What is a car payment agreement letter?

A car payment agreement letter is a written document that outlines the terms and conditions of a car loan or financing agreement between a buyer and a seller. It serves as a legally binding contract that ensures both parties are aware of their obligations and rights regarding the car purchase.

The purpose of this letter is to provide clarity and protection to both the buyer and the seller. It specifies important details such as the amount of the loan, the interest rate, the repayment schedule, and any penalties or fees that may apply. By having a car payment agreement letter, both parties can refer to it in case of any disputes or misunderstandings that may arise during the course of the loan repayment.

Why is a car payment agreement letter important?

There are several reasons why a car payment agreement letter is important:

- Clarity: The agreement letter ensures that both parties are on the same page regarding the terms of the car purchase. It clearly outlines the agreed-upon price, payment schedule, interest rates, and any additional fees or charges. Having this clarity helps prevent misunderstandings or disputes in the future.

- Protection: A car payment agreement letter protects both the buyer and the seller. For the buyer, it ensures that the seller cannot change the terms of the purchase midway or demand additional payments. It also provides a legal recourse in case the seller fails to deliver the car or violates any of the agreed-upon terms. For the seller, it serves as proof of the buyer’s commitment to make the payments as agreed, allowing them to take legal action in case of non-payment or default.

- Enforceability: By having a written agreement, the terms and conditions become legally enforceable. In case of any disputes or conflicts, the agreement letter can be presented as evidence in court or used to negotiate a resolution. It provides a sense of security and peace of mind for both parties involved in the car purchase.

How to create a car payment agreement letter

Here are the steps to follow when creating a car payment agreement letter:

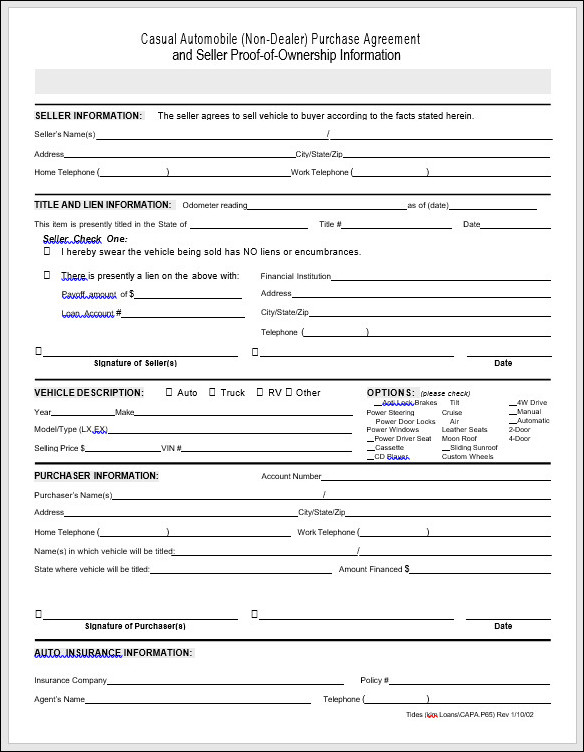

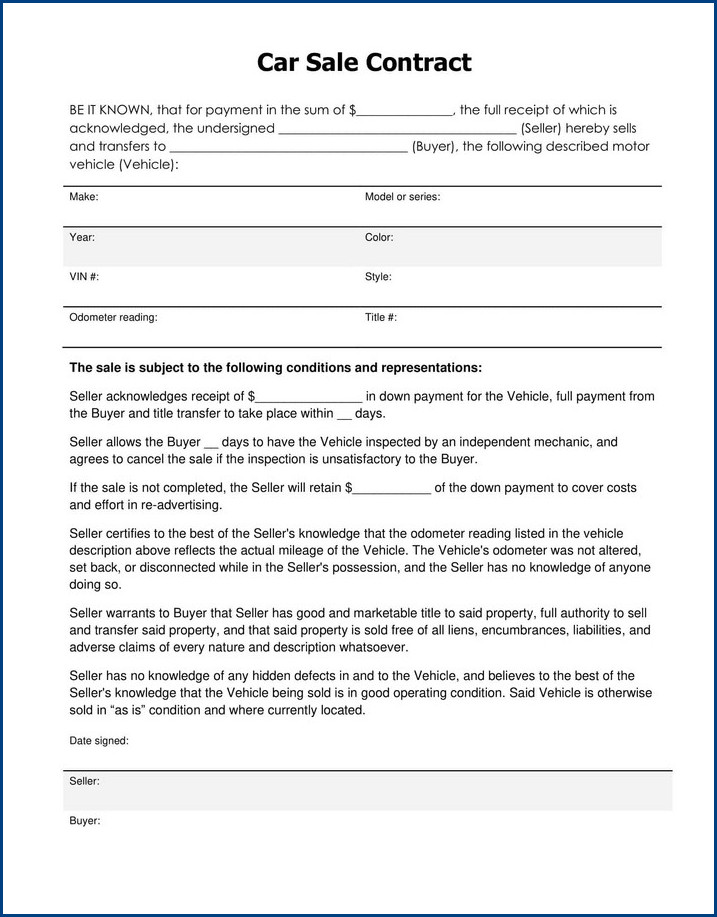

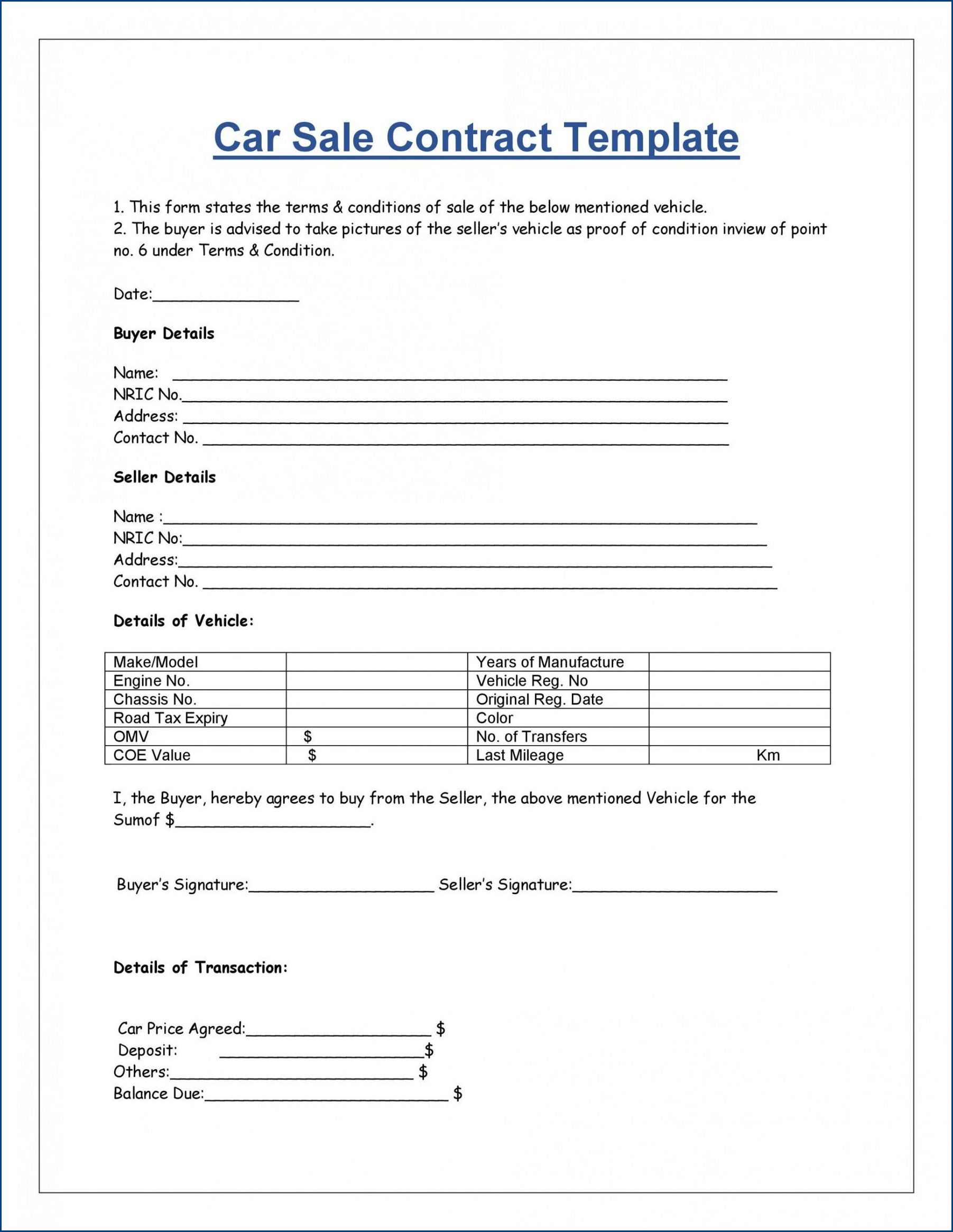

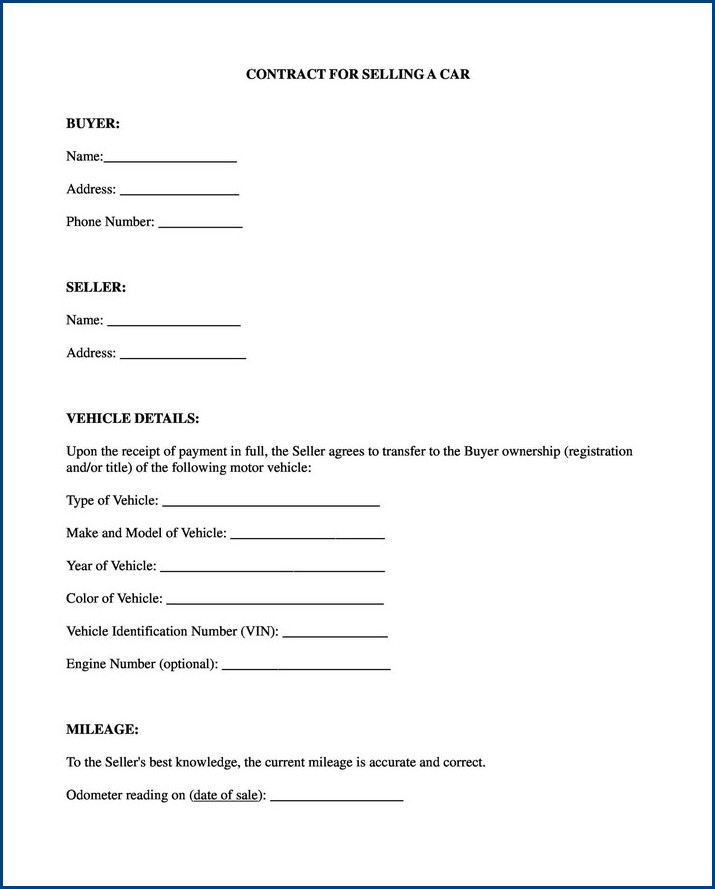

- Title: Begin by creating a title for the agreement, such as “Car Payment Agreement Letter” or “Vehicle Loan Agreement.”

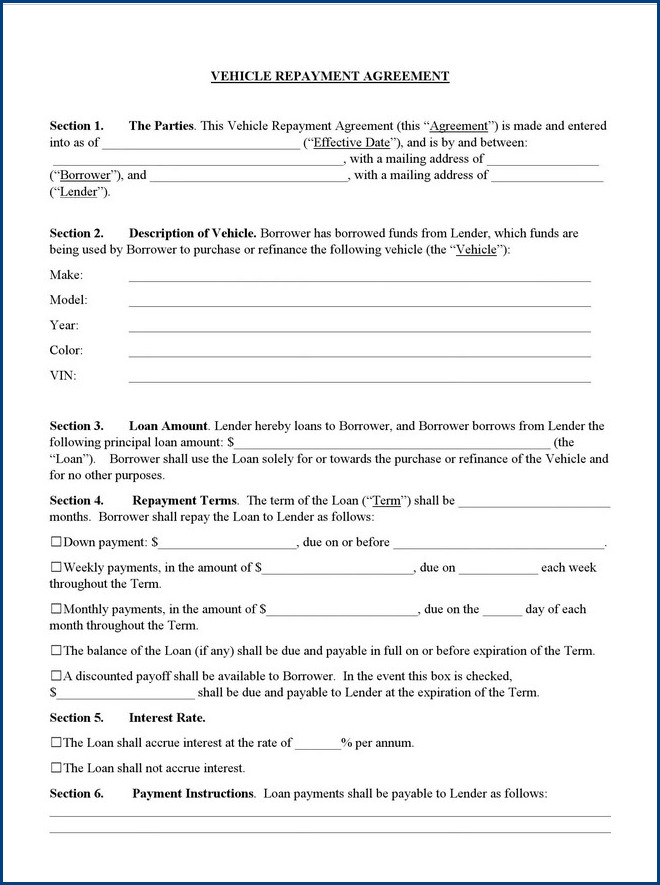

- Introduction: Start the letter by introducing the parties involved, including the name and contact information of the borrower and the lender. Clearly state the purpose of the agreement, which is to outline the terms and conditions of the car loan.

- Loan Details: Provide detailed information about the loan, including the amount borrowed, the interest rate, and the repayment schedule. Include any additional fees or charges that may apply, such as late payment fees or early repayment penalties.

- Collateral: If the loan is secured by the vehicle, specify the details of the collateral, including the make, model, year, and vehicle identification number (VIN). This ensures that the lender has the right to repossess the vehicle in case of default.

- Payment Terms: Clearly outline the payment terms, including the amount of each installment, the due date, and the preferred method of payment. Specify whether the payments will be made monthly, bi-weekly, or in another frequency.

- Default and Remedies: Include a section that explains the consequences of defaulting on the loan, such as late payment penalties, repossession of the vehicle, or legal action. It is important to be clear about the remedies available to the lender in case of default.

- Signatures: Finally, provide space for both parties to sign and date the agreement. This signifies their acceptance of the terms and conditions outlined in the car payment agreement letter.

Creating a car payment agreement letter is essential to establish a clear and legally binding agreement between the borrower and the lender. By following these steps and including all the necessary details, both parties can have peace of mind and avoid any potential misunderstandings or disputes in the future.

Car Payment Agreement Letter Template | Word – Download