What is a donation receipt letter?

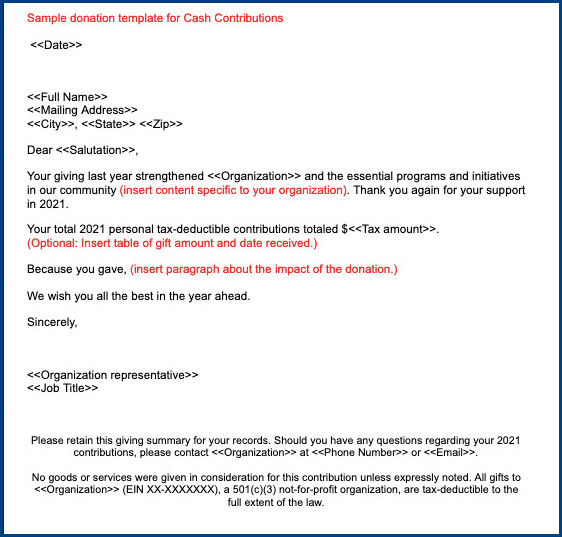

A donation receipt letter is an official document that is provided to donors by charitable organizations to acknowledge and confirm their financial contribution. It serves as proof of donation for individuals and organizations who wish to claim tax deductions or seek reimbursement from their employers.

The primary purpose of a donation receipt letter is to express gratitude to the donor and provide them with a record of their contribution. It is an essential tool for maintaining transparency and building trust between the nonprofit organization and its donors.

One of the main benefits of a donation receipt letter is its role in facilitating tax deductions. By providing a written record of the donation, the donor can use it to claim tax deductions, potentially reducing their taxable income.

Additionally, for businesses or individuals seeking reimbursement from their employers, a donation receipt letter serves as evidence of the contribution made. This can be particularly useful for companies that offer matching gift programs, where they pledge to match their employees’ donations to eligible nonprofit organizations.

Another significant benefit of a donation receipt letter is its ability to strengthen the relationship between the nonprofit organization and its donors. By promptly sending a personalized and well-crafted receipt letter, the organization shows appreciation for the donor’s generosity and commitment to the cause. This acknowledgment can inspire continued support and even encourage larger contributions in the future.

What should a donation receipt say?

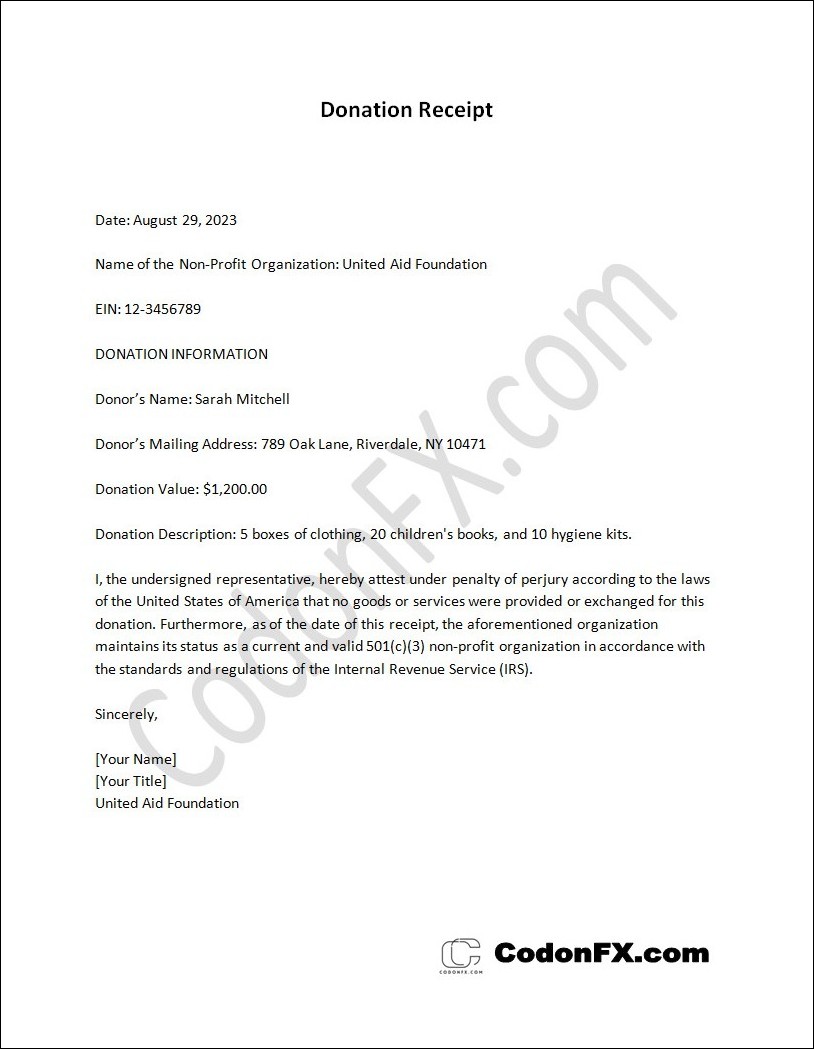

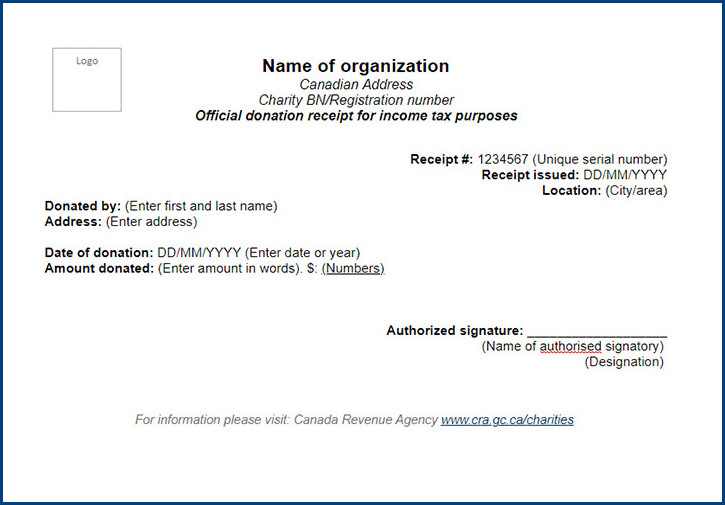

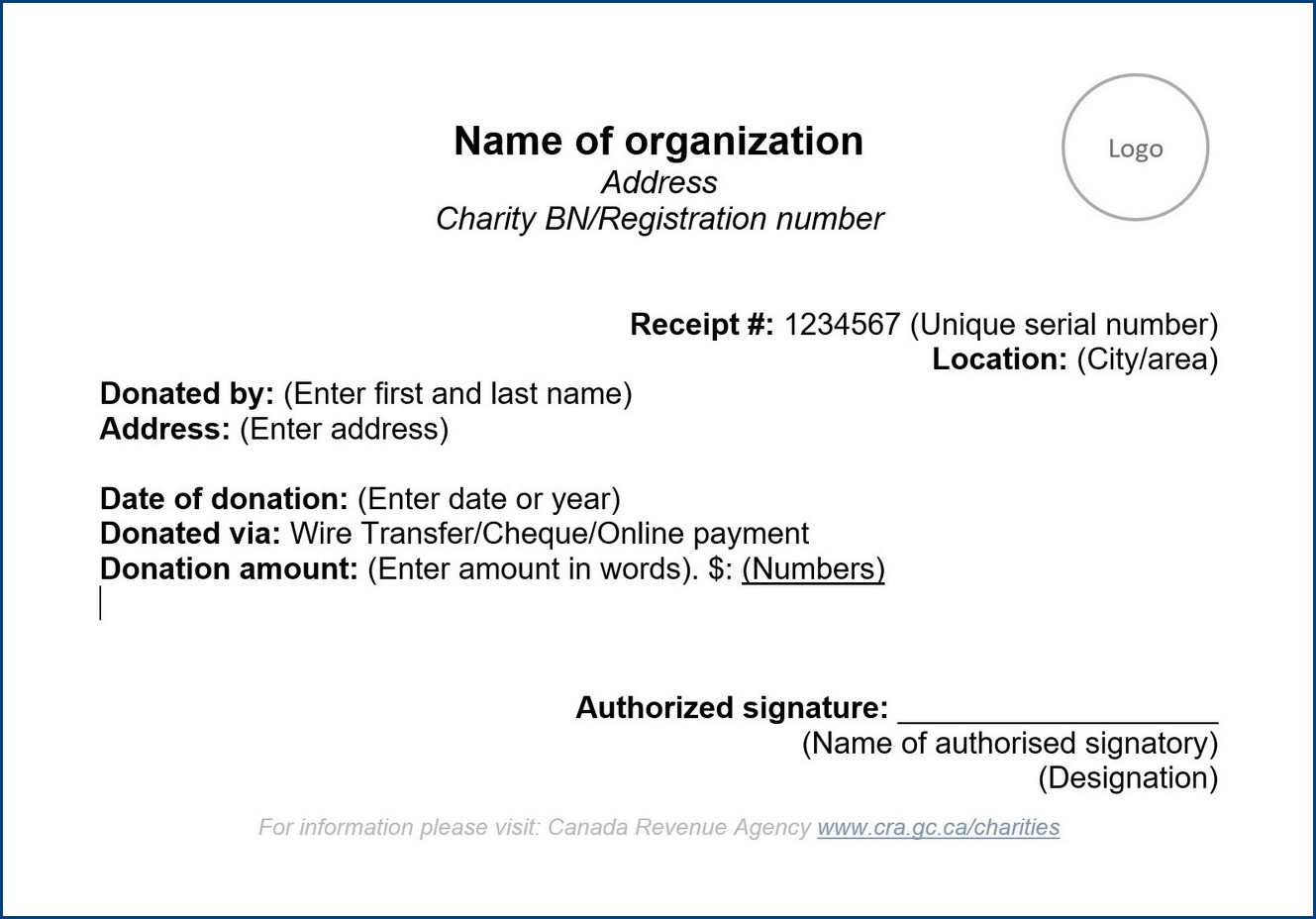

A well-crafted donation receipt should include the following details:

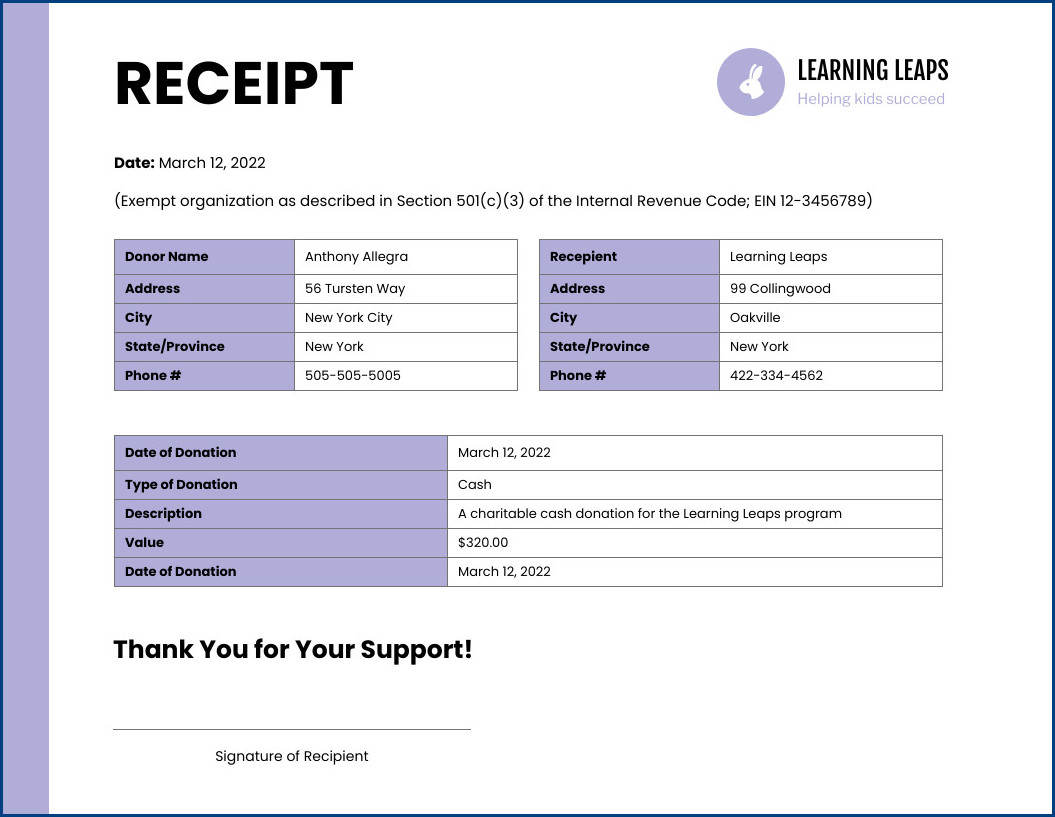

- Date of Donation: The receipt should clearly state the date on which the donation was made. This helps both the donor and the recipient organization keep accurate records.

- Donor’s Information: It is crucial to include the name, address, and contact details of the donor. This allows the organization to reach out to the donor if necessary and also helps in verifying the legitimacy of the donation.

- Recipient Organization’s Information: The receipt should clearly state the name, address, and contact information of the nonprofit organization receiving the donation. This information helps the donor identify the organization and ensures that the receipt is issued by the correct entity.

- Description of Donation: The receipt should provide a detailed description of the donated item or the purpose of the donation. This helps the donor and the organization understand the nature of the contribution and its intended use.

- Value of Donation: It is crucial to include the fair market value of the donated item or the amount of cash donation. This allows the donor to claim a tax deduction and helps the organization accurately report the contribution.

Donation Receipt Letter Template | Word – Download