A loan amortization schedule is a table that displays the breakdown of each loan payment over its term. It shows the amount of each payment that goes towards the principal balance and the amount that goes towards interest. This schedule helps borrowers understand how their loan will be repaid over time and allows them to plan their finances accordingly.

Loan amortization schedules are commonly used for mortgages, car loans, and other types of installment loans. They provide detailed information about the loan, including the total amount borrowed, the interest rate, the term of the loan, and the monthly payment amount.

How Does a Loan Amortization Schedule Work?

A loan amortization schedule works by dividing the total loan amount into equal monthly payments over the loan term. Each payment consists of a portion that goes towards reducing the principal balance and a portion that covers the interest charges.

At the beginning of the loan term, a larger portion of the payment goes towards interest, while a smaller portion is applied to the principal. As the loan progresses, the balance decreases, resulting in a lower interest charge and a higher portion of the payment being allocated to the principal.

The loan amortization schedule shows the breakdown of each payment, including the principal and interest amounts. It also displays the remaining balance after each payment is made.

Why Should You Use a Loan Amortization Schedule?

Using a loan amortization schedule can be beneficial for both borrowers and lenders. Here are some reasons why:

- Financial Planning: A loan amortization schedule allows borrowers to plan their finances by knowing exactly how much they need to pay each month. This helps them budget and ensure they can afford the loan.

- Transparency: The schedule provides transparency about the loan terms, including the interest rate and the total amount of interest paid over the term. This helps borrowers understand the true cost of the loan.

- Comparison: By using a loan amortization schedule, borrowers can compare different loan offers and determine which one is the most suitable for their needs. They can see how the interest rate and terms affect the monthly payments and the total cost of the loan.

- Early Repayment: The schedule also allows borrowers to see the impact of making extra payments or paying off the loan early. They can determine how much they can save on interest by making additional payments.

How to Create a Loan Amortization Schedule

Creating a loan amortization schedule can be done manually or by using an online calculator or spreadsheet software. Here are the steps to create a loan amortization schedule:

- Gather Loan Information: Collect all the necessary information about the loan, including the principal amount, interest rate, and term.

- Calculate Monthly Payment: Use a loan payment calculator or a formula to calculate the monthly payment amount.

- Create a Table: Set up a table with columns for the payment number, payment date, payment amount, principal payment, interest payment, and remaining balance.

- Fill in the Table: Start with the first payment and calculate the principal and interest amounts. Subtract the principal payment from the previous balance to get the remaining balance.

- Repeat the Process: Continue filling in the table for each payment until the loan is fully amortized.

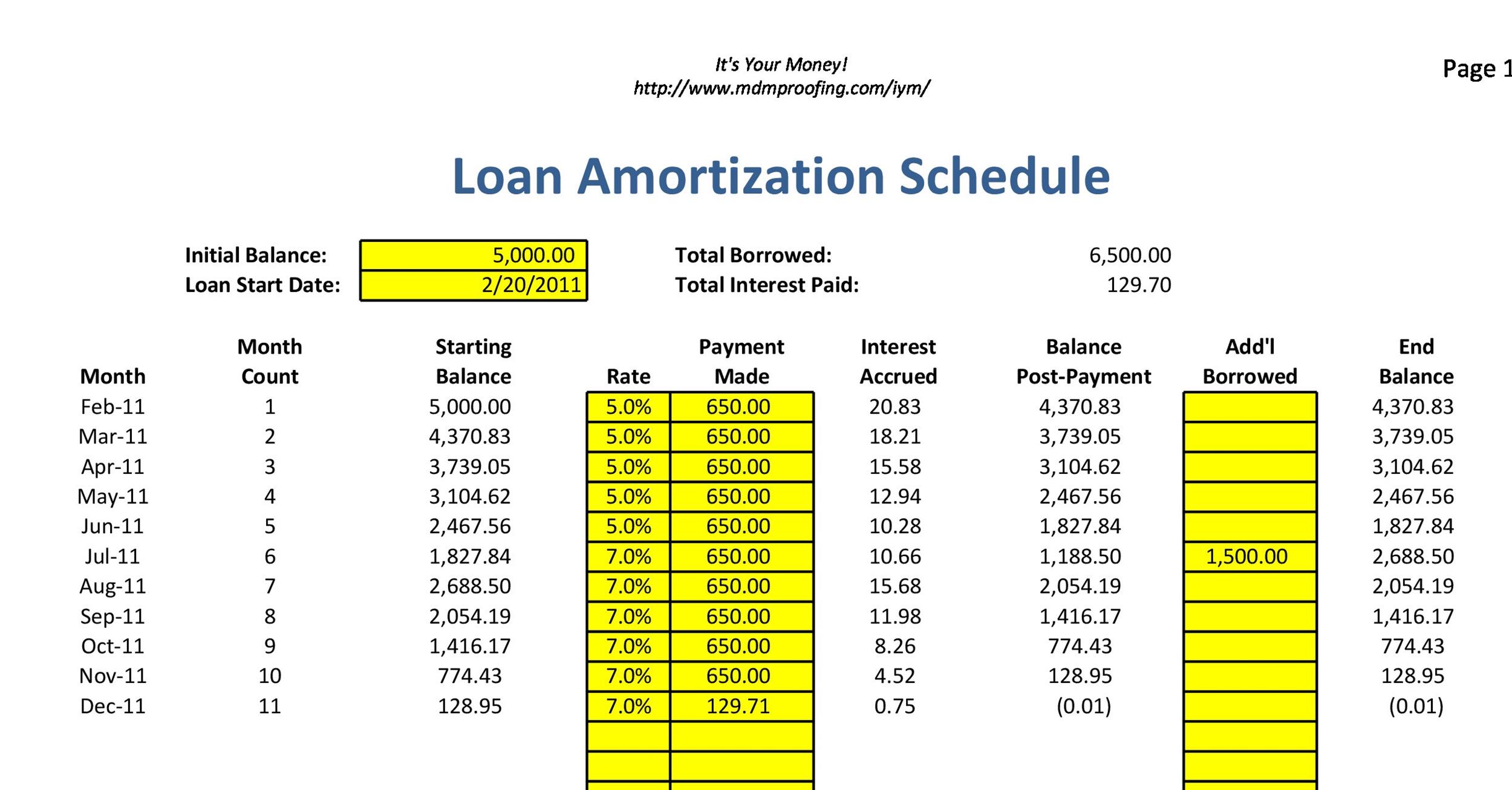

Example of a Loan Amortization Schedule

Let’s consider an example to illustrate how a loan amortization schedule works. Suppose you borrow $10,000 at an interest rate of 5% for a term of 5 years.

Using a loan payment calculator, the monthly payment amount is calculated to be $188.71. The loan amortization schedule would look like this:

| Payment Number | Payment Date | Payment Amount | Principal Payment | Interest Payment | Remaining Balance |

|---|---|---|---|---|---|

| 1 | 01/01/2023 | $188.71 | $39.71 | $149.00 | $9,960.29 |

| 2 | 02/01/2023 | $188.71 | $40.37 | $148.34 | $9,919.92 |

| 3 | 03/01/2023 | $188.71 | $41.05 | $147.66 | $9,878.87 |

| 4 | 04/01/2023 | $188.71 | $41.73 | $146.98 | $9,837.14 |

| 5 | 05/01/2023 | $188.71 | $42.42 | $146.29 | $9,794.72 |

Top Benefits of Using a Loan Amortization Schedule

Using a loan amortization schedule offers several benefits for borrowers:

- Clear Understanding: A loan amortization schedule provides borrowers with a clear understanding of how their loan will be repaid and the breakdown of each payment.

- Budget Planning: By knowing the exact monthly payment amount, borrowers can plan their budget accordingly and ensure they can afford the loan.

- Comparison Shopping: The schedule allows borrowers to compare different loan offers and choose the one that best suits their financial situation.

- Transparency: Borrowers can see how much of each payment goes towards interest and how much goes towards reducing the principal balance, helping them make informed financial decisions.

- Early Repayment: The schedule shows the impact of making extra payments or paying off the loan early, allowing borrowers to save on interest and potentially pay off the loan faster.

Where Can You Find a Loan Amortization Schedule?

A loan amortization schedule can be easily created using online calculators or spreadsheet software such as Microsoft Excel or Google Sheets. Many financial websites also provide free templates or tools to generate loan amortization schedules.

Alternatively, borrowers can consult with their lenders or financial advisors, who can provide them with a personalized loan amortization schedule based on their specific loan terms.

Conclusion

A loan amortization schedule is a valuable tool for borrowers to understand the repayment of their loans. It provides a detailed breakdown of each payment, helping borrowers plan their finances and make informed decisions. By using a loan amortization schedule, borrowers can gain transparency, compare loan offers, and potentially save on interest by making extra payments or paying off the loan early.

Whether you’re considering a mortgage, car loan, or any other type of installment loan, using a loan amortization schedule can greatly assist you in managing your finances and achieving your financial goals.

Loan Amortization Schedule Template – Download