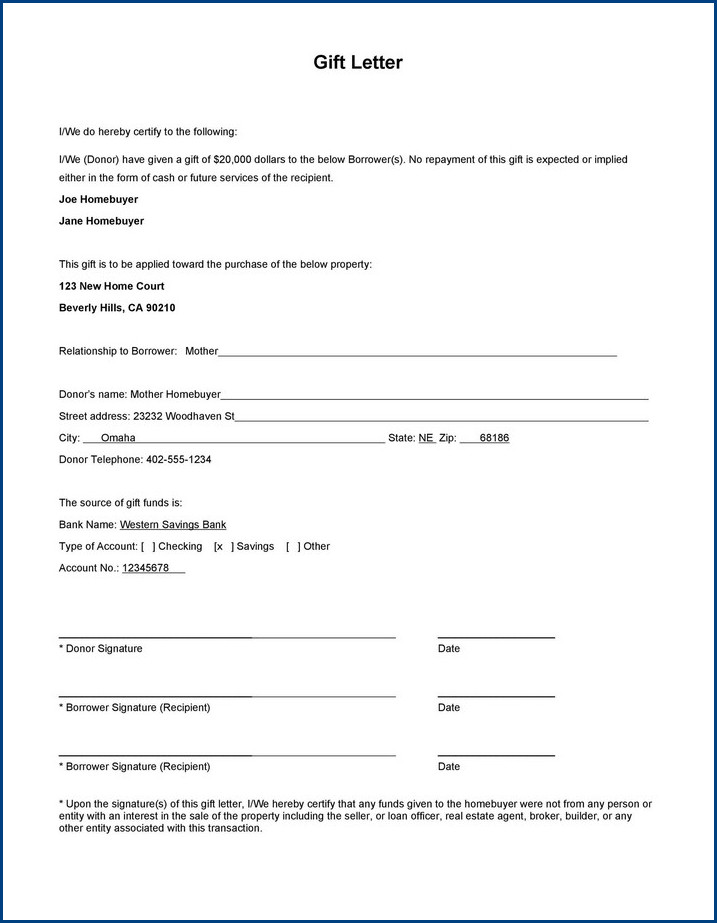

What to Include in a Gift Letter for Mortgage?

1. Donor Information

The first section of a gift letter for a mortgage should include clear and detailed information about the donor. This includes the donor’s full name, address, and contact information. It is important to provide accurate information to ensure that the mortgage lender can verify the legitimacy of the gift. Additionally, if the donor is related to the recipient, their relationship should be mentioned. For instance, if the gift is from a parent, it should be stated clearly in the letter.

2. Recipient Information

The next section of the gift letter should focus on the recipient’s information. This includes the full name, address, and contact details of the individual who will be receiving the gift. It is crucial to mention that the gift is intended for a specific purpose, such as the down payment or closing costs for a mortgage. Providing the recipient’s details helps the lender verify the transaction and ensures that the gift is used appropriately.

3. Gift Details

In this section, it is important to provide a clear and concise description of the gift. This includes specifying the exact amount of money or the nature of the gift, such as a monetary transfer or a specific item. If it is a monetary gift, the letter should state the exact amount and currency. It is also crucial to mention the date on which the gift was given or will be given, as this helps establish the timeline of the transaction.

4. Donor Affirmations

The donor affirmations section is where the letter confirms that the gift is indeed a gift and not a loan. The donor should explicitly state that they do not expect any form of repayment or compensation from the recipient. It is also important to mention that the gift is given willingly and without any conditions attached. This section helps demonstrate to the mortgage lender that the funds are not a liability for the recipient and will not affect their ability to repay the mortgage.

5. Signatures

The final section of the gift letter should include the signatures of both the donor and the recipient. Both parties should sign and date the letter to provide evidence of their agreement and acknowledgment of the gift. It is advisable to include the full names of the individuals next to their signatures for clarity. The signatures indicate that both parties understand and agree to the terms outlined in the gift letter. This section serves as a formal closure to the letter and emphasizes the commitment of both parties in the gift process.

How do I write a letter to give a mortgage as a gift?

Here are some steps to help you write a letter to give a mortgage as a gift:

- Begin with a formal salutation: Start the letter with a polite and respectful greeting, addressing the recipient by their name.

- Clearly state your intention: Begin the letter by clearly stating that you are writing to give a mortgage as a gift. This will eliminate any confusion and set the tone for the rest of the letter.

- Provide details: Include all the necessary information related to the mortgage gift. This should include the amount of the mortgage, the terms and conditions, and any specific instructions or requirements.

- Express your intentions: Take a moment to explain why you are giving this gift. Whether it is to help a loved one purchase their dream home or to support them financially, expressing your intentions can add a personal touch to the letter.

- Offer assistance: Let the recipient know that you are available to answer any questions or provide further assistance regarding the mortgage gift. This will show your willingness to help and ensure that they have all the support they need.

Writing a letter to give a mortgage as a gift requires attention to detail and clear communication. By following these steps and including all the necessary information, you can create a thoughtful and comprehensive letter that properly conveys your intentions.

How to express your intentions in a letter to give a mortgage as a gift?

- Be sincere: Use genuine and heartfelt language to convey your intentions. Let the recipient know that you are giving this gift out of love, support, or any other personal reasons.

- Focus on the recipient: Highlight how the mortgage gift will benefit the recipient. Whether it will help them achieve their dream of becoming a homeowner or provide them with financial stability, emphasizing their needs and goals will show your thoughtfulness.

- Share personal stories or experiences: If applicable, share personal stories or experiences that demonstrate why giving this mortgage gift holds special meaning for you. This can create a deeper emotional connection and further emphasize your intentions.

- Use positive and uplifting language: Choose words that convey positivity, encouragement, and optimism. This will help create a warm and supportive tone throughout the letter.

- End with good wishes: Conclude the letter by expressing your good wishes for the recipient’s future. Whether it is happiness, success, or any other positive outcome, ending on a positive note will leave a lasting impression.

Remember to be genuine, focus on the recipient, and use positive language to create a meaningful and heartfelt message.

Gift Letter Template for Mortgage | Word – Download