Whether you’re a seasoned homeowner or a first-time buyer, understanding the concept of an amortization schedule is crucial. This schedule provides a detailed breakdown of your mortgage payments, helping you understand how much of each payment goes toward the principal balance and the interest.

In this guide, we’ll delve into the intricacies of an amortization schedule, exploring its importance, how it works, and why it matters to you.

What is an Amortization Schedule?

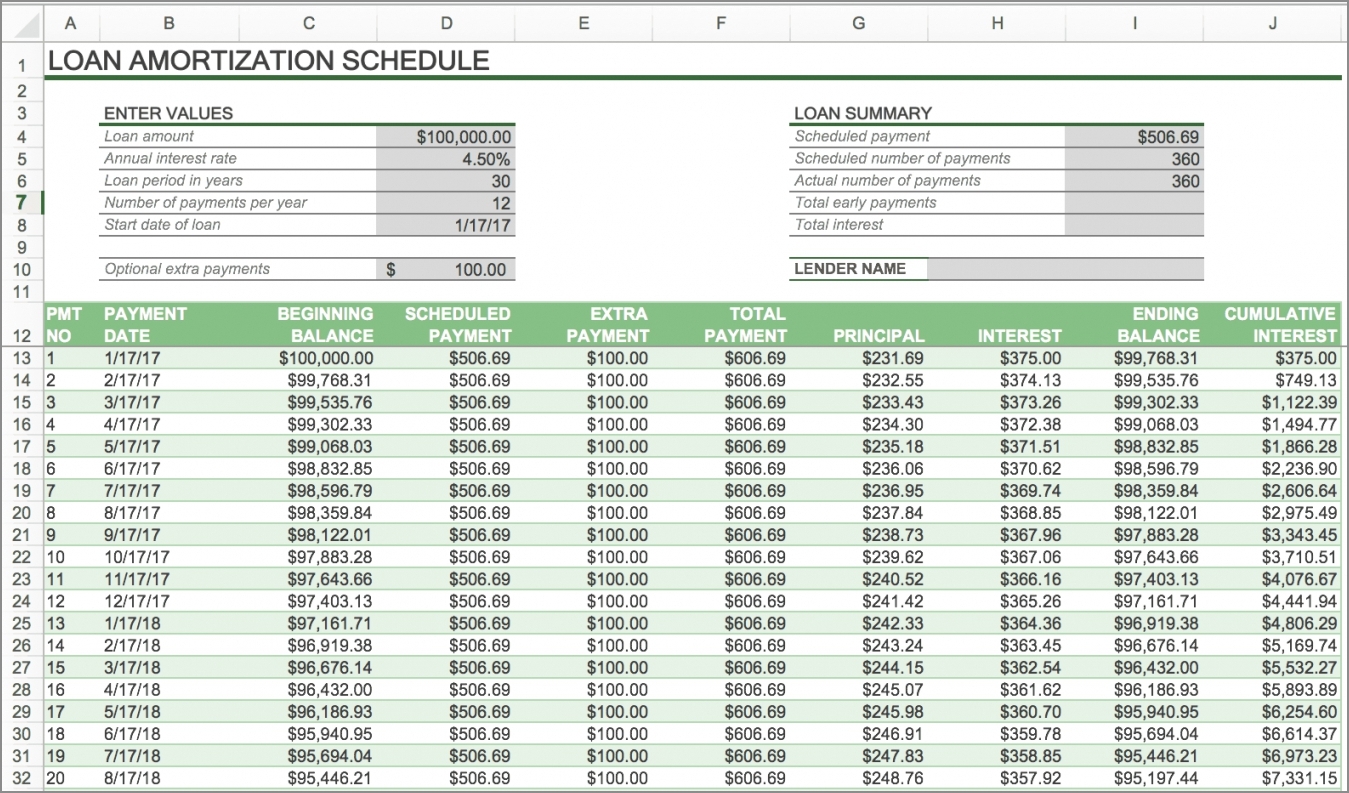

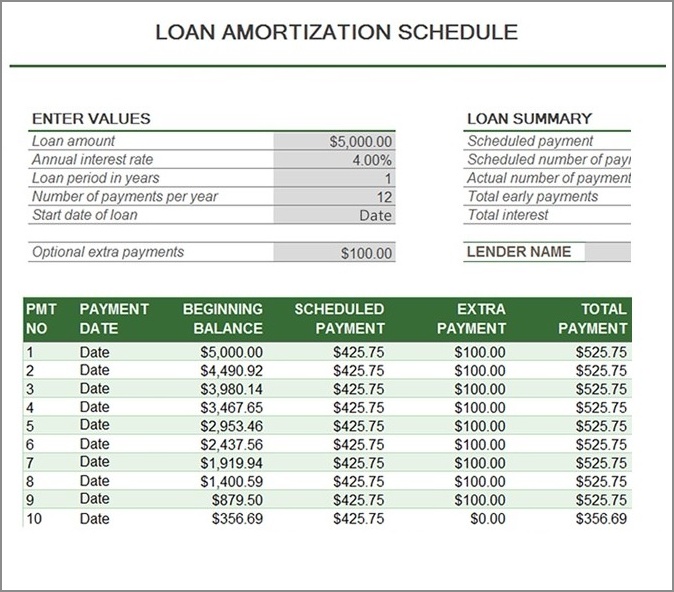

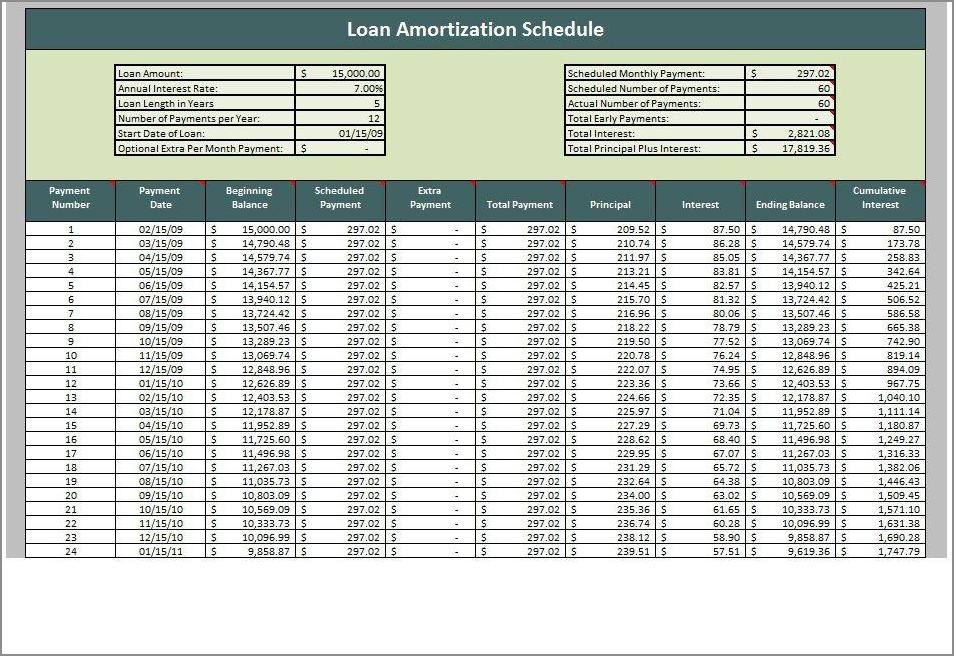

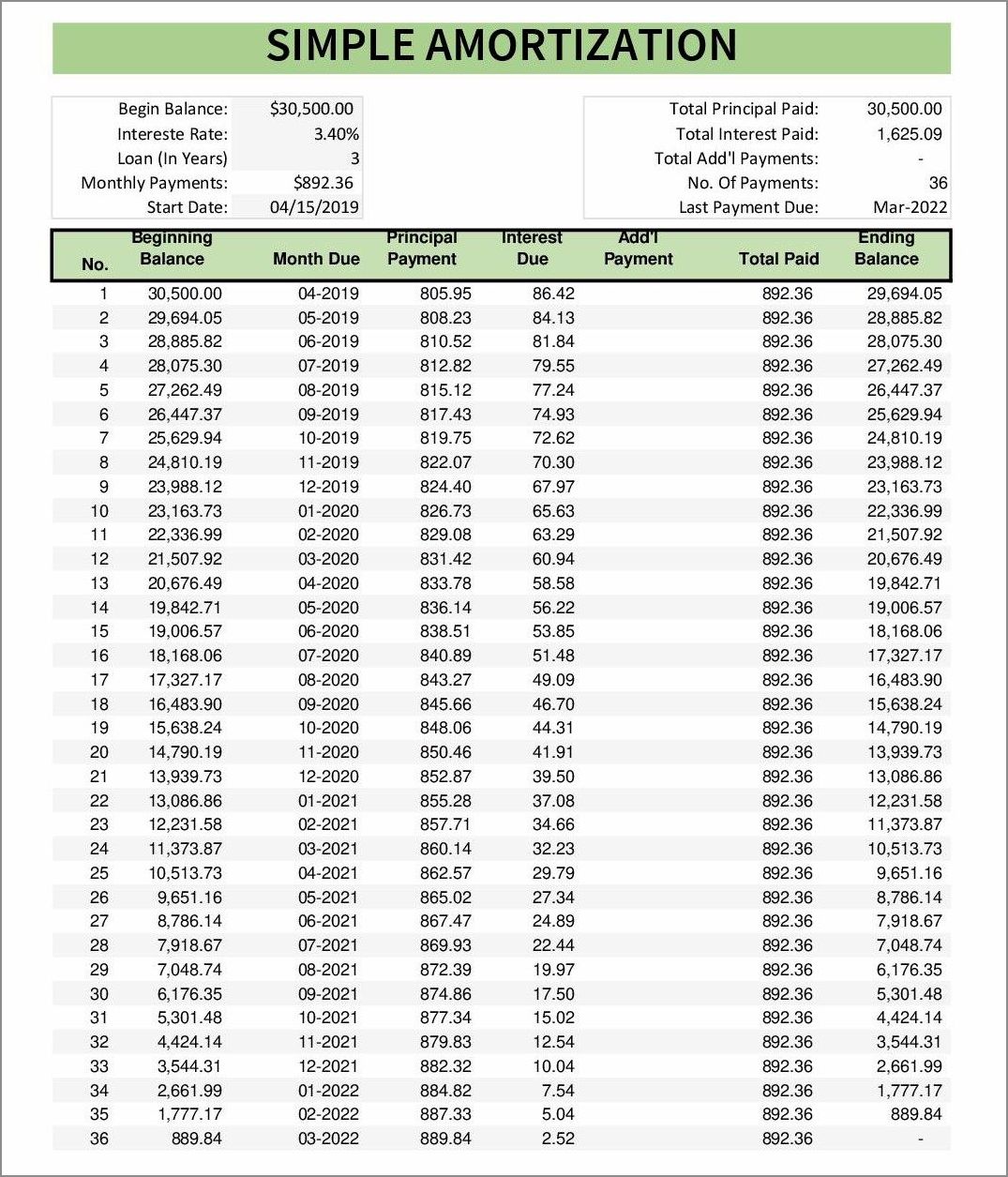

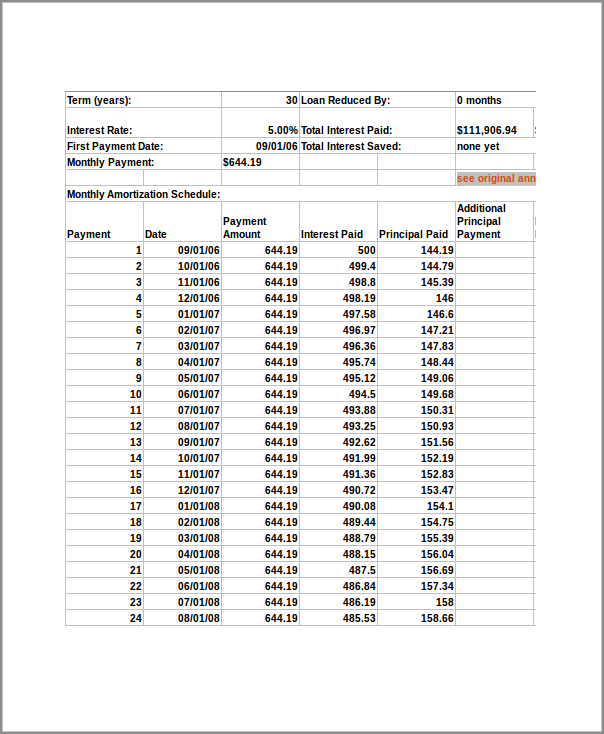

An amortization schedule is a table that outlines all the details of your mortgage payments over its term. It provides a month-by-month breakdown of how much of your payment goes towards the principal amount and how much is allocated to the interest. Additionally, it shows the remaining balance after each payment is made.

This schedule is created by your lender and serves as a roadmap for the life of your mortgage. It helps you understand how your payments are applied to your loan and how long it will take to pay off your mortgage in full.

How Does an Amortization Schedule Work?

When you take out a mortgage, your lender calculates the amortization schedule based on the loan amount, interest rate, and term. Each monthly payment is divided into two components: principal and interest.

At the beginning of your mortgage term, the interest portion of your payment is higher, while the principal portion is lower. As you make regular payments, the interest portion gradually decreases, and the principal portion increases. This shift occurs because the interest is calculated based on the outstanding balance, so as you pay down the principal, the interest amount decreases.

Over time, your monthly payments remain the same, but the allocation between principal and interest changes. Towards the end of your mortgage term, the principal portion becomes the larger share, and the interest portion becomes smaller until the loan is fully paid off.

Why is an Amortization Schedule Important?

Understanding your amortization schedule is crucial for several reasons:

- Financial planning: By knowing the breakdown of your mortgage payments, you can budget and plan your finances more effectively.

- Interest savings: With an amortization schedule, you can identify opportunities to make extra payments towards the principal, reducing the overall interest paid over the life of the loan.

- Refinancing decisions: If you’re considering refinancing your mortgage, an amortization schedule can help you evaluate the potential savings and determine if it’s the right move for you.

- Understanding equity: The schedule shows how your equity in the property grows over time as you pay down the principal balance.

How to Read an Amortization Schedule?

Reading an amortization schedule may seem complex at first, but with a little guidance, it becomes much simpler. Here’s what you need to look for:

1. Payment Number

This column indicates the number of payments you’ve made so far. It starts at 1 and increments with each payment.

2. Payment Date

The payment date column shows the specific date on which each payment is due.

3. Payment Amount

In this column, you’ll find the total amount you need to pay each month, including both principal and interest.

4. Principal Payment

This column displays the portion of your monthly payment that goes towards reducing the principal balance.

5. Interest Payment

Here, you’ll see the amount allocated towards interest for each payment. This will decrease over time as you pay down the principal.

6. Total Interest Paid

This column provides a cumulative total of the interest you’ve paid to date. It helps you understand the overall cost of borrowing.

7. Remaining Balance

The remaining balance column shows how much is left to be paid on your mortgage after each payment is made. This helps you track your progress and see how close you are to paying off the loan.

Example of an Amortization Schedule

Let’s look at an example to illustrate how an amortization schedule works:

Loan amount: $200,000

Interest rate: 4%

Loan term: 30 years (360 months)

Payment Number: 1

Payment Date: March 1, 2023

Payment Amount: $955.43

Principal Payment: $288.37

Interest Payment: $667.06

Total Interest Paid: $667.06

Remaining Balance: $199,711.63

As you continue down the schedule, the principal payment gradually increases, while the interest payment decreases. This pattern repeats until the loan is fully paid off.

Tips for Managing Your Amortization Schedule

- Make extra payments: If possible, consider making additional payments towards the principal to reduce the overall interest paid and shorten the loan term.

- Refinance at a lower rate: If interest rates have dropped significantly since you took out your mortgage, refinancing may help you secure a lower rate and potentially save thousands of dollars over the life of the loan.

- Understand prepayment penalties: Some mortgages come with prepayment penalties, which can incur fees if you pay off your loan early. Be aware of these penalties and factor them into your decision-making process.

- Review your schedule regularly: Check your amortization schedule periodically to track your progress and make adjustments as needed.

- Seek professional advice: If you’re uncertain about any aspect of your amortization schedule or mortgage, consult with a financial advisor or mortgage specialist who can provide personalized guidance.

Conclusion

An amortization schedule is an essential tool for homeowners to understand their mortgage payments and track their progress towards paying off their loan. By familiarizing yourself with this schedule, you can make informed financial decisions and potentially save money in the long run. Take advantage of the tips mentioned here to manage your amortization schedule effectively and achieve your homeownership goals.

Amortization Schedule Template Excel – Download