What is a property tax assessment appeal letter?

A property tax assessment appeal letter is a formal written document that a property owner submits to their local tax assessor’s office to challenge the assessed value of their property for tax purposes. This letter outlines the owner’s arguments and presents evidence to support their claim that the assessment is inaccurate or unfair. The purpose of a property tax assessment appeal letter is to seek a reduction in the assessed value, which can lead to lower property tax payments for the owner.

The benefits of submitting a property tax assessment appeal letter are numerous.

- It provides property owners with an opportunity to correct any errors or discrepancies in the assessed value of their property. This can result in significant savings on property taxes, especially if the appeal is successful.

- A successful appeal can also lead to a more accurate assessment of the property’s value, ensuring that the owner is not overburdened with excessive taxes.

- The appeal process allows property owners to exercise their rights and have their voices heard, giving them a sense of control over their tax obligations.

How do I write a tax appeal letter?

Writing a tax appeal letter can be a daunting task, but with careful planning and attention to detail, you can effectively present your case to the tax authority. Here are some steps to help you write a persuasive tax appeal letter:

- Gather all relevant information: Before you begin writing your appeal letter, collect all the necessary documents and information related to your tax issue. This may include tax returns, supporting documents, and any correspondence with the tax authority.

- Address the letter properly: Start your letter by addressing it to the appropriate tax authority. Use the correct format, including the recipient’s name, title, and address. This will show that you have taken the time to personalize your appeal.

- State the purpose of your letter: Clearly explain in the opening paragraph that you are writing to appeal a specific tax decision or assessment. Be concise and to the point, avoiding unnecessary details.

- Provide a brief background: In the subsequent paragraphs, provide a brief overview of the circumstances leading to the tax issue. Include relevant dates, facts, and any supporting evidence.

- Highlight errors or misunderstandings: If you believe that the tax assessment or decision was based on incorrect information or misunderstandings, clearly and objectively state your reasons. Support your claims with factual evidence or legal references.

- Propose a resolution: In the conclusion of your letter, propose a reasonable resolution that you believe is fair and just. This could include a request for a reassessment, a correction of errors, or a compromise.

Writing a tax appeal letter requires careful attention to detail and a clear presentation of your case. By following these steps and ensuring that your letter is well-structured and persuasive, you increase your chances of a successful appeal. Remember to remain professional and respectful throughout the letter, as this will help you establish credibility and convey your message effectively.

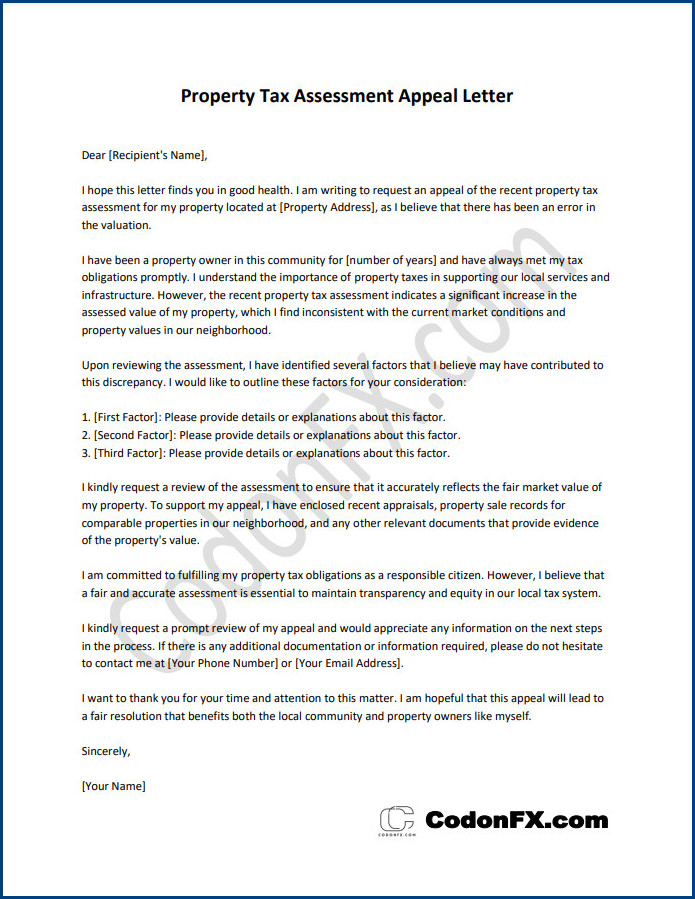

Property Tax Assessment Appeal Letter Template | PDF – Download

Property Tax Assessment Appeal Letter Template | Word – Download