What is a gift letter for a down payment?

A gift letter for a down payment is a document that confirms a financial gift given to a homebuyer by a family member or friend, which is intended to be used as a down payment for purchasing a property. This letter is typically required by mortgage lenders to verify that the funds being used for the down payment are a gift and not a loan that would need to be repaid. The purpose of the gift letter is to ensure transparency and prevent any potential fraud or misrepresentation in the mortgage application process.

The main benefit of a gift letter for a down payment is that it allows homebuyers to receive financial assistance from their loved ones to purchase a home. This can be especially helpful for first-time homebuyers who may struggle to save enough money for a down payment on their own. By receiving a financial gift, homebuyers can increase their chances of qualifying for a mortgage and potentially secure a better interest rate.

Additionally, the gift letter helps lenders assess the borrower’s financial situation and determine their ability to make mortgage payments, as the gift funds do not have to be repaid.

Moreover, the gift letter also provides peace of mind to lenders by confirming that the funds being used for the down payment are not a loan. This prevents any potential issues with debt-to-income ratios and ensures that the borrower’s financial stability is accurately evaluated. It also helps protect against fraudulent activities such as falsely inflating the down payment amount or misrepresenting the source of funds.

How do you write a gift deposit letter?

Here are the steps to follow when writing a gifted deposit letter:

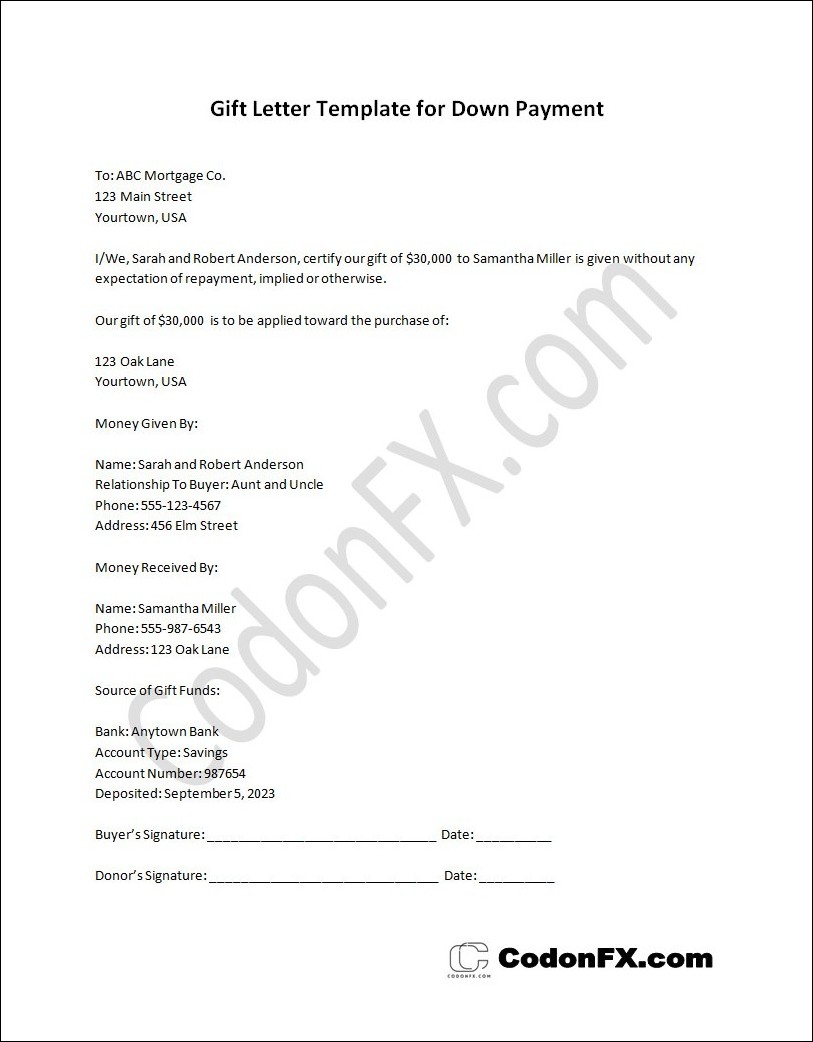

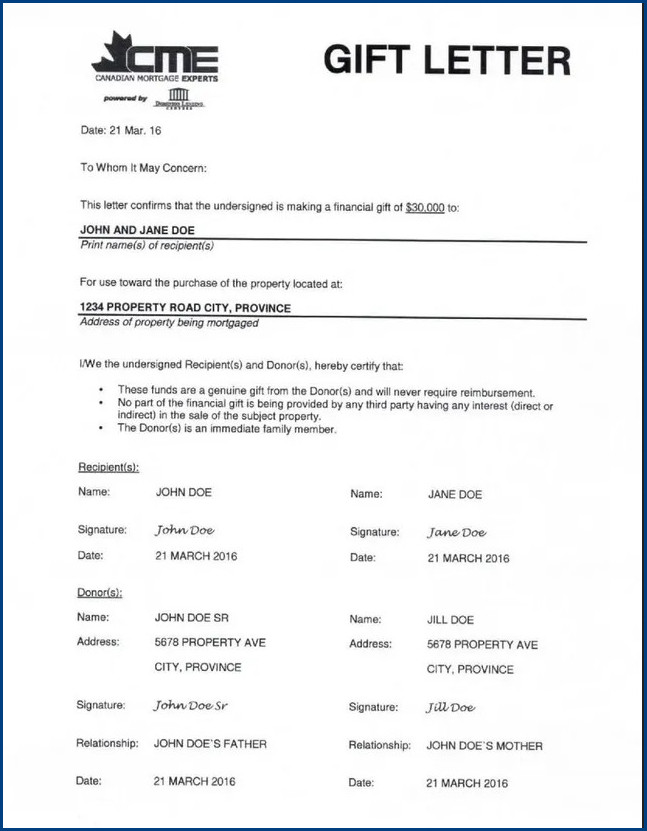

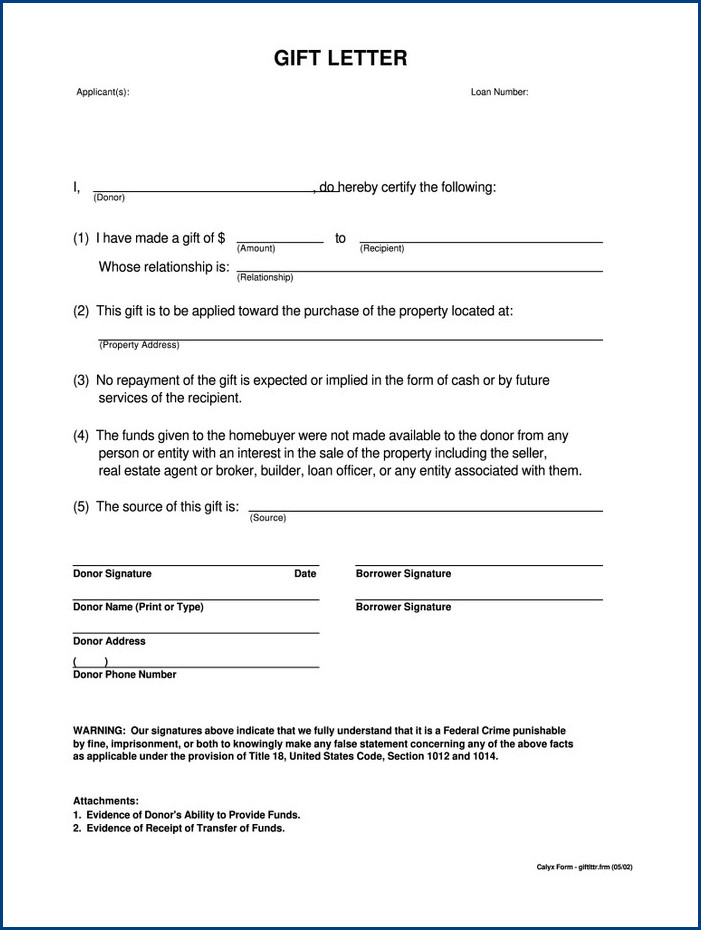

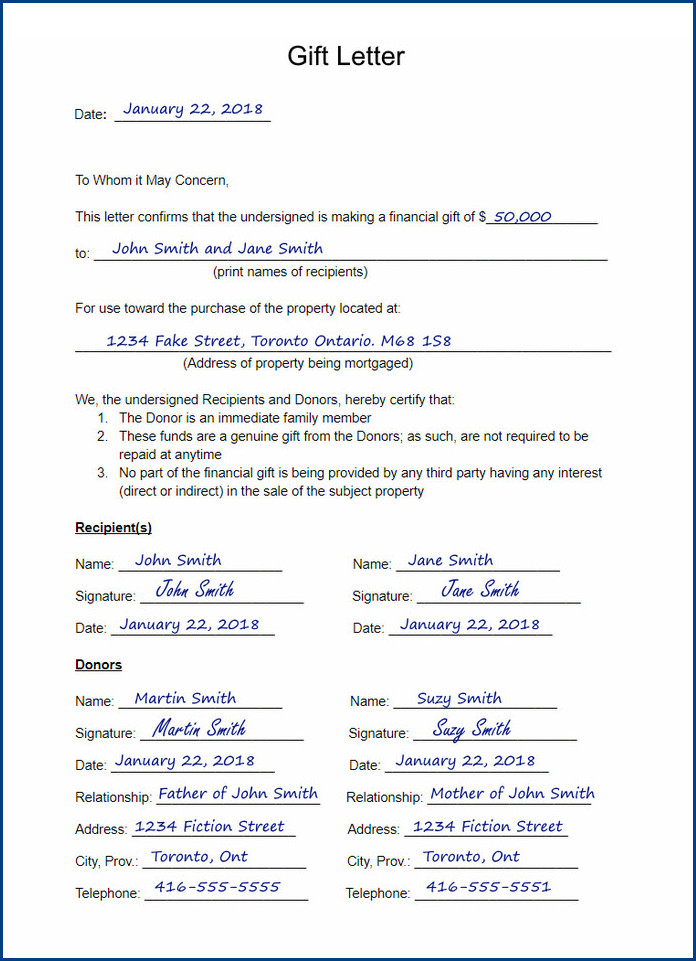

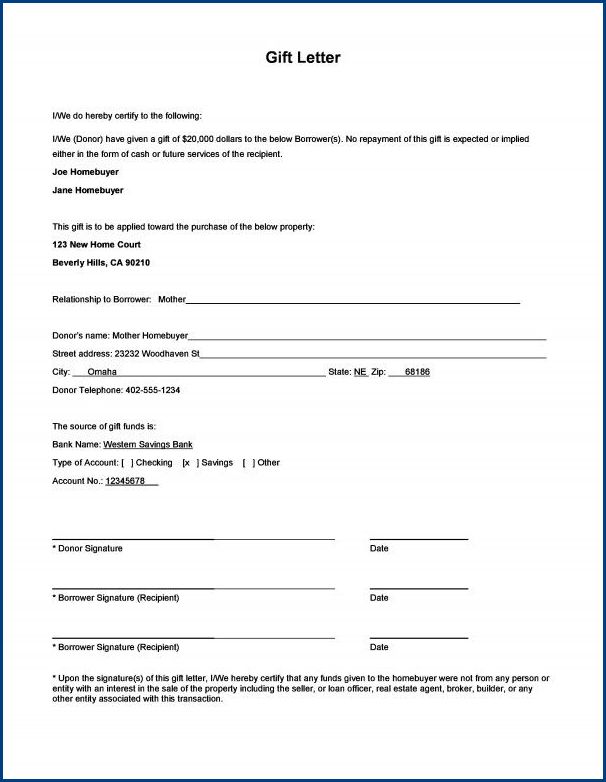

- Include the date and addresses: Begin the letter by including the current date and the addresses of both the buyer and the donor. This provides a clear record of the parties involved.

- State the purpose of the letter: Clearly state in the opening paragraph that the letter is being written to confirm that a gifted deposit is being provided for the purchase of a property.

- Provide details of the property: Include the full address of the property being purchased to ensure clarity and reference.

- Specify the amount and nature of the gift: Clearly state the exact amount of the gift deposit and specify that it is a non-repayable gift, not a loan.

- State the relationship between the buyer and donor: Include information about the relationship between the buyer and the donor, such as family members or close friends.

- Include contact information: Provide contact details for both the buyer and the donor, including full names, phone numbers, and email addresses.

By following these steps and including all the necessary information, you can effectively write a gifted deposit letter that meets legal requirements and ensures transparency between the buyer and the donor.

Remember to keep a copy of the letter for your records and consult with legal professionals if needed to ensure compliance with any specific regulations or requirements in your jurisdiction.

Gift Letter Template for Down Payment | Word – Download