Managing payroll is an essential aspect of running a business. As an employer, you have the responsibility of ensuring that your employees are paid accurately and on time. To achieve this, you need to establish a payroll schedule that outlines when and how often your employees will be paid.

In this guide, we will explore everything you need to know about payroll schedules, including why they are important, how to set them up, and best practices to ensure a smooth payroll process.

What is a Payroll Schedule?

A payroll schedule is a predetermined timeline that outlines when and how often employees will be paid. It provides clarity and consistency for both employers and employees, ensuring that everyone understands when they can expect to receive their wages. A well-defined payroll schedule is crucial for maintaining employee satisfaction and compliance with labor laws.

When setting up a payroll schedule, you need to consider various factors, such as your business’s cash flow, employee expectations, and legal requirements. By establishing a clear payroll schedule, you can streamline your payroll process and avoid any confusion or delays in paying your employees.

Why is a Payroll Schedule Important?

Having a well-thought-out payroll schedule is essential for several reasons:

- Employee Satisfaction: A consistent and reliable payroll schedule ensures that your employees can plan their finances effectively. Knowing when they will be paid allows them to budget and meet their financial obligations.

- Compliance with Labor Laws: Many jurisdictions have specific laws regarding the frequency of pay periods. By establishing a payroll schedule, you can ensure that you comply with these regulations.

- Efficient Payroll Processing: A clearly defined payroll schedule allows you to streamline your payroll process. It helps you allocate resources effectively and ensures that you have enough time to process payroll accurately.

- Transparency and Trust: Providing your employees with a predictable payroll schedule builds trust and transparency within your organization. It shows that you value your employees and their financial well-being.

How to Set Up a Payroll Schedule

Setting up a payroll schedule involves several steps. Here’s a step-by-step guide to help you establish an effective payroll schedule:

1. Determine Payroll Frequency

The first step is to decide how often you will pay your employees. Common payroll frequencies include:

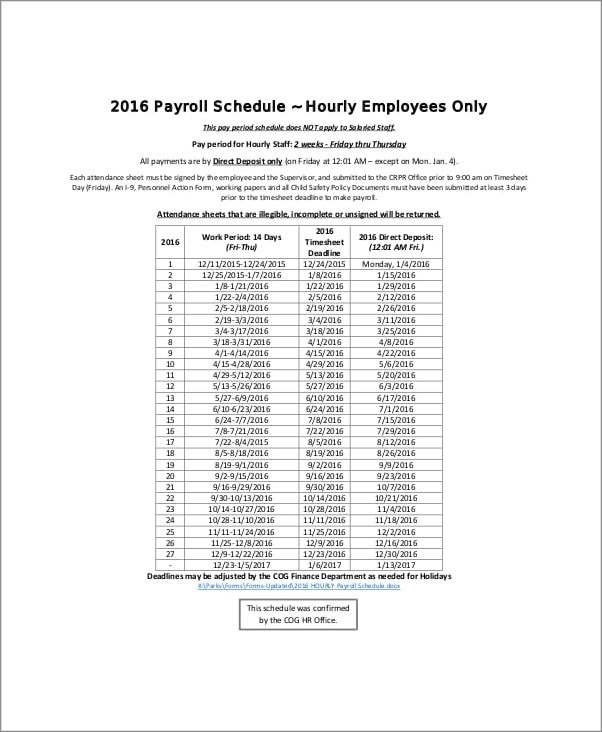

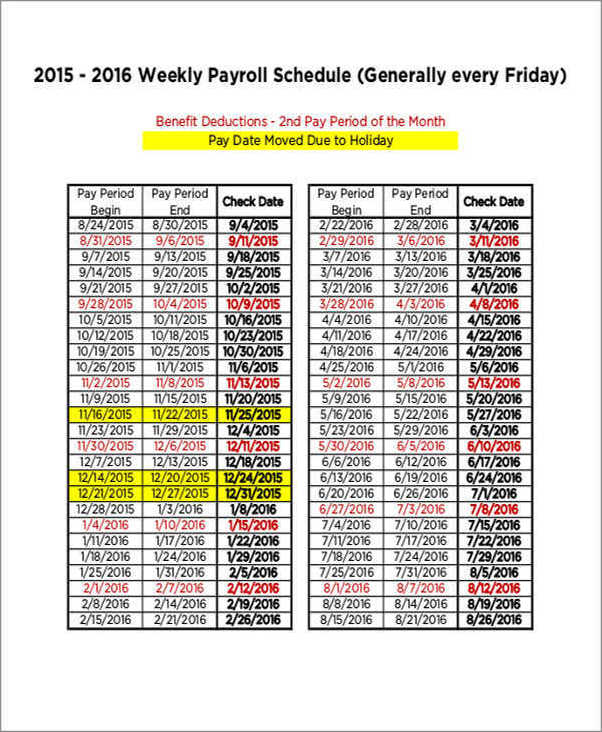

- Weekly

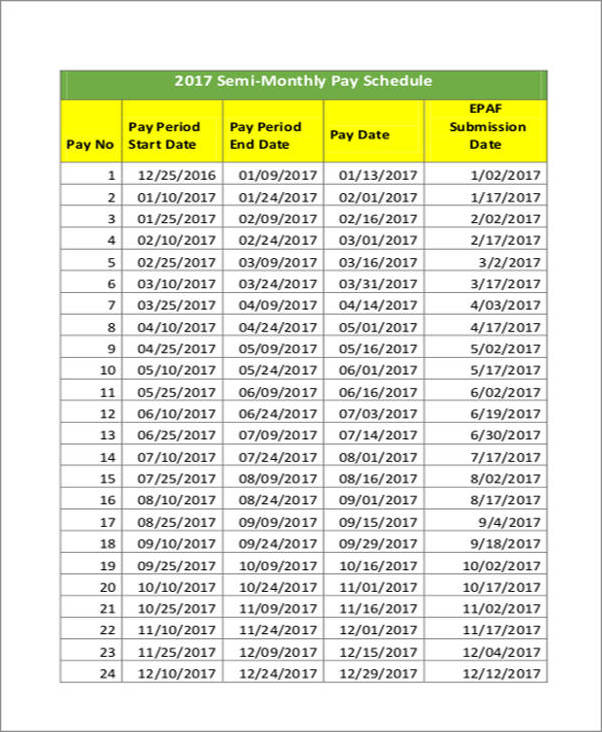

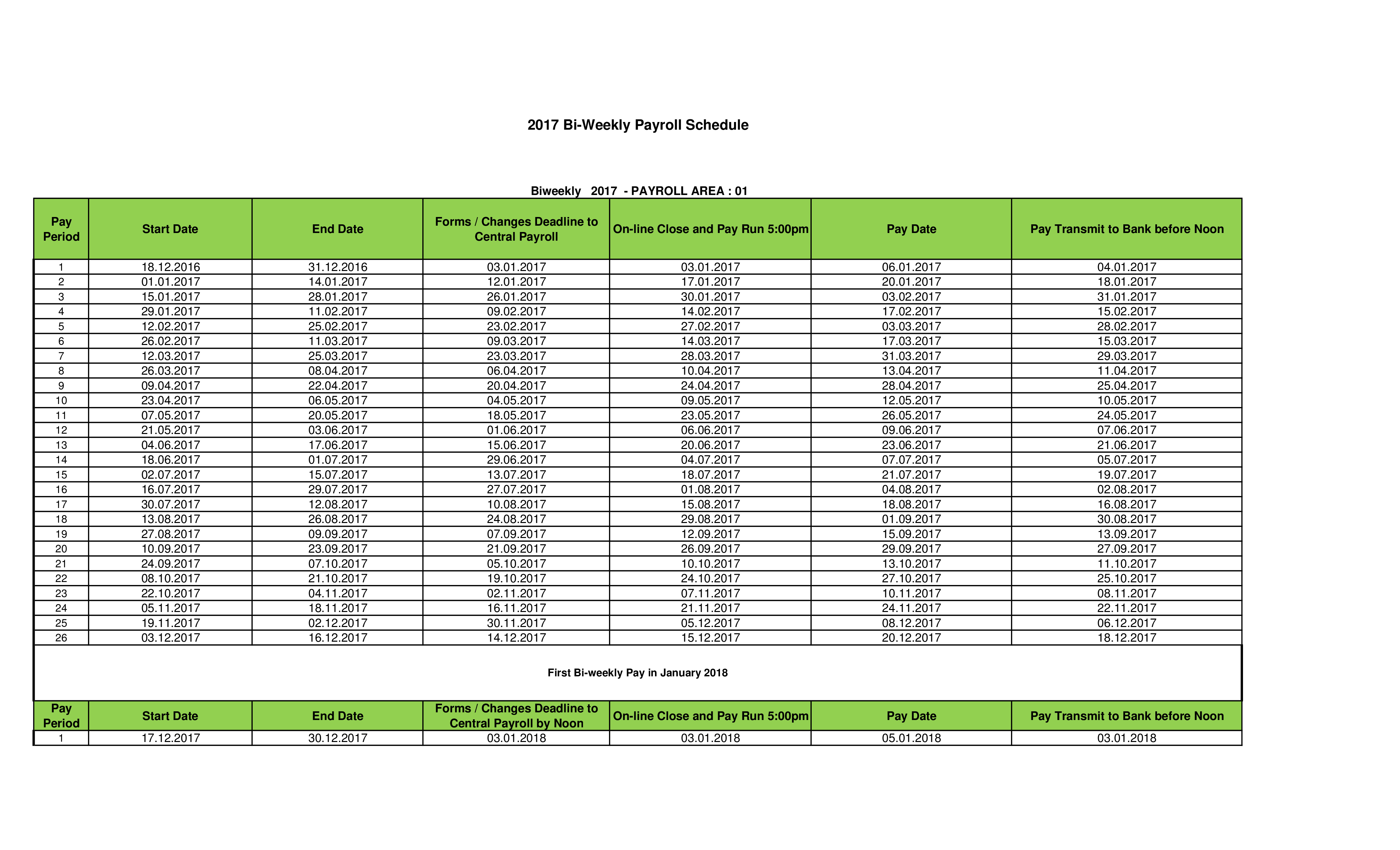

- Bi-weekly

- Semi-monthly

- Monthly

Consider your business’s cash flow, employee preferences, and any legal requirements when choosing the frequency. Remember that some states or countries may have specific rules regarding pay periods.

2. Choose a Payroll Start Date

Once you’ve determined the frequency, select a specific start date for your payroll schedule. This date will be the beginning of each pay period. It’s essential to choose a start date that aligns with your business’s financial cycle and allows enough time for payroll processing.

3. Define Payroll Submission Deadlines

Establish clear deadlines for employees to submit their timecards or any other required payroll information. This ensures that you have sufficient time to process payroll accurately and on time. Communicate these deadlines to your employees and provide reminders to avoid any delays.

4. Calculate Payroll Processing Time

Determine how long it takes to process payroll from the submission deadline to the actual payday. Consider factors such as data entry, tax calculations, and any other payroll-related tasks. Allocate enough time to review and verify the accuracy of the payroll before disbursing the funds.

5. Communicate the Payroll Schedule

Once you have established your payroll schedule, communicate it clearly to your employees. Provide written documentation or create a shared calendar that outlines the pay periods, paydays, and any other relevant information. Ensure that your employees have easy access to this information.

Best Practices for Payroll Schedules

Here are some best practices to ensure a smooth payroll process:

- Automate Payroll: Consider using payroll software to automate and streamline your payroll process. This reduces the chances of errors and saves you time.

- Maintain Accurate Employee Records: Keep detailed records of your employees’ information, including their hours worked, overtime, and any deductions. This ensures accurate payroll calculations.

- Stay Updated on Labor Laws: Familiarize yourself with the labor laws in your jurisdiction to ensure compliance. Stay updated on any changes that may affect your payroll schedule.

- Train Your Payroll Team: Ensure that your payroll team is well-trained and understands the payroll process. Provide regular training sessions to keep them updated on any changes or new regulations.

- Regularly Review and Audit Payroll: Conduct regular reviews and audits of your payroll to identify any discrepancies or errors. This helps maintain accuracy and ensures that your employees are paid correctly.

- Communicate Changes: If there are any changes to the payroll schedule, make sure to communicate them promptly to your employees. Provide ample notice and answer any questions they may have.

- Seek Professional Help: If you find managing payroll overwhelming, consider hiring a professional payroll service or consulting with an accountant. They can help ensure compliance and take the burden off your shoulders.

Conclusion

A well-planned and communicated payroll schedule is vital for the smooth operation of any business. It ensures that your employees are paid accurately and on time, improving employee satisfaction and maintaining compliance with labor laws. By following the steps outlined in this guide and implementing best practices, you can establish an effective payroll schedule that benefits both your employees and your business.

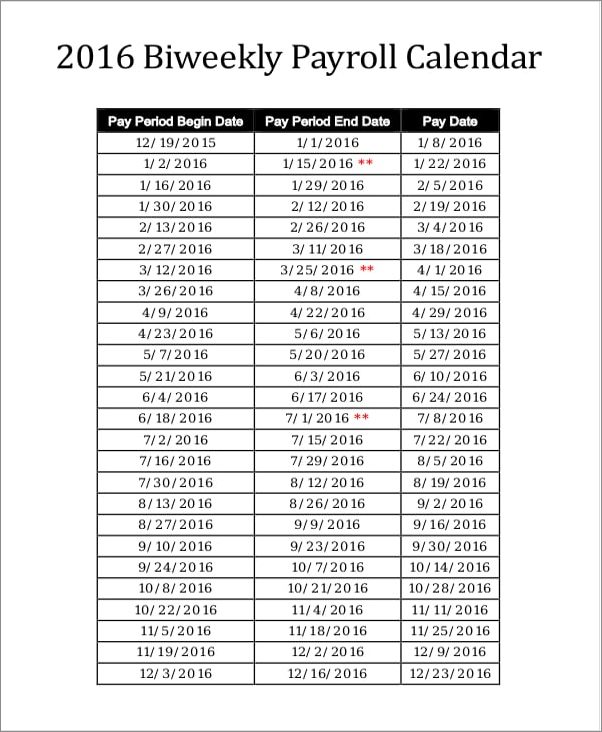

Payroll Schedule Template – Download