What is a dispute of debt letter?

A dispute of debt letter is a written communication that individuals use to challenge the validity or accuracy of a debt that has been claimed against them. This letter serves as a formal way to assert one’s rights and protect oneself from any potential unfair or incorrect debt collection practices. It is an essential tool for consumers to exercise their rights under the Fair Debt Collection Practices Act (FDCPA) and ensure that they are not being wrongly pursued for a debt they do not owe.

The primary purpose of a dispute of debt letter is to dispute the validity or accuracy of a debt. By sending this letter, a consumer can request the debt collector to provide evidence that the alleged debt is indeed legitimate and belongs to them. This letter helps consumers safeguard their financial interests and maintain their creditworthiness. It also acts as a legal document that can be used as evidence in case further legal action becomes necessary.

The benefits of using a dispute of debt letter are numerous.

- It allows individuals to exercise their rights as consumers and protect themselves from unfair practices.

- It provides a formal and documented way to challenge the validity of a debt, ensuring transparency and accountability from debt collectors.

- By disputing a debt, individuals can prevent negative impacts on their credit score and financial well-being.

How do you formally dispute a debt?

When you find yourself facing a disputed debt, it is important to know the proper steps to take to formally dispute it.

First, gather all relevant documentation related to the debt, such as bills, statements, and correspondence. Carefully review the information to ensure accuracy and identify any discrepancies.

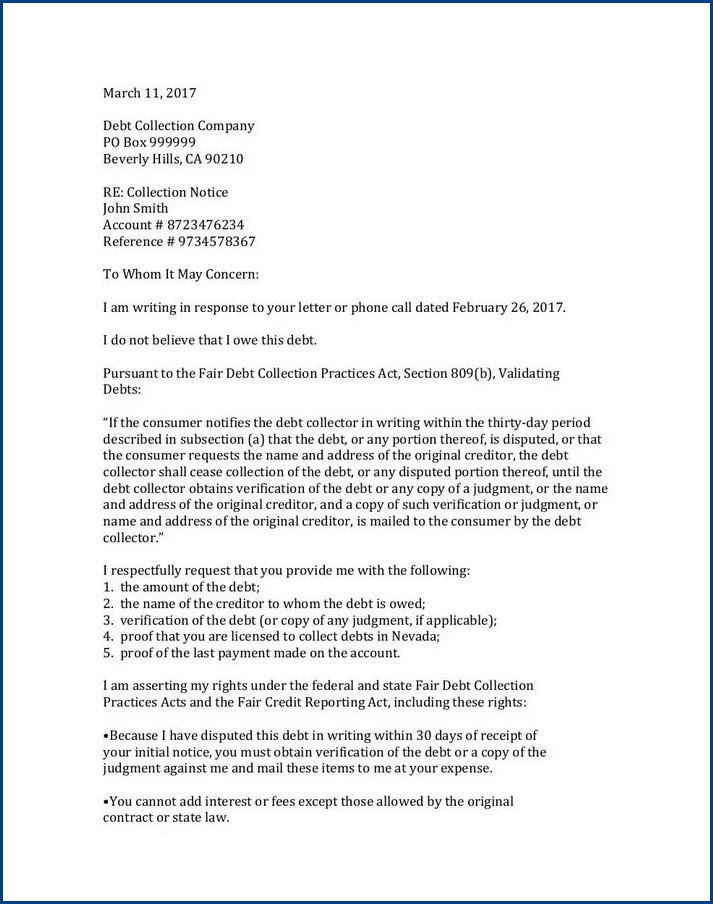

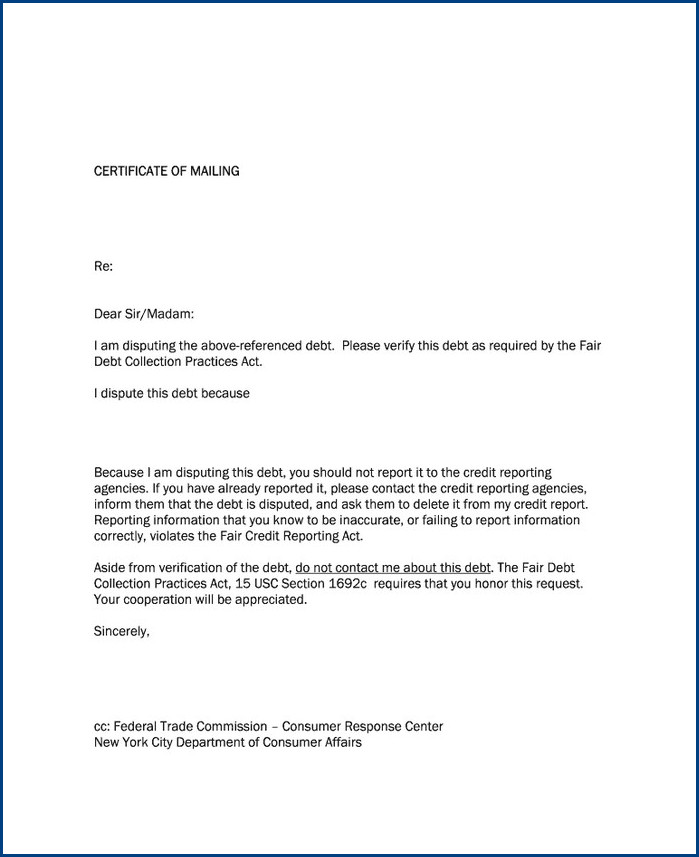

Next, write a formal dispute letter to the creditor or collection agency. In the letter, clearly state the reasons for disputing the debt and provide any supporting evidence. Be sure to send the letter via certified mail with the return receipt requested to maintain a record of the dispute.

It is crucial to understand your rights when disputing a debt. The Fair Debt Collection Practices Act (FDCPA) provides guidelines that protect consumers from unfair debt collection practices. Under the FDCPA, you have the right to request validation of the debt. This means you can ask the creditor or collection agency to provide proof that the debt is legitimate and that they have the legal right to collect it. If the debt cannot be verified, it must be removed from your credit report. Additionally, the FDCPA prohibits collectors from engaging in deceptive or abusive practices, such as harassment or making false statements.

Once the dispute letter has been sent, the creditor or collection agency is required to investigate the debt and provide a response. If they fail to respond within the specified timeframe, or if their response is unsatisfactory, you may escalate the matter by filing a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general’s office. It is important to keep copies of all correspondence and records related to the dispute for your records.

What is the best reason to put when disputing a collection?

When it comes to disputing a collection, it is important to have a valid reason that will increase your chances of success.

- One of the best reasons to put forward is that the debt is not yours. This could be due to identity theft, as it is not uncommon for criminals to use someone else’s personal information to open accounts and incur debts. By stating that the debt does not belong to you, you are asserting your innocence and requesting proof of the debt’s validity. This reason is strong and can help you in resolving the collection issue.

- Another valid reason when disputing a collection is that the debt has already been paid. It is not uncommon for debts to be overlooked or misplaced, resulting in incorrect reporting to collection agencies. If you have evidence that the debt has been satisfied, such as bank statements or receipts, you can use this as a reason for disputing the collection. Providing clear and documented proof will greatly strengthen your case and increase your chances of having the collection removed from your credit report.

- Additionally, you can dispute a collection if the debt is past the statute of limitations. Each state has a specific time limit for how long a debt can be legally pursued. If the debt in question is beyond this time limit, it is considered time-barred, and the collection agency should not be able to take legal action against you. By citing the statute of limitations as your reason for disputing the collection, you are asserting your rights and requesting that the debt be removed from your record. However, it is important to note that even though the debt may be time-barred, it can still appear on your credit report, so disputing it is crucial to ensure its removal.

How do I write a letter to dispute a debt?

Here are some steps to help you write an effective letter to dispute a debt:

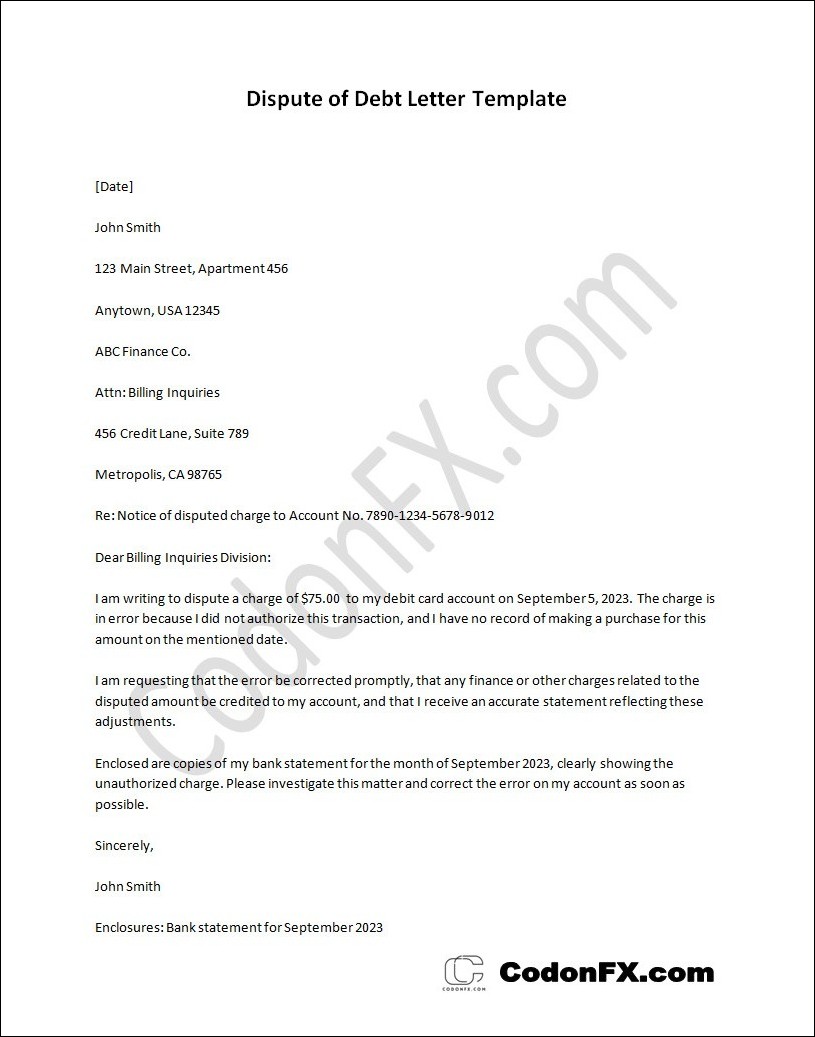

- Start with a formal salutation: Begin your letter with a professional greeting, such as “Dear [Creditor’s Name].” This sets the tone for respectful and formal communication.

- Provide your contact information: Clearly state your full name, address, and contact details at the beginning or end of the letter. This enables the recipient to easily identify and respond to your dispute.

- State the purpose of your letter: Clearly express that you are writing to dispute a specific debt. Include the account number or any relevant reference numbers to help the creditor identify the debt in question.

- Explain the reason for your dispute: Clearly and concisely explain why you believe the debt is inaccurate or unjust. Provide any supporting evidence or documentation that supports your claim.

- Request for investigation: Politely request that the creditor investigate the disputed debt and provide a response within a reasonable time frame. State that you expect a written response to your dispute.

- End with a formal closing: Conclude your letter with a formal closing, such as “Sincerely” or “Yours faithfully.” Sign your name below the closing to add a personal touch.

Writing a letter to dispute a debt can be a crucial step in resolving any inaccuracies or unfairness. It is important to maintain a formal and professional tone throughout the letter to ensure your concerns are taken seriously.

By following the steps outlined above, you can effectively communicate your dispute and increase the likelihood of a satisfactory resolution to your debt dispute.

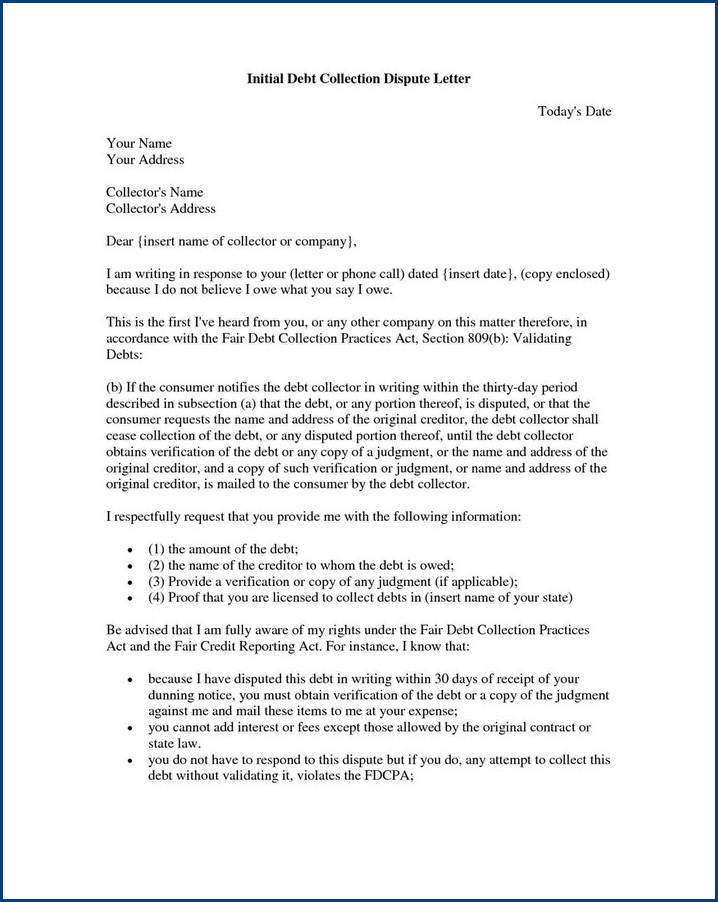

Dispute of Debt Letter Template | Word – Download