What is a Charitable Donations Receipt?

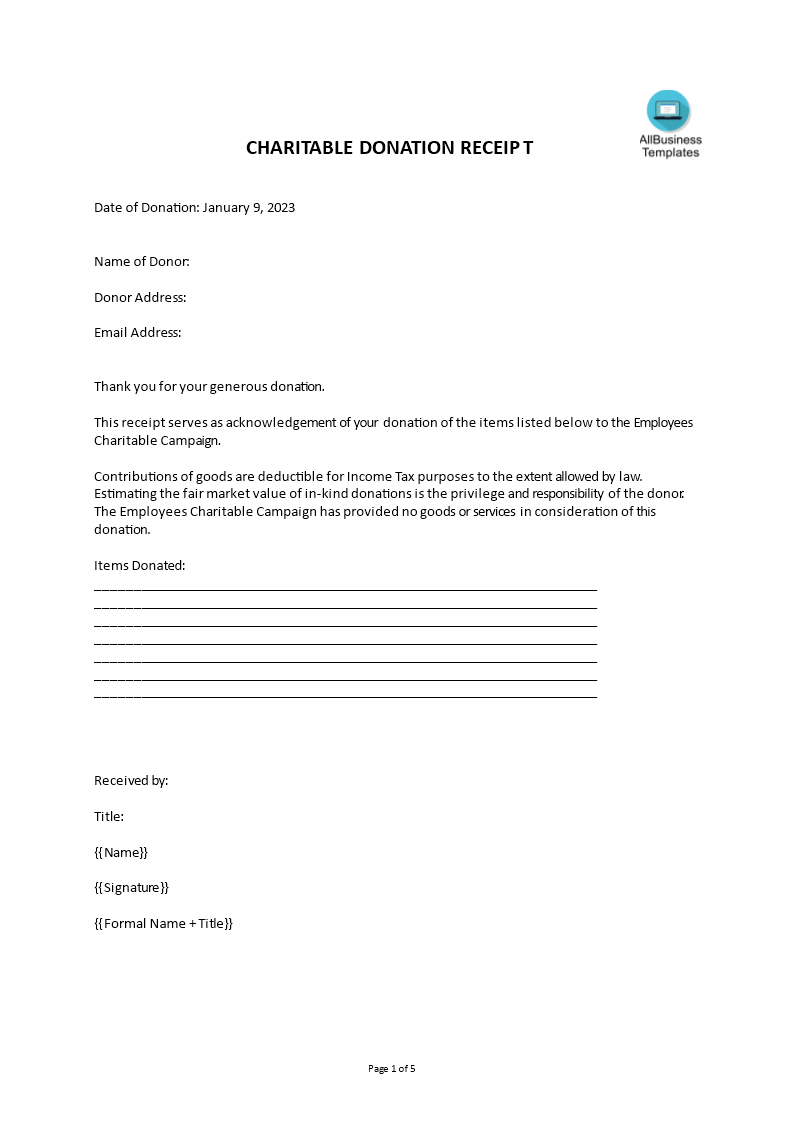

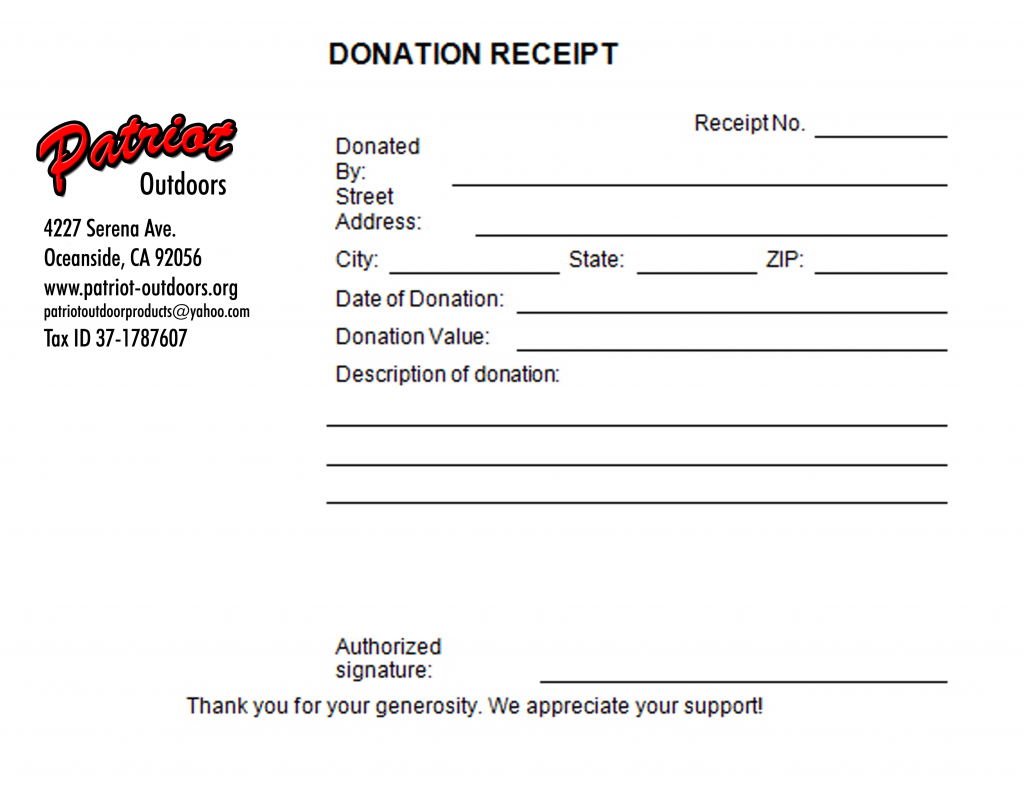

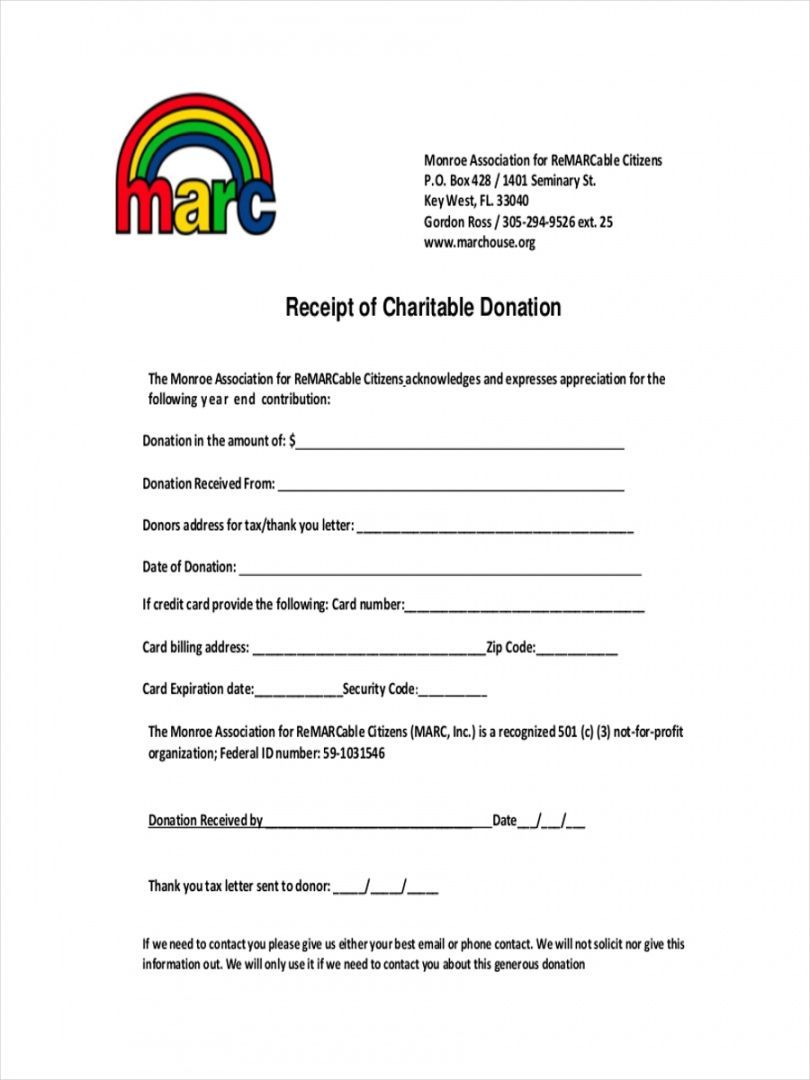

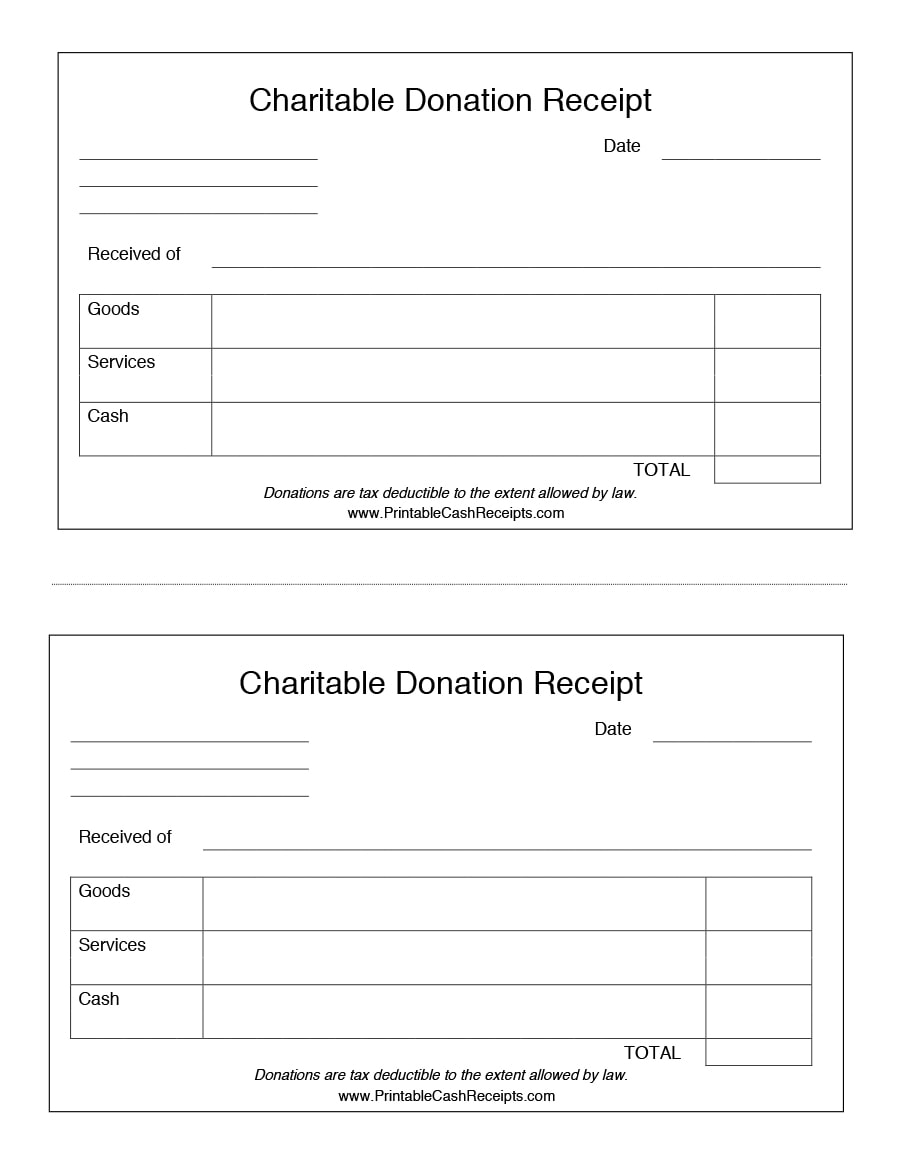

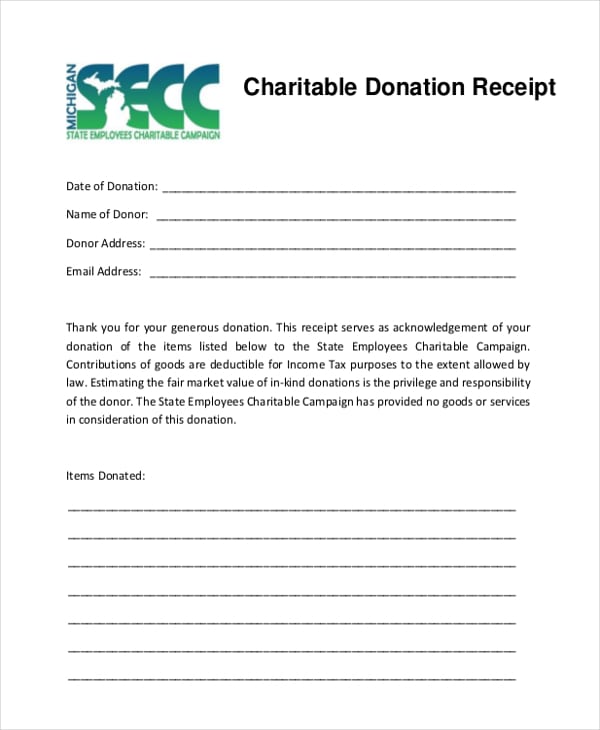

A charitable donations receipt template is a document that is used by charitable organizations to provide donors with a receipt for their contributions. This template serves as proof of donation and can be used by donors to claim tax deductions. It typically includes details such as the donor’s name, the organization’s name, the date of the donation, a description of the donated items or monetary amount, and the organization’s tax-exempt status.

Creating a well-designed and informative charitable donation receipt template is essential for both the organization and the donor. It ensures transparency, accountability, and compliance with tax regulations. In this article, we will guide you through the process of creating and using a charitable donations receipt template.

Why Use a Charitable Donations Receipt?

Using a charitable donations receipt template offers several benefits for both the organization and the donor:

- Transparency: A well-designed template ensures transparency in the donation process, providing clear documentation of the contribution.

- Tax Deductions: Donors can use the receipt as proof of their charitable contributions and claim tax deductions.

- Legal Compliance: The template helps organizations comply with tax regulations and maintain accurate records of donations.

- Professionalism: A professionally designed template enhances the organization’s credibility and professionalism.

How to Create a Charitable Donations Receipt

Creating a charitable donations receipt template involves a few key steps:

1. Determine the Necessary Information

Start by identifying the information that needs to be included in the template. This typically includes:

- Donor’s name and contact information

- The organization’s name and contact information

- Date of the donation

- Description of the donated items or monetary amount

- Organization’s tax-exempt status information

Consider including any additional details that may be required for tax purposes or specific legal requirements in your jurisdiction.

2. Choose a Design and Format

Select a design and format that aligns with your organization’s branding and professionalism. Use a clean and easily readable font and consider incorporating your organization’s logo.

3. Include Clear Instructions

Provide clear instructions for donors on how to use the receipt for tax purposes. Explain the process of claiming tax deductions and any specific requirements they need to follow.

4. Test and Review

Before finalizing the template, test it by issuing sample receipts and reviewing it for any errors or missing information. Ensure that the template meets all legal and tax requirements in your jurisdiction.

How to Use a Charitable Donations Receipt Template

Once you have created the charitable donations receipt template, follow these steps to effectively use it:

1. Customize the Template

Before issuing a receipt, customize the template by filling in the relevant details such as the donor’s name, the organization’s name, and the donation amount or description.

2. Provide the Receipt to the Donor

Issue the receipt to the donor either in person, via email, or by mail. Ensure that the donor receives a copy of the receipt for their records.

3. Maintain a Copy for Your Records

Keep a copy of each receipt for your organization’s records. This will help with tax compliance and auditing purposes.

4. Stay Organized

Implement a system to organize and store the receipts securely. This can be done physically or digitally, depending on your organization’s preferences and resources.

Best Practices for Creating an Effective Charitable Donations Receipt

Here are some best practices to consider when creating your charitable donations receipt template:

- Clarity: Use clear and concise language to ensure that donors understand the purpose and details of the receipt.

- Accuracy: Double-check all the information on the receipt to ensure accuracy and avoid any potential discrepancies.

- Consistency: Use a standardized format and design for all receipts to maintain a professional and cohesive image.

- Compliance: Familiarize yourself with local tax regulations and legal requirements to ensure your template meets all necessary compliance standards.

- Accessibility: Make the template easily accessible to donors, whether through your organization’s website or by request.

Conclusion

A charitable donations receipt template is an essential tool for both charitable organizations and donors. It provides transparency, accountability, and a means for donors to claim tax deductions. By following the steps outlined in this article, you can create an effective and professional template that meets all legal and tax requirements. Remember to customize the template for each donation, provide a copy to the donor, and maintain records for your organization’s compliance. With a well-designed template, you can streamline the donation process and foster trust with your donors.

Charitable Donations Receipt Template – Download