What is an insurance appeals letter?

An insurance appeals letter is a written communication that individuals or healthcare providers send to their insurance company to challenge a denied claim or request reconsideration of a decision. The purpose of an insurance appeals letter is to present a compelling argument, supported by relevant documentation, to convince the insurance company to reverse its decision and approve the claim. These letters are typically used when an insurance claim has been denied due to reasons such as lack of medical necessity, incorrect billing codes, or insufficient supporting documentation.

The insurance appeals letter serves as a tool to exercise the rights of policyholders and healthcare providers to challenge an unfavorable decision made by the insurance company. It allows individuals and providers to provide additional information, clarify misunderstandings, and address any discrepancies that may have led to the claim denial. The letter should be concise, well-organized, and clearly state the reasons for the appeal, providing any additional evidence or supporting documents that can strengthen the case. The ultimate goal of an insurance appeals letter is to secure the approval of the claim, ensuring that individuals receive the coverage they are entitled to and healthcare providers are fairly compensated for their services.

Why is an insurance appeals letter important?

There are several reasons why insurance appeals letters are important:

- Ensuring fair treatment: Insurance appeals letters are essential in ensuring that individuals receive fair treatment from their insurance providers. By submitting a well-crafted letter, policyholders have the opportunity to present additional evidence, arguments, or documentation to support their claim. This gives them a fair chance to dispute any incorrect or incomplete decisions made by the insurance company.

- Maximizing coverage: Another critical importance of insurance appeals letters is that they can help policyholders maximize their coverage. Often, insurance companies may deny a claim based on technicalities, such as missing information or improper documentation. By submitting an appeals letter, individuals can rectify errors, provide the necessary information, and potentially secure the coverage they are entitled to.

- Preserving financial stability: Insurance appeals letters play a vital role in preserving the financial stability of individuals. Denied insurance claims can result in significant financial burdens, especially in cases where medical expenses or property damages need to be covered. By appealing the decision, individuals have a chance to obtain the financial support they need to recover from unexpected events and maintain their financial well-being.

How to create an insurance appeals letter

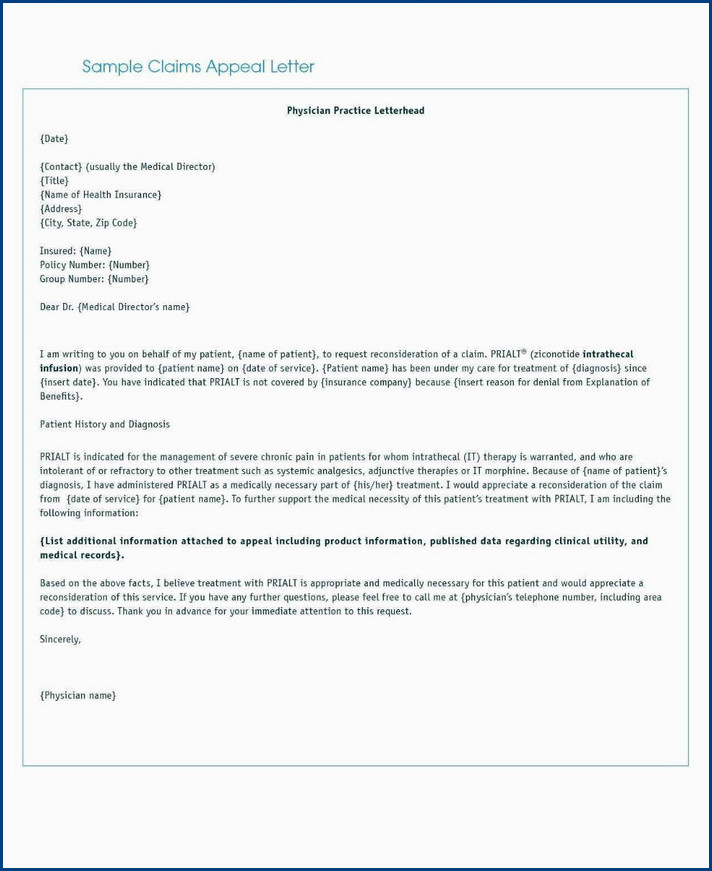

Here are the steps to create a compelling insurance appeals letter:

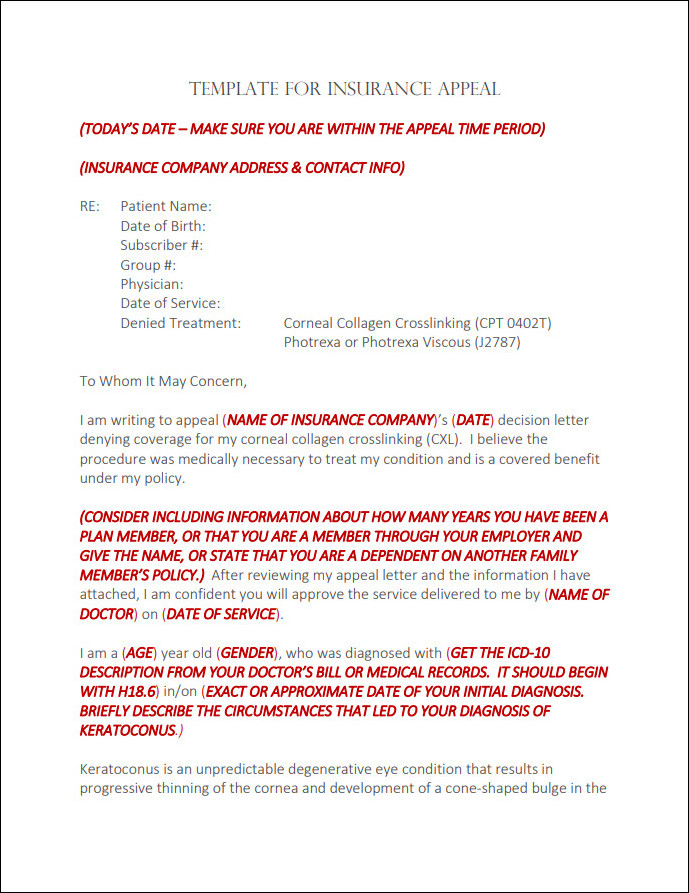

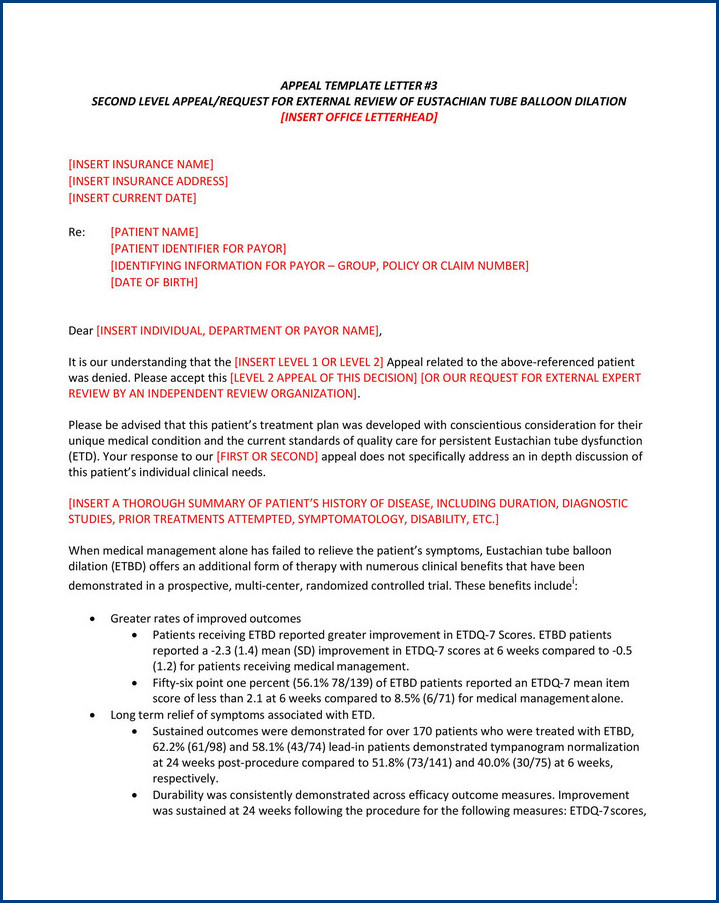

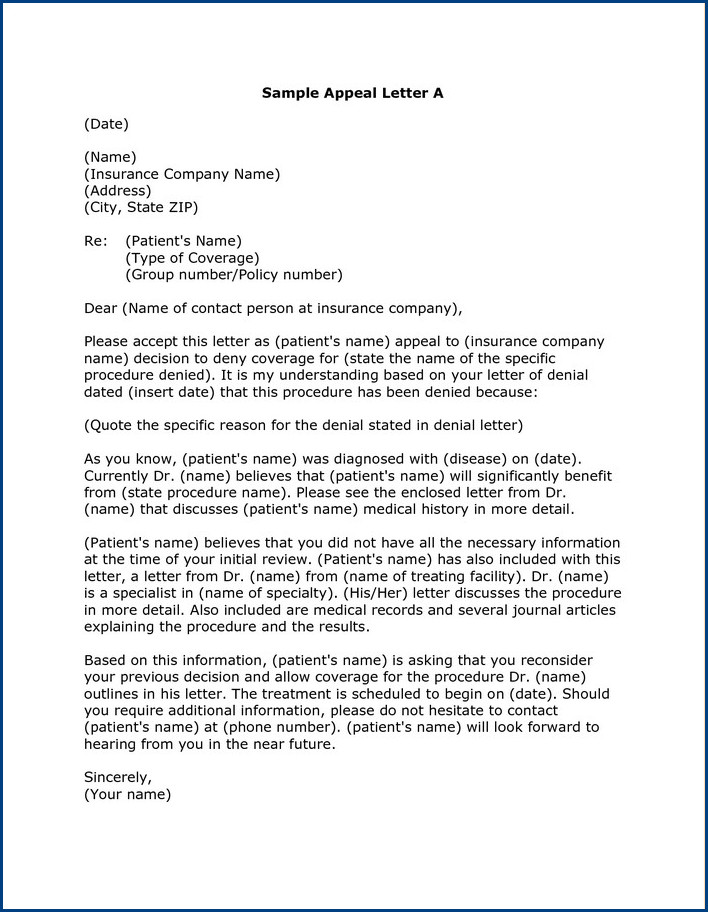

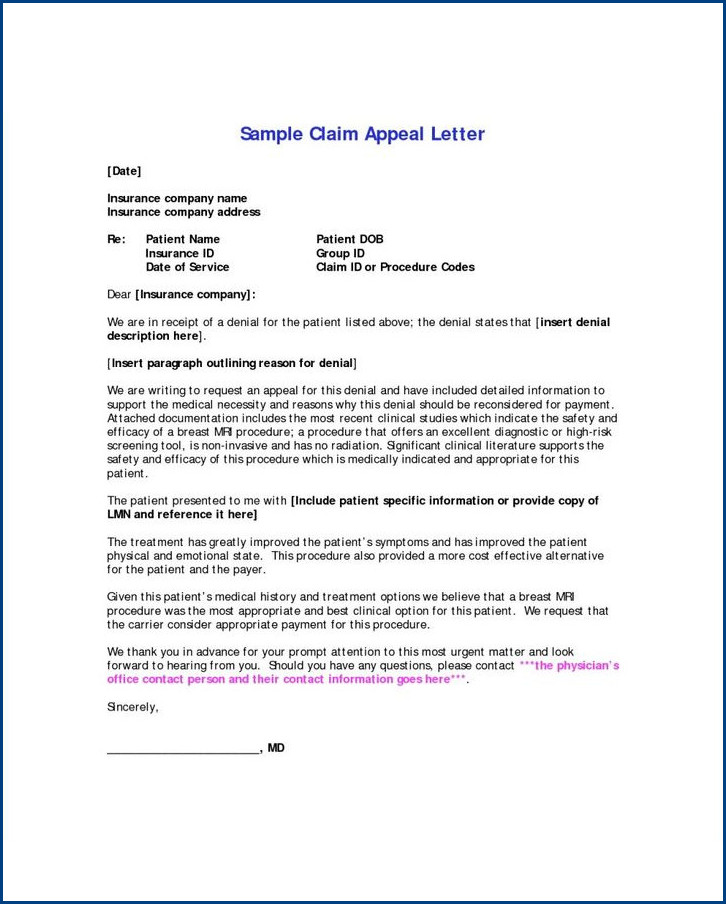

- Gather all necessary information: Before you start writing your insurance appeals letter, make sure you have all the relevant documents and information at hand. This includes the denial letter from your insurance company, any supporting medical records or documentation, and your policy details.

- Address the letter: Begin your letter by addressing it to the appropriate person or department at your insurance company. Use a professional tone and include your contact information so they can easily reach you.

- State the purpose of your letter: Clearly explain in the opening paragraph that you are writing to appeal the denial of your claim. Be concise and to the point, highlighting the specific reasons why you believe the decision was incorrect.

- Provide supporting evidence: In the body of your letter, present the facts and evidence that support your case. This could include medical records, test results, or any other relevant documentation. Be sure to reference specific policy provisions or guidelines that support your claim.

- Make a persuasive argument: Use logical reasoning and compelling language to make your case. Explain why the denial is unfair or incorrect, and how it has negatively impacted your health or financial situation.

- Request a reconsideration: Clearly state that you are requesting a reconsideration of the denial and specify the outcome you are seeking. Be polite and professional throughout the letter.

- Close the letter: In the closing paragraph, thank the reader for their time and consideration. Provide your contact information once again and request a prompt response.

Writing a well-crafted insurance appeals letter can significantly increase your chances of reversing a denied claim. By following these steps and presenting a compelling argument supported by evidence, you can effectively communicate your case to the insurance company and potentially receive the coverage you deserve.

Remember to be concise, professional, and polite throughout the letter, as it greatly influences how your appeal is perceived.

Insurance Appeals Letter Template | PDF – Download