Dealing with debt can be overwhelming and stressful. It’s important to have a clear understanding of your debt obligations and how they impact your financial well-being. One tool that can help you manage your debt effectively is a debt schedule.

In this article, we will explore what a debt schedule is, how it works, and why it is crucial for individuals and businesses alike. Whether you are looking to pay off your loans or manage the debt of your business, this guide will provide you with the necessary information to navigate your financial obligations.

What is a Debt Schedule?

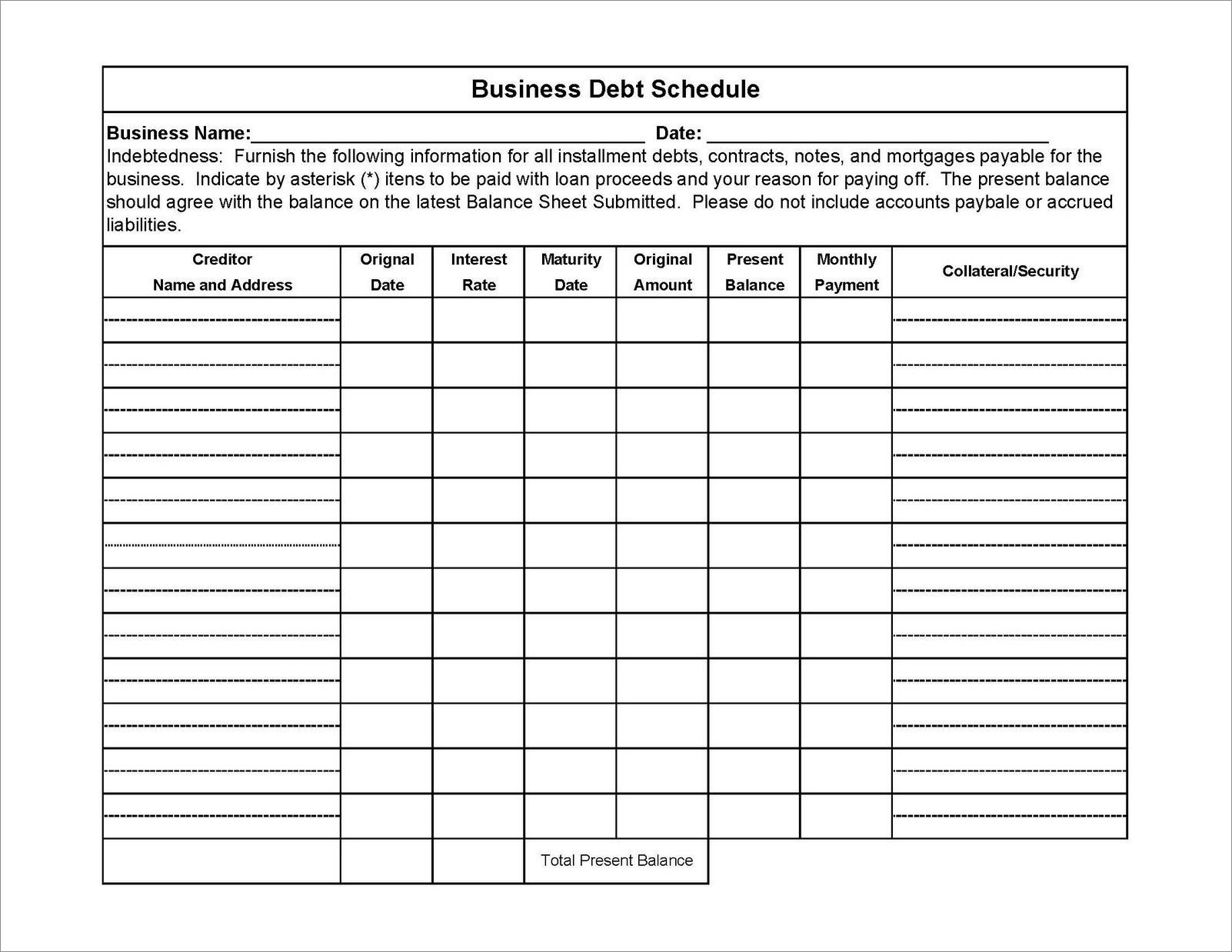

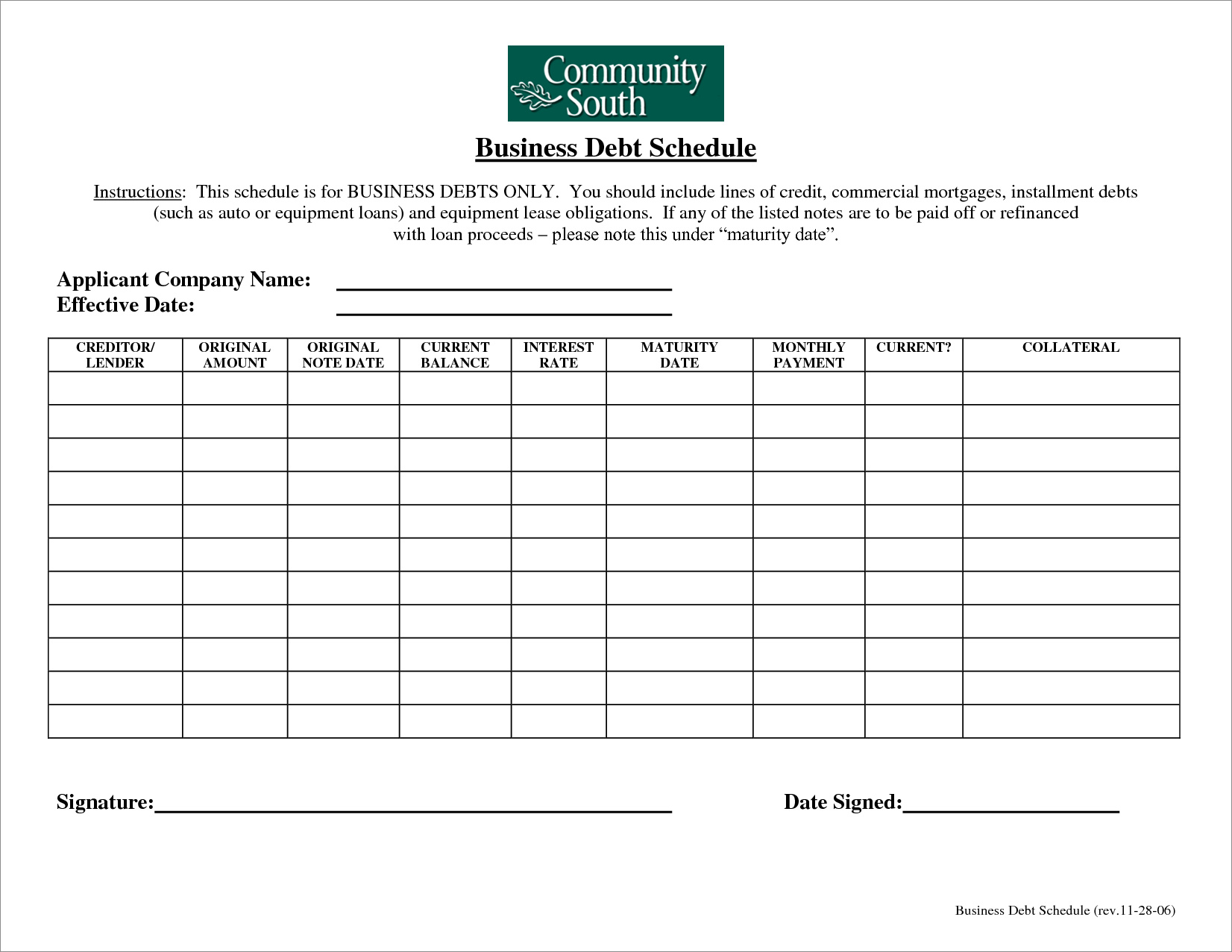

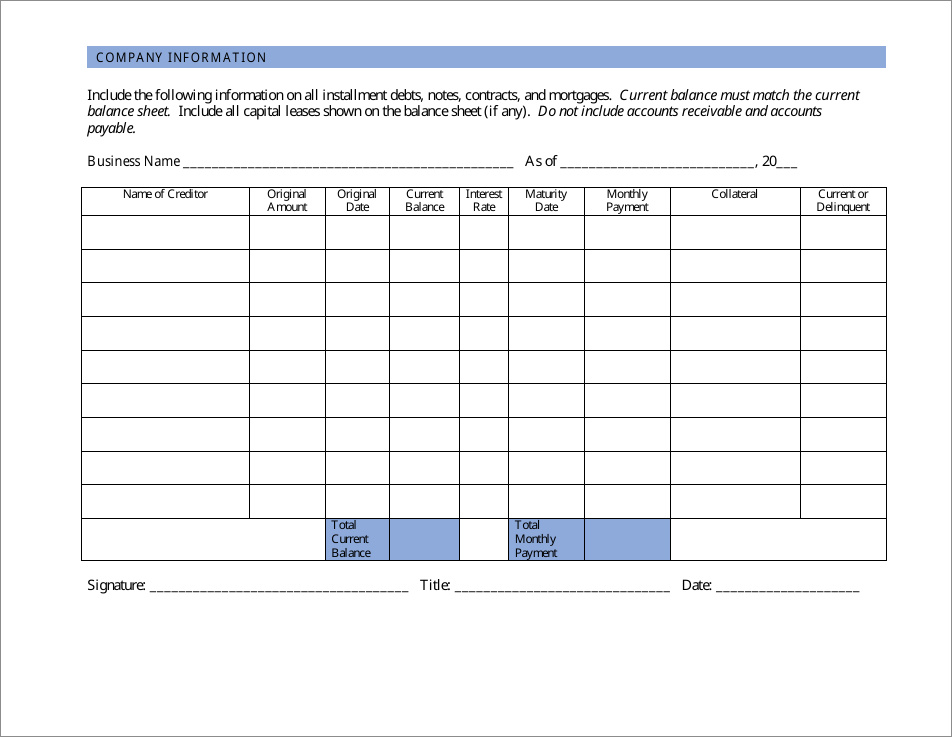

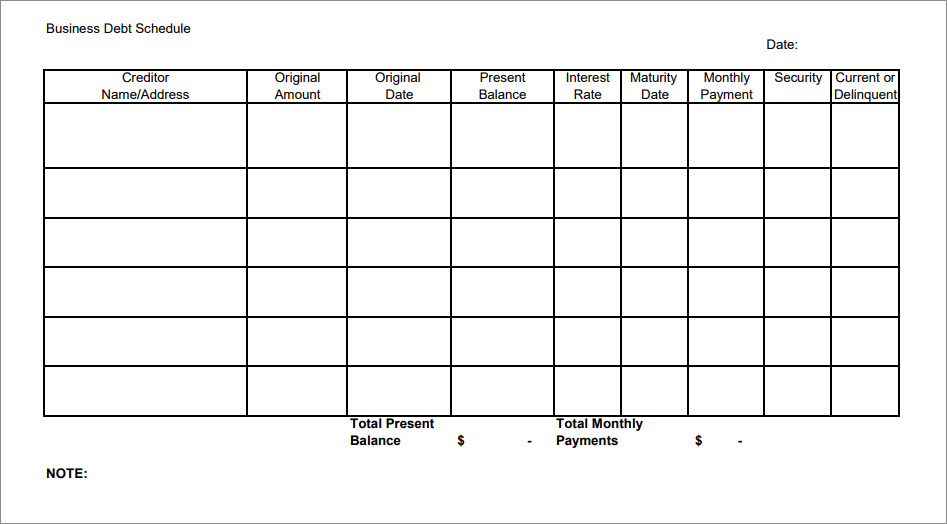

A debt schedule is a document that outlines all the debt obligations of an individual or a company. It provides a detailed overview of the amount owed, the interest rates, the maturity dates, and the payment schedule for each debt. This schedule helps the debtor keep track of their outstanding debts and plan their payments accordingly. It is commonly used by individuals managing personal loans, credit card debts, or mortgages, as well as businesses with multiple loans or bonds.

Creating a debt schedule requires gathering information about all outstanding debts, including the principal amount, interest rate, and payment terms. This information is then organized in a table format, typically arranged by debt type or creditor. The debt schedule serves as a roadmap for the debtor, helping them prioritize their payments and understand the impact of their debt on their overall financial health.

How Does a Debt Schedule Work?

A debt schedule works by providing a comprehensive overview of an individual or company’s debt obligations. It helps the debtor understand the timeline for repayment, the interest costs associated with each debt, and the total amount owed. By having all this information in one place, the debtor can create a realistic plan to pay off their debts and avoid any potential financial pitfalls.

The debt schedule typically includes the following information for each debt:

- Debt Type: The type of debt, such as a personal loan, credit card debt, or mortgage.

- Creditor: The name of the lender or creditor.

- Principal Amount: The original amount borrowed or owed.

- Interest Rate: The annual interest rate charged on the debt.

- Maturity Date: The date when the debt is due to be fully repaid.

- Payment Schedule: The frequency and amount of payments required to satisfy the debt.

By analyzing the debt schedule, debtors can identify which debts have the highest interest rates or are due for repayment soon. This information helps them prioritize their payments, ensuring that they allocate their resources effectively and minimize the overall cost of their debt.

Why is a Debt Schedule Important?

A debt schedule is important for several reasons:

- Organization: It provides a centralized and organized view of all outstanding debts, making it easier for individuals and businesses to manage their financial obligations.

- Planning: It helps debtors create a realistic plan to pay off their debts, taking into account factors such as interest rates, maturity dates, and available resources.

- Financial Awareness: It increases the debtor’s awareness of their overall debt situation, allowing them to make informed decisions about their finances.

- Cost Optimization: By understanding the interest rates and payment terms for each debt, debtors can minimize the overall cost of their debt by prioritizing high-interest debts or negotiating better terms.

- Transparency: It provides a transparent view of the debtor’s financial situation, which can be helpful when applying for new loans or negotiating with creditors.

Overall, a debt schedule is a powerful tool that empowers individuals and businesses to take control of their debt and make informed financial decisions.

How to Create a Debt Schedule

Creating a debt schedule may seem daunting, but it can be done by following a few simple steps:

- Gather Information: Collect all the necessary information about your outstanding debts, including the principal amount, interest rate, and payment terms.

- Organize the Data: Create a table or spreadsheet to organize the information. Include columns for debt type, creditor, principal amount, interest rate, maturity date, and payment schedule.

- Calculate Total Debt: Sum up the principal amounts to calculate your total debt.

- Identify Priorities: Analyze the interest rates and maturity dates to identify which debts should be prioritized for repayment.

- Create a Payment Plan: Use the debt schedule to create a realistic payment plan that fits your financial situation. Consider factors such as available resources and monthly cash flow.

- Update Regularly: Review and update your debt schedule regularly to reflect any changes in your debt obligations.

By following these steps, you can create a debt schedule that serves as a valuable tool for managing your debt effectively.

Sample Debt Schedule

Here’s a sample debt schedule to illustrate how it can be structured:

1. Personal Loans

- Loan 1: $10,000 at 7% interest, due in 3 years with monthly payments of $300.

- Loan 2: $5,000 at 5% interest, due in 2 years with monthly payments of $250.

2. Credit Card Debts

- Credit Card 1: $2,000 at 18% interest, minimum payment of $100 per month.

- Credit Card 2: $3,500 at 20% interest, minimum payment of $150 per month.

3. Mortgage

- Mortgage: $200,000 at 4% interest, due in 30 years with monthly payments of $955.

4. Business Loans

- Loan 1: $50,000 at 6% interest, due in 5 years with monthly payments of $1,000.

- Loan 2: $30,000 at 8% interest, due in 3 years with monthly payments of $900.

This sample debt schedule provides a clear overview of the different types of debts, their interest rates, and payment terms. It allows the debtor to prioritize their payments and plan their finances accordingly.

Conclusion

Managing debt can be challenging, but a debt schedule can provide the clarity and organization needed to tackle it effectively. By understanding what a debt schedule is, how it works, and why it is important, individuals and businesses can take control of their debt and make informed financial decisions. Remember to regularly update your debt schedule and adjust your payment plan as necessary. With a well-structured debt schedule, you can navigate your financial obligations with confidence and work towards a debt-free future.

Debt Schedule Template Excel – Download