When it comes to conducting audits, having a well-structured checklist is essential to ensure that all necessary steps are followed and no important details are overlooked. An audit checklist serves as a guide for auditors, helping them stay organized and focused throughout the auditing process.

In this article, we will explore the importance of an audit checklist, what it should include, and how to effectively use one.

What is an Audit Checklist?

An audit checklist is a tool used by auditors to ensure that all necessary steps are taken during an audit. It serves as a comprehensive guide, outlining the different areas that need to be examined, the documents that need to be reviewed, and the questions that need to be asked. By following a checklist, auditors can ensure consistency and accuracy in their work, minimizing the risk of errors or omissions.

Using an audit checklist provides several benefits. It helps auditors:

- Stay organized and focused throughout the audit process.

- Ensure that all necessary areas and documents are covered.

- Minimize the risk of errors or omissions.

- Standardize the audit process for consistency.

- Save time by having a structured approach.

Why is an Audit Checklist Important?

An audit checklist is important for several reasons. Firstly, it helps auditors stay organized and focused, ensuring that they cover all necessary areas and documents. This is particularly crucial in complex audits, where multiple departments or processes need to be examined.

Secondly, an audit checklist helps auditors minimize the risk of errors or omissions. By providing a structured approach, it ensures that auditors don’t miss important details or skip critical steps. This is especially important in audits that have legal or regulatory implications, as even a small oversight can have significant consequences.

Furthermore, an audit checklist helps standardize the audit process. By having a predefined list of tasks and questions, auditors can ensure consistency in their work, regardless of who is conducting the audit. This is important for organizations that undergo regular audits, as it allows for easy comparison and identification of trends or patterns.

How to Create an Effective Audit Checklist

Creating an effective audit checklist requires careful planning and consideration. Here are some key steps to follow:

1. Identify the Purpose of the Audit

Before creating an audit checklist, it’s important to clearly define the purpose of the audit. What specific areas or processes are you looking to assess? Are there any specific goals or objectives you want to achieve? By identifying the purpose, you can tailor the checklist to focus on the most relevant areas.

2. Determine the Scope of the Audit

Next, determine the scope of the audit. Will it cover the entire organization or specific departments or processes? Understanding the scope will help you determine the level of detail and the number of tasks that need to be included in the checklist.

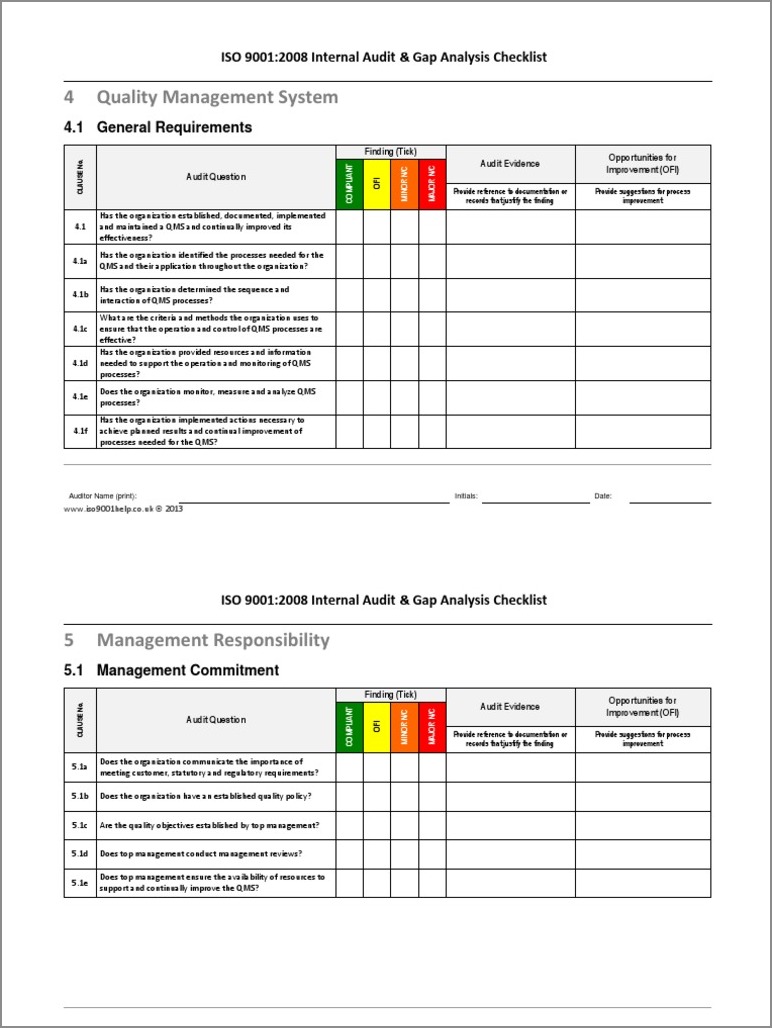

3. Research Applicable Standards and Regulations

Research any applicable standards or regulations that need to be considered during the audit. This will help ensure that the checklist includes all necessary requirements and that the audit is conducted in compliance with relevant guidelines.

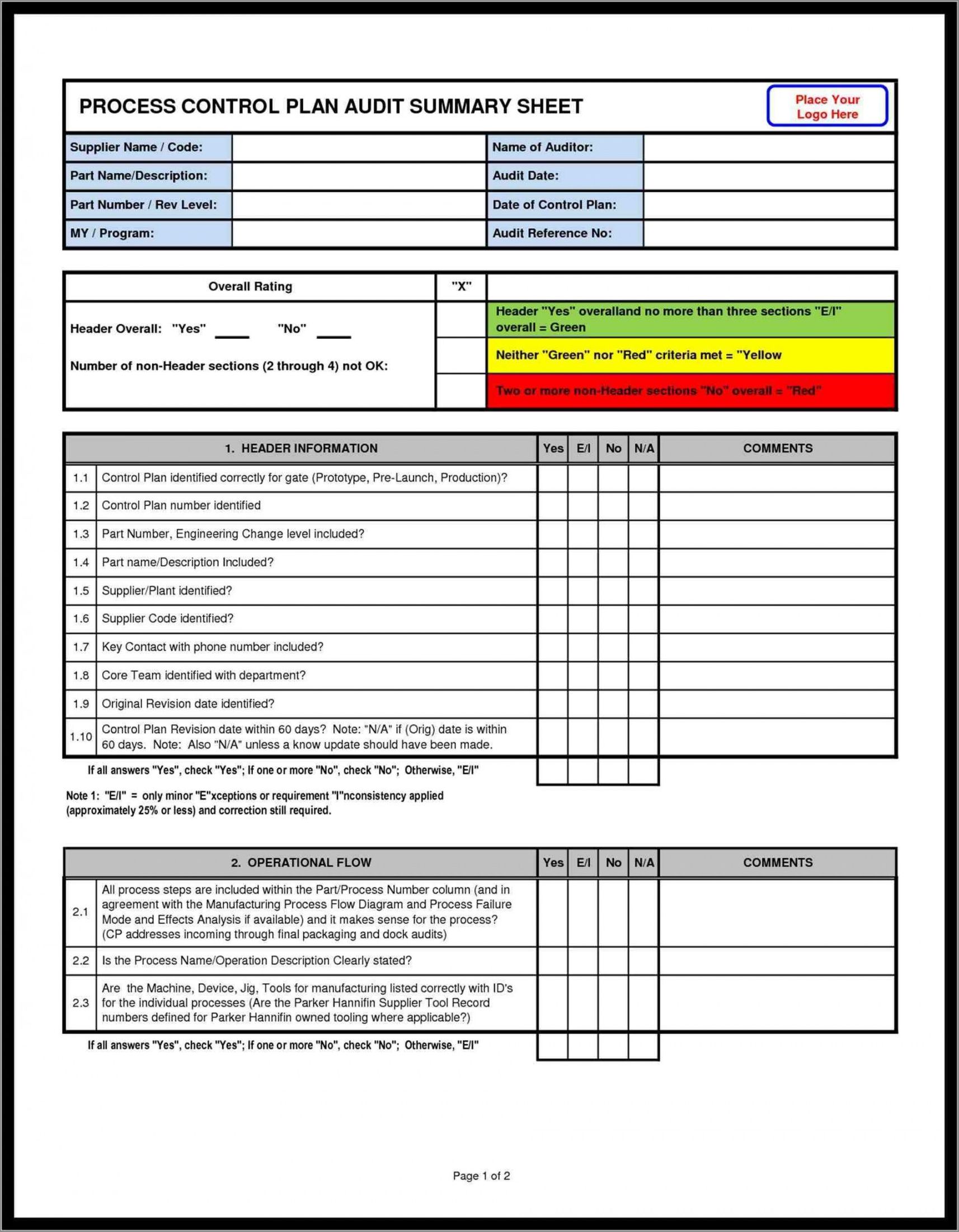

4. Break Down the Audit into Sections

Break down the audit into sections based on the different areas or processes that need to be examined. This will help organize the checklist and make it easier to navigate. For example, you could have sections for financial statements, internal controls, and compliance.

5. Identify Key Tasks and Questions

For each section, identify the key tasks and questions that need to be addressed. What specific documents need to be reviewed? What information needs to be gathered? What questions need to be asked? Be as specific as possible to ensure that nothing is missed.

6. Prioritize Tasks and Questions

Prioritize the tasks and questions based on their importance and relevance. This will help auditors focus on the most critical areas first, ensuring that they allocate their time and resources effectively.

7. Include Reference Documents and Resources

Include any reference documents or resources that auditors may need to consult during the audit. This could include company policies, industry standards, or regulatory guidelines. Having these resources readily available will help auditors conduct a thorough and accurate audit.

8. Test the Checklist

Before using the checklist for an actual audit, test it to ensure that it covers all necessary areas and that the tasks and questions are clear. You can do this by conducting a mock audit or by having another auditor review the checklist for feedback.

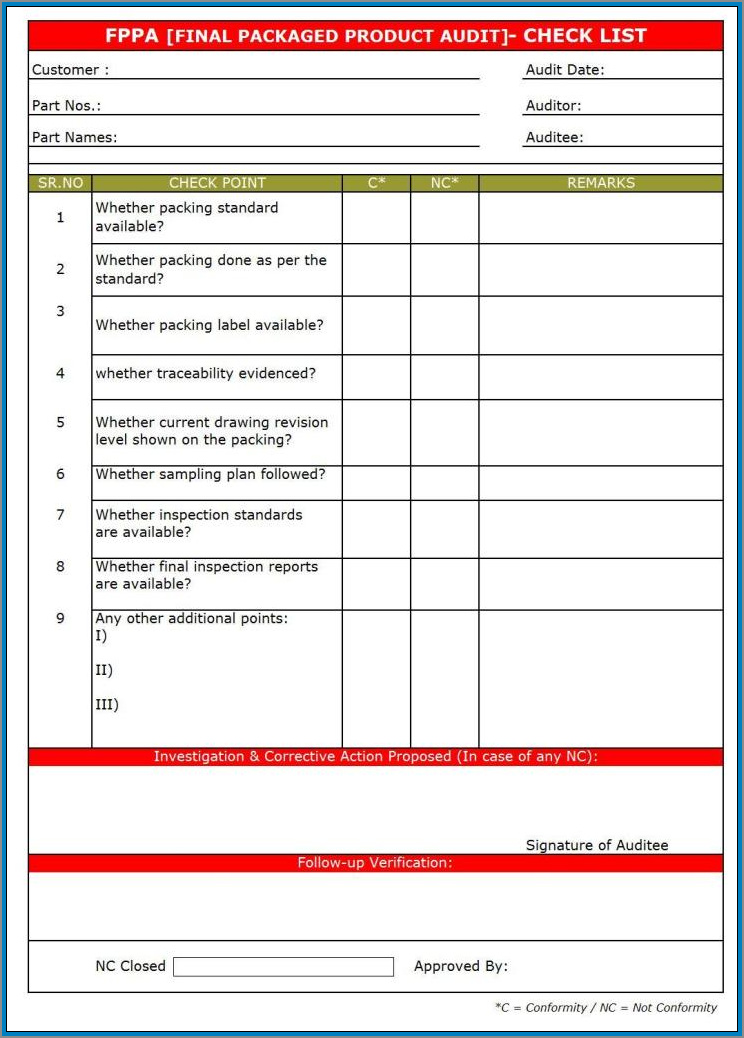

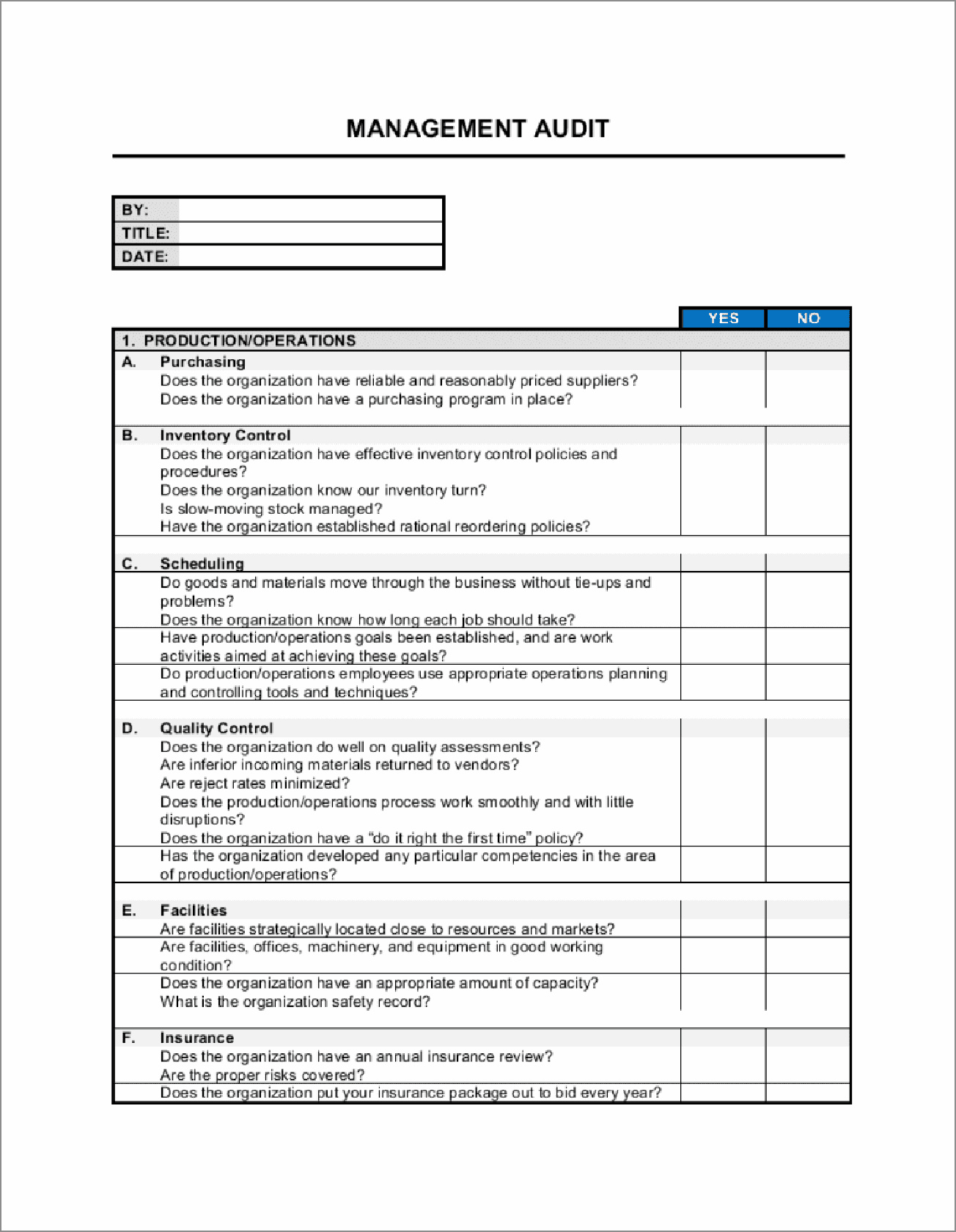

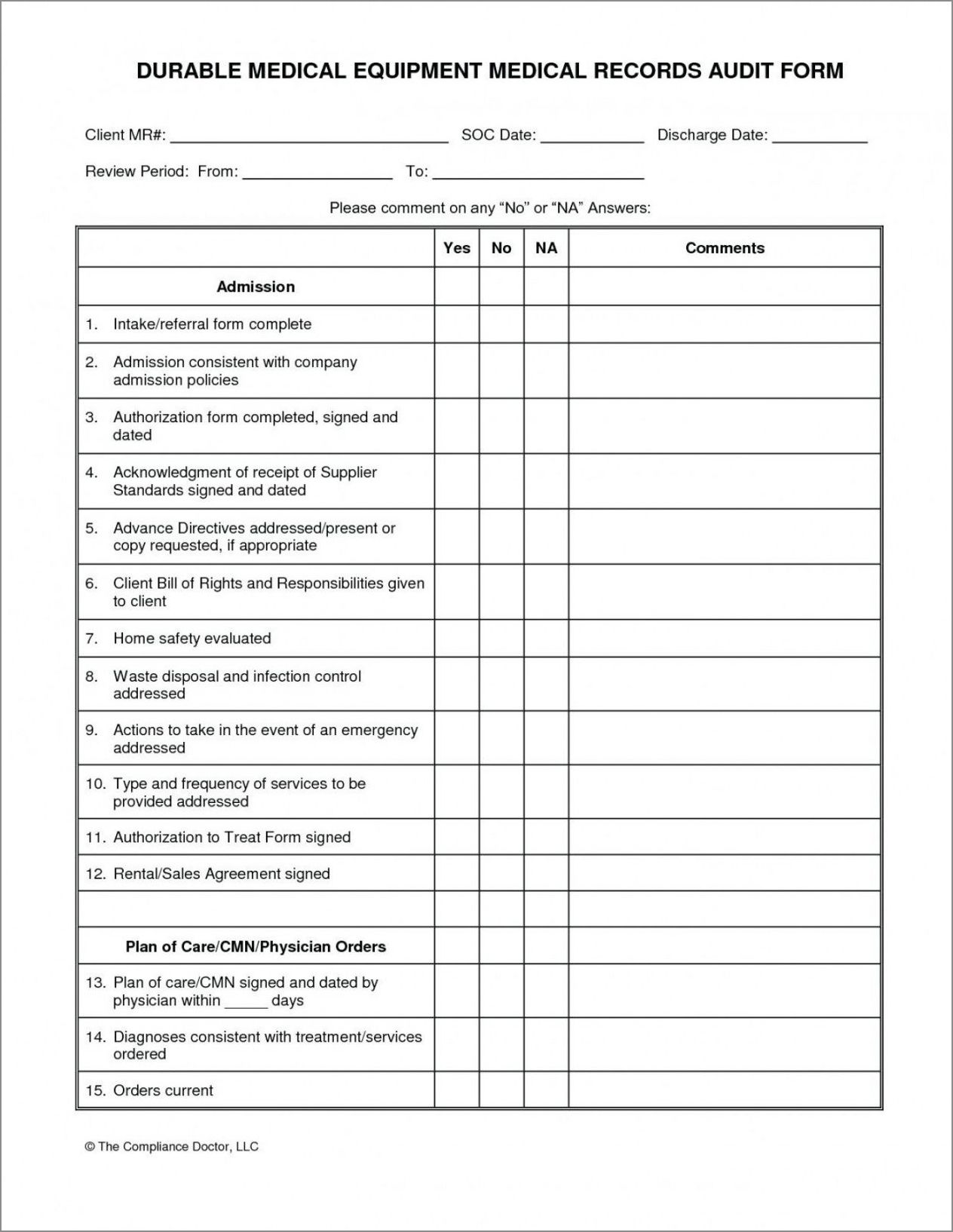

Sample Audit Checklist

Here is an example of a sample audit checklist that could be used for a financial audit:

- Financial Statements

- Review the balance sheet for accuracy and completeness.

- Examine the income statement for any irregularities or inconsistencies.

- Verify cash flow statement against supporting documents.

- Internal Controls

- Evaluate the effectiveness of internal controls in place.

- Assess the segregation of duties to ensure proper checks and balances.

- Review access controls for sensitive financial systems.

- Compliance

- Ensure compliance with applicable accounting standards.

- Check for adherence to tax regulations and reporting requirements.

- Review any legal or regulatory filings for accuracy and completeness.

Conclusion

An audit checklist is a valuable tool for auditors, helping them stay organized, focused, and consistent throughout the auditing process. By following a well-structured checklist, auditors can ensure that all necessary areas and documents are covered, minimizing the risk of errors or omissions. Creating an effective audit checklist involves careful planning, research, and prioritization. By investing time and effort into creating a comprehensive checklist, auditors can conduct thorough and accurate audits, providing valuable insights and recommendations to the organization.

Audit Checklist Template Word – Download