In the business world, creditworthiness is a crucial factor in determining the success or failure of a company. Before extending credit to a potential client, assessing their creditworthiness and mitigating any risks involved is essential. One effective way to gather the necessary information for this assessment is by using a business credit application form.

This form allows businesses to collect vital details about potential clients, enabling a thorough evaluation of their creditworthiness.

What is a Business Credit Application Form?

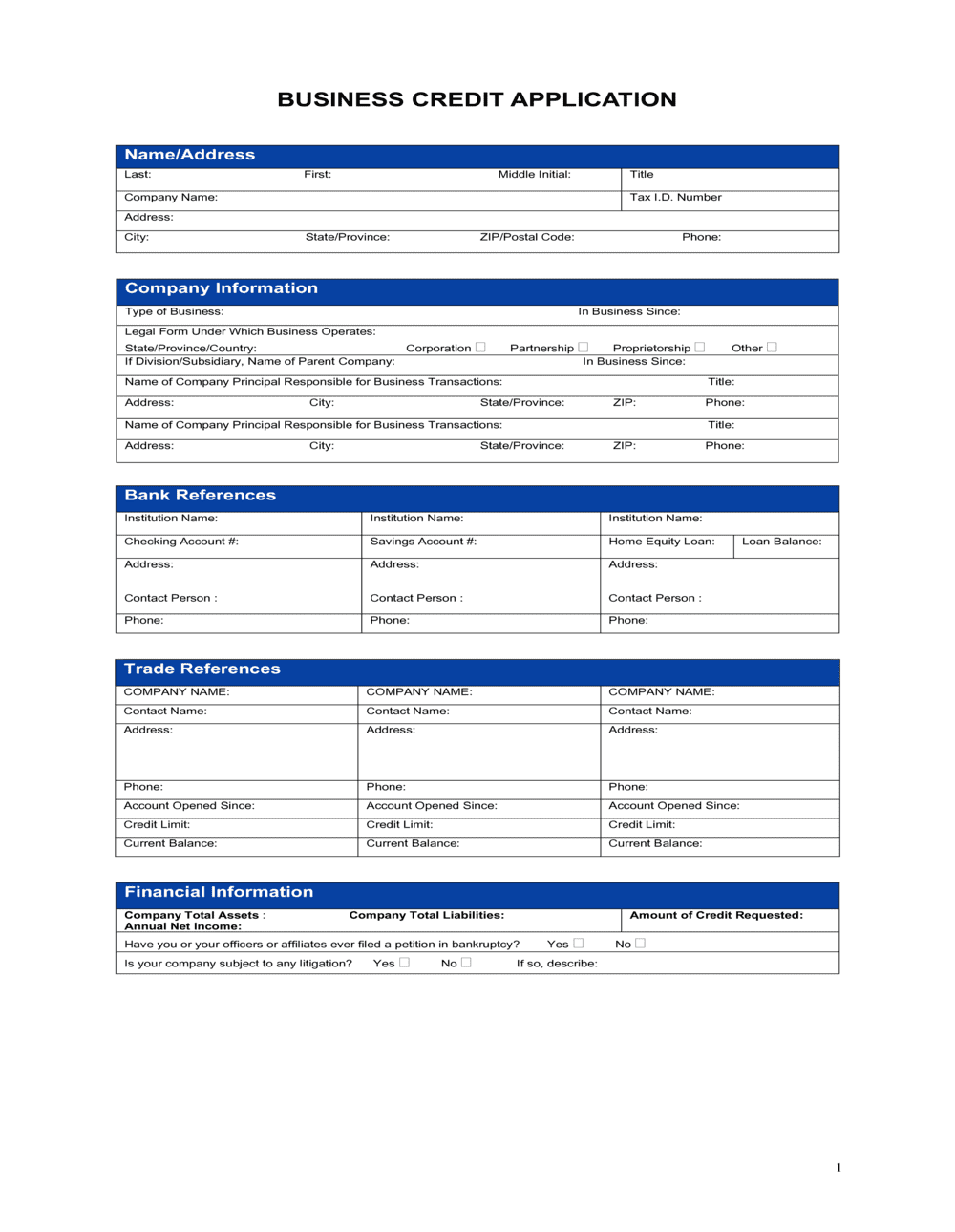

A business credit application form is a document businesses use to gather essential information about potential clients applying for credit. It serves as a tool to assess these clients’ creditworthiness and determine the risk associated with extending credit to them.

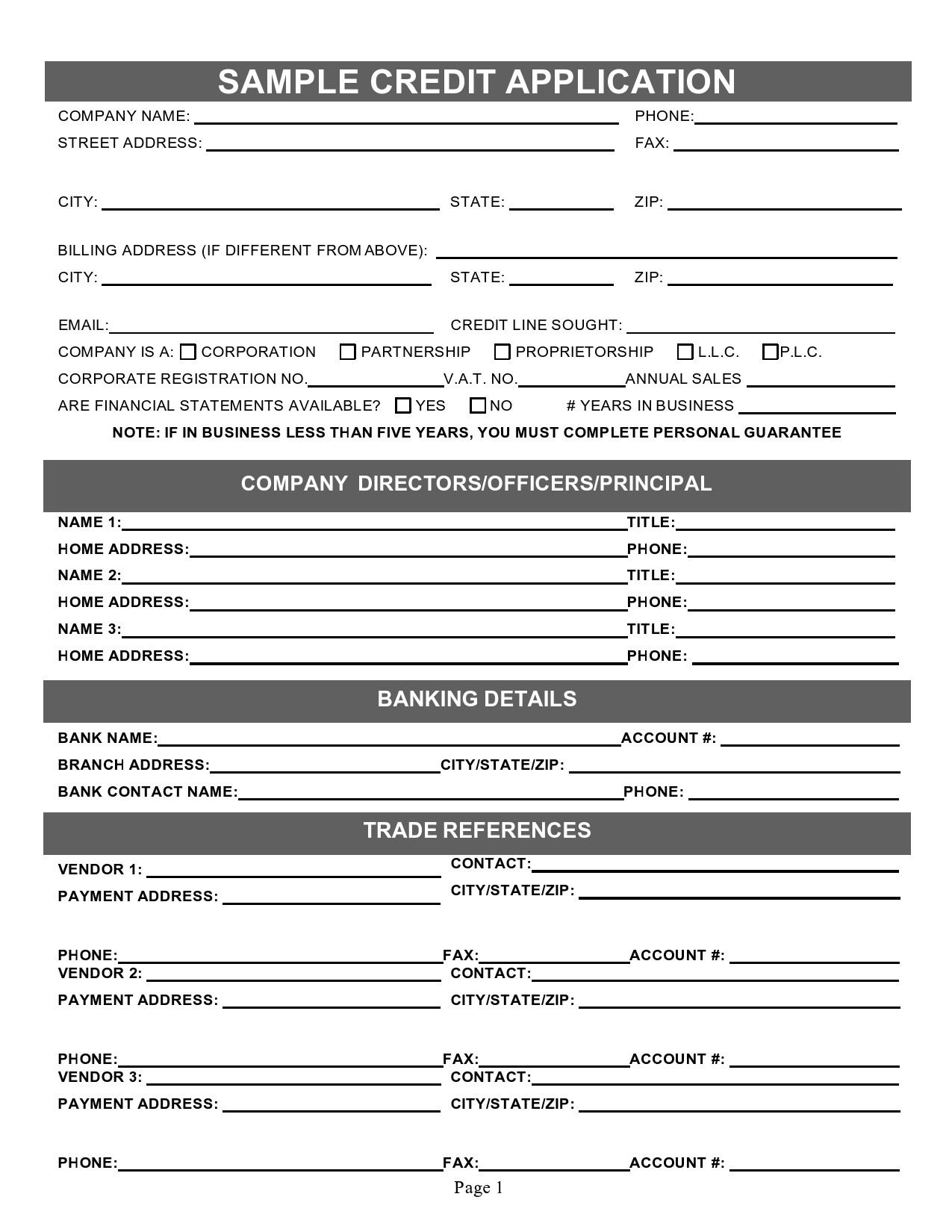

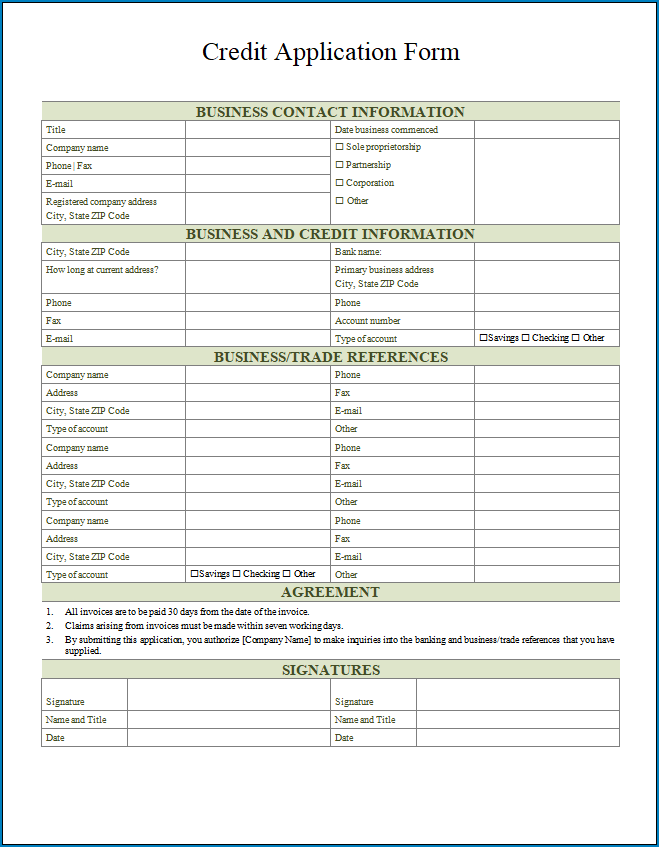

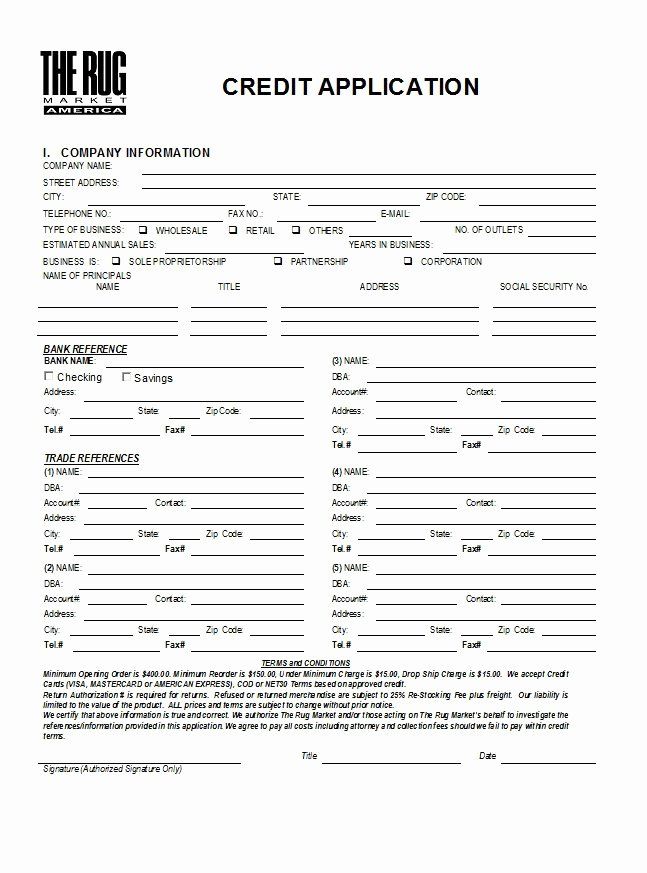

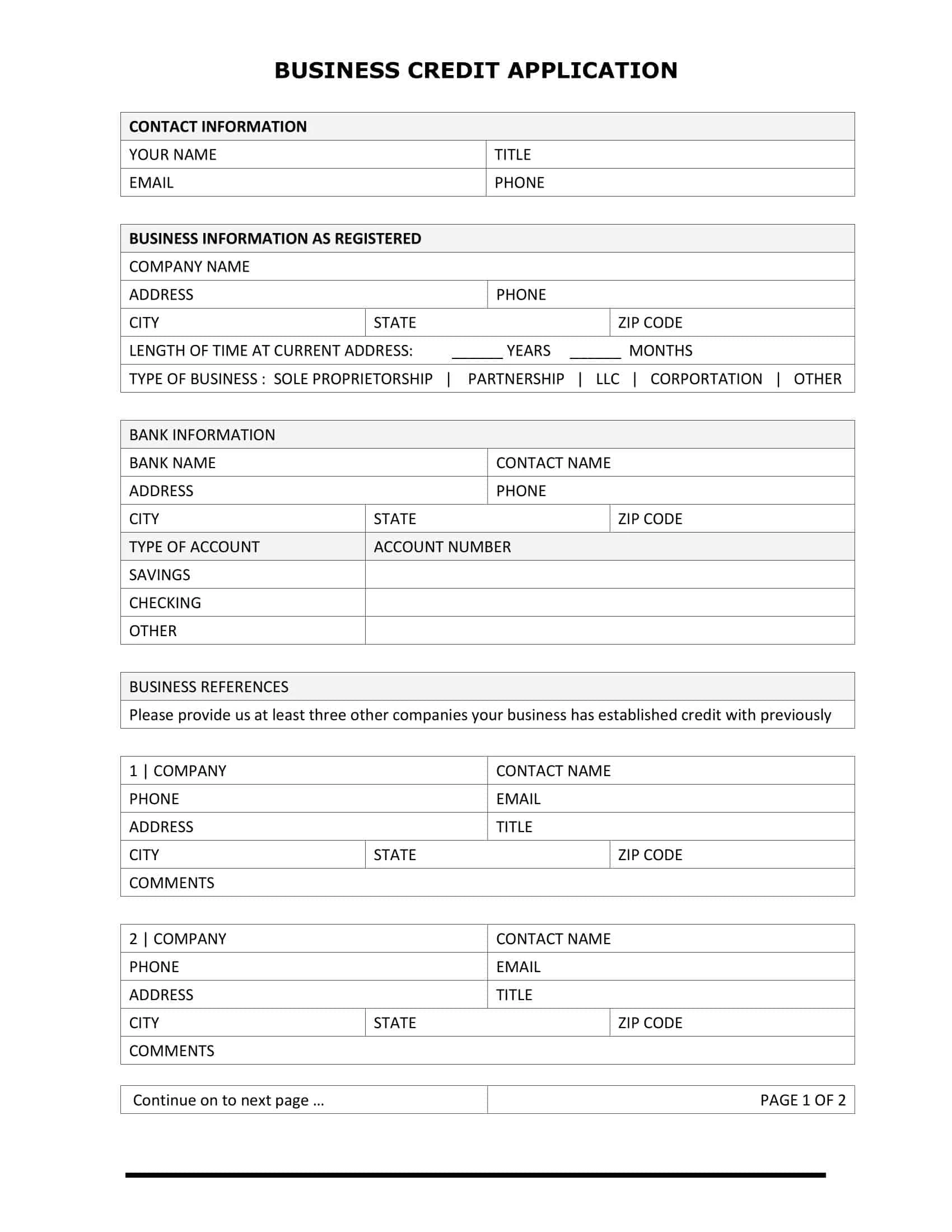

The form typically includes fields for personal and business information, financial statements, trade references, and authorization for credit checks.

Why Use a Business Credit Application Form?

The use of a business credit application form offers several benefits to businesses:

- 1. Mitigates Risk: By gathering essential information about potential clients, businesses can make informed decisions about extending credit. This helps mitigate the risk of non-payment or default.

- 2. Thorough Assessment: The form provides a comprehensive view of the client’s financial position, allowing businesses to assess their creditworthiness thoroughly.

- 3. Legal Protection: The form includes authorization for credit checks, ensuring that businesses comply with legal requirements when evaluating potential clients.

- 4. Consistency: Using a standardized form ensures that businesses collect the same information from all applicants, promoting consistency in the evaluation process.

- 5. Streamlines Decision-Making: The form provides a structured format for collecting information, making it easier for businesses to review and analyze the data.

How to Create a Business Credit Application Form?

Creating a business credit application form involves several steps:

- 1. Determine the Required Information: Identify the essential information needed to assess the creditworthiness of potential clients. This may include personal and business details, financial statements, trade references, and authorization for credit checks.

- 2. Design the Form: Use word processing or design software to create a professional-looking form. Consider using a template or seeking professional help to ensure the form’s layout is clear and easy to understand.

- 3. Include Clear Instructions: Provide clear instructions on how to fill out the form to avoid confusion. Use headings, subheadings, and bullet points to organize the information effectively.

- 4. Customize the Form: Tailor the form to suit the specific needs of your business. Include fields that are relevant to your industry or the type of credit being extended.

- 5. Add Contact Information: Include your business’s contact information on the form, making it easy for potential clients to reach out with any questions or concerns.

- 6. Review and Test: Before finalizing the form, review it carefully for any errors or inconsistencies. Test the form by filling it out yourself to ensure it is user-friendly.

- 7. Distribute the Form: Make the business credit application form accessible to potential clients. This can be done by posting it on your website, sharing it via email, or providing printed copies at your business premises.

Examples

Tips for Successful Use of a Business Credit Application Form

Here are some tips to ensure the successful use of a business credit application form:

- 1. Be Clear and Concise: Use clear and concise language in the form to make it easy for potential clients to understand and fill out.

- 2. Request Relevant Information: Only ask for information that is necessary for assessing creditworthiness. Avoid asking for excessive or irrelevant details.

- 3. Provide Guidance: Include instructions or examples where necessary to guide applicants on how to provide accurate and complete information.

- 4. Keep the Form Updated: Regularly review and update the form to ensure it includes all the necessary information and complies with any legal requirements.

- 5. Follow-Up: Once you receive a completed form, follow up with the applicant to clarify any unclear or missing information.

Conclusion

A business credit application form is a valuable tool for businesses looking to assess the creditworthiness of potential clients. By gathering essential information about these clients, businesses can mitigate the risk of extending credit and make informed decisions.

Creating a well-designed form and following best practices for its use can enhance the effectiveness of this assessment process and contribute to the overall success of the business.

Business Credit Application Form – Download