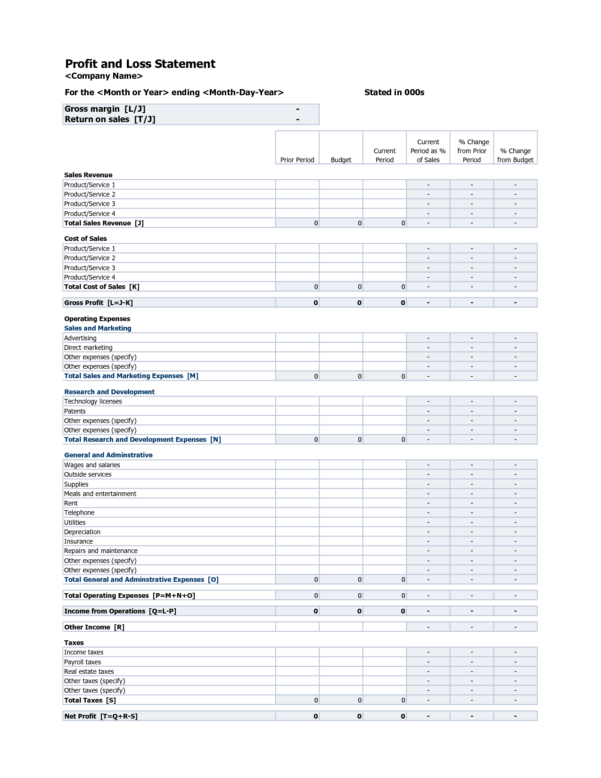

A profit and loss statement, also known as an income statement, is a financial document that provides an overview of a business’s revenues, costs, and expenses over a specific period. It helps business owners assess their financial performance and determine the profitability of their operations. For self-employed individuals, a profit and loss statement can be a valuable tool for managing their finances and making informed business decisions.

Why is a Profit and Loss Statement Important for Self-Employed Individuals?

Self-employed individuals often have unique financial situations compared to traditional employees. They are responsible for managing their finances, including tracking their income and expenses. A profit and loss statement can help self-employed individuals understand how their business is performing financially and identify areas where they can make improvements.

Additionally, a profit and loss statement is often required when applying for loans or mortgages, as it provides lenders with crucial information about an individual’s income and financial stability. It can also be useful when filing taxes, as it helps self-employed individuals accurately report their income and claim deductions.

How to Create a Profit and Loss Statement for Self-Employed?

Creating a profit and loss statement for self-employed individuals involves several steps:

1. Gather Income Information

Start by gathering all the information related to your income. This can include sales revenues, fees, commissions, and any other sources of income you receive as a self-employed individual. It’s important to be thorough and include all sources of income to get an accurate picture of your financial situation.

2. Track Expenses

Next, track and categorize your expenses. This can include costs related to supplies, equipment, rent, utilities, marketing, and any other expenses incurred while running your business. Keep detailed records and receipts to ensure accuracy.

3. Calculate Gross Profit

To calculate your gross profit, subtract your total expenses from your total income. This will give you a rough estimate of the profitability of your business before considering other factors such as taxes and overhead costs.

4. Consider Taxes and Other Costs

Self-employed individuals are responsible for paying their taxes. It’s important to set aside a portion of your income to cover tax obligations. Additionally, consider any other costs such as insurance, licenses, or professional fees that may apply to your business.

5. Calculate Net Profit

To calculate your net profit, subtract taxes and other costs from your gross profit. This will give you a clear understanding of your business’s profitability after taking into account all expenses.

6. Review and Analyze

Once you have completed your profit and loss statement, take the time to review and analyze the information. Look for areas where you can reduce expenses or increase revenue to improve profitability. Consider consulting with a financial advisor or accountant to gain further insights into your financial situation.

Tips for Creating an Effective Profit and Loss Statement

Creating an effective profit and loss statement requires attention to detail and accuracy. Here are some tips to help you create a comprehensive and accurate statement:

- Organize your records: Keep detailed records of your income and expenses throughout the year. This will make it easier to create your profit and loss statement at the end of the reporting period.

- Categorize expenses: Group your expenses into categories such as supplies, marketing, utilities, etc. This will make it easier to identify areas of high spending and potential cost-cutting opportunities.

- Be consistent: Use the same accounting method consistently to ensure accurate reporting. This could be cash-based accounting or accrual-based accounting.

- Review periodically: Regularly review your profit and loss statement to track your business’s financial progress and make any necessary adjustments.

- Seek professional help: If you’re unsure about creating a profit and loss statement or need assistance with complex financial matters, consider seeking help from a financial advisor or accountant.

Conclusion

A profit and loss statement is an essential financial tool for self-employed individuals. It provides valuable insights into the financial performance of their business and helps them make informed decisions. By tracking income, categorizing expenses, and calculating profit, self-employed individuals can better manage their finances and work towards improving their business’s profitability. Remember to keep accurate records, review periodically, and seek professional help when needed to ensure the accuracy and effectiveness of your profit and loss statement.

Profit And Loss Statement Template For Self Employed – Download